Rules for Taking Social Security While Working

October 28th, 2020 | 3 min. read

Social Security will undoubtedly be a part of your retirement plan, and if you’re like many Americans, work may be, too.

The definition of retirement changes from generation to generation. Two things changing our concept of retirement today are increasing life expectancies and the effects of two major economic crises.

As people live longer lives, we have realized a fulfilling retirement requires more than just time spent on leisure activities. We want to do things that provide meaning and purpose.

Further, the Great Recession and economic impact of the COVID-19 pandemic have been reminders of the importance of a solid safety net to cover unexpected costs and prepare for market volatility. Not to mention, as many companies restructure, many workers are forced to retire earlier than planned.

These are reasons why more and more workers see working as a part of their retirements. A recent survey by Voya Financial found the majority of workers from all age groups plan to work some kind of job during their retirement years. Of those, 56% cited the mental health benefits of work as a reason, while 40% said it’s because they want the added financial protection.

As with any financial or retirement decision, there are consequences. When it comes to working in retirement, a major consequence is the effect earnings have on your Social Security benefit.

If you plan to retire yet still work throughout your early to late-60s, it is important to know the rules for taking Social Security while working. They can help you decide how much to work or what type of job to pursue, and determine if it is better to delay your benefit.

Quick Social Security Basics

You can file for Social Security as early as age 62, but for a permanently reduced benefit. To receive the full amount of your benefit, you must claim Social Security at your full retirement age (FRA), which is 66 or 67 depending on the date of your birth.

However, every year you delay starting Social Security from age 62 up to age 70 entitles you to a higher benefit of up to 8% per year. A benefit at age 70 will be 76-77% higher than the payout if you start at age 62.

Rules for Taking Social Security While Working

Now, let’s say you want or need to work before you reach your full retirement age.

If you receive work earnings and Social Security income before the year you reach FRA, $1 is withheld for every $2 you earn above $18,240 (2020).

In the year you reach FRA, $1 withheld for every $3 earned above $48,600 (2020) until the month you reach FRA.

Once you reach FRA or older, you may keep all your benefits, no matter how much you earn.

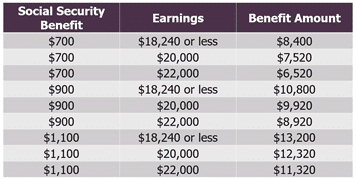

The table below illustrates how your monthly Social Security benefit would be impacted in 2020 based on your monthly benefit amount and your earnings.

Impact of work earnings on total yearly Social Security benefits for people younger than full retirement age during 2020

Source: Social Security Administration

Additional Things to Know about Social Security While Working

- If some of your monthly benefits are withheld because of your earnings, your monthly Social Security income will be increased permanently to reflect the months that your benefit was reduced.

- Only your wages count toward the earnings limits. For those who are self-employed, only your net earnings from self-employment count. Income that does not count toward the earnings limit include other government benefits, investment earnings, interest, pensions, annuities and capital gains.

- You pay Social Security taxes on work earnings, even when your benefit is reduced.

- The reduction only applies to earnings after you retire and begin receiving Social Security. In 2020, a person younger than full retirement age for the entire year is considered retired if monthly earnings are $1,520 or less.

- The same temporary reduction applies to a spouse working before FRA and receiving a spousal benefit. Your earnings can also reduce the spousal benefit payable to your spouse.

- People who retire mid-year may have already earned more than the annual earnings limit. For them, a special rule applies for the first year you retire, under which you can receive a full benefit check for any whole month you’re retired, regardless of your yearly earnings.

- You get a Social Security do-over if you notify the Social Security Administration within 12 months of claiming Social Security that you’re working and pay back the benefits you’ve already received.

Planning When to File for Social Security

As you can see, navigating the various rules of Social Security is no easy task. It is important to carefully consider when to file because your Social Security benefit will make up a major portion of your retirement income.

For about half of older adults, Social Security makes up at least 50% of their income, with one in four of them relying on it for at least 90% of income, according to the Center on Budget and Policy Priorities.

This is why it is so helpful to meet with a financial adviser before you become eligible for Social Security. An adviser can help determine what strategy works best for your situation, especially if you are married and have two benefits to consider.

For such a crucial piece of your retirement plan, the cost of professional guidance is more than worth it.

To learn more about how and when you should file for Social Security, download our free Guide to Social Security Benefits.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.