Q1 2024 Market Update: Economy Stays Positive

April 2nd, 2024 | 3 min. read

The long and winding road back to an environment where economic growth is positive, jobs are readily available and pay well, while inflation moderates, is slowly coming into focus.

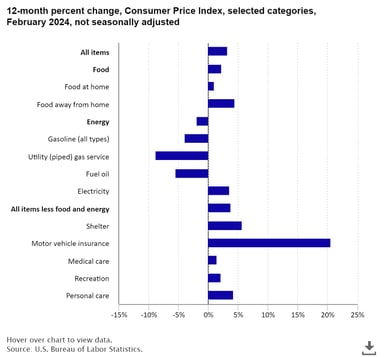

Although prices shot higher over the past few years in the aftermath of the pandemic, the rate of change has declined significantly recently. The Consumer Price Index, the most widely followed indicator of inflation, has fallen to around 3.2 percent per year, slightly below its historical average of 3.3 percent.

Still, the damage inflation has inflicted on the economy, consumers and businesses is profound and will likely take years to work through. We all feel the effects of higher prices for goods and services, mortgage rates, and housing prices, to name a few. Many businesses struggle with paying higher wages to attract talented employees, along with higher input costs, insurance and commodity prices.

Through it all, our economy has shown remarkable resilience, which should bode well for further expansion and growth in the capital markets.

Labor market trends

First, let’s look at the positives and negatives surrounding the economy. The most obvious positive trend is the low unemployment rate and healthy wage gains across most sectors of the economy. In fact, the nation’s unemployment rate remains below 4 percent, compared to a historical average of over 5 percent, while wages are growing a healthy 4.3 percent year-over-year. Further, the economy has added close to three million jobs over the past year.

While positive, there are signs that the labor market is cooling. The recent strength of hiring was concentrated in a few areas, such as health care, government and food services, while average weekly hours worked has declined slightly. Also, many people are holding multiple jobs to supplement their income. Still, the strength of the employment picture has led to persistent consumer spending.

Another positive is the services sector of the economy, which includes industries such as construction, health care and general retail. Although cooling from its torrid pace of a few years ago, the services sector is expanding with an improvement in new orders and business activity.

Manufacturing and housing struggles

On the other hand, the manufacturing and housing sectors continue to struggle amidst weak demand and ongoing pricing pressures. The latest data shows factory activity shrank faster than expected as orders, production and employment contracted. For more than a year, the manufacturing sector has been stuck in contraction mode after a major surge in demand during the pandemic.

Only eight sectors reported growth while seven reported a contraction of activity, including furniture and machinery products. Yet, business activity appears to be stabilizing and costs are moderating. If the Federal Reserve begins to cut interest rates, the manufacturing sector should improve.

The housing sector has been hit hard over the past few years by a surge in mortgage interest rates, limited inventory and low home affordability. However, the latest report showed a bounce back in new housing starts and building permits. Single-family home construction increased to a two-year high, and correspondingly, homebuilder sentiment climbed to an eight-month high.

While tenuous, a combination of pent-up demand and the potential for lower mortgage rates could prove beneficial to the housing sector later in the year.

Federal Reserve policy shift

Amidst the mostly positive economic data, with hints of a modest slowdown ahead, the Federal Reserve’s interest rate policy shifted slightly in their most recent committee meeting in March. In short, the long-awaited path to lower interest rates appears on the horizon. The Fed intimated that three interest rate cuts are possible this year, starting sometime this summer. Further, they indicated that balance sheet runoff would start soon.

Modest growth, falling inflation and the prospects of lower interest rates propelled the capital markets over the past quarter. The S&P 500 Index returned 10.55 percent for the quarter, while the small- and mid-cap indices returned 2.44 percent and 9.94 percent, respectively.

In bonds, modestly higher and still volatile interest rates led to below-average results, with the Bloomberg Aggregate index declining -0.78 percent. The more credit-sensitive areas of the bond market generally produced slightly positive returns during the quarter.

Our outlook

Looking ahead, the combination of moderating inflation, near-full employment and growing corporate earnings should keep economic growth positive and produce solid returns in the capital markets. Although certain sectors of the domestic stock market appear pricey based on historical valuation metrics, other areas appear reasonable.

Also, if the Federal Reserve follows through on cutting interest rates later this year, it could broaden returns across economically sensitive sectors along with small- and mid-cap stocks. In bonds, if inflation continues to moderate and the Fed eventually lowers interest rates, bond returns should be modestly positive after several years of below-average results.

Christopher Kostiz, President & CIO

Chris is the President and Chief Investment Officer (CIO) of Advance Capital Management. As CIO, he directs the strategy and structure of the discretionary model portfolios and leads the investment committee.