Financial Steps to Take When Losing a Loved One

September 10th, 2019 | 3 min. read

The loss of a loved one is a difficult experience. Unfortunately, it can become even more difficult when managing the deceased’s estate and all the financial obligations that come with it. While finances may seem trivial during times like these, it is an important matter that should be addressed as soon as possible to better protect the deceased’s wishes – and yours.

The loss of a loved one is a difficult experience. Unfortunately, it can become even more difficult when managing the deceased’s estate and all the financial obligations that come with it. While finances may seem trivial during times like these, it is an important matter that should be addressed as soon as possible to better protect the deceased’s wishes – and yours.

This is especially true for surviving spouses. Around 70% of widows and 50% of widowers reported experiencing significant financial troubles after losing their spouse, according to a survey by New York Life Insurance. Surviving spouses have to adjust to living on a reduced income and cutting discretionary expenses. In some families, only one spouse is in charge of all finances. If he or she passes away, the survivor may struggle learning how to manage the family’s money for the first time.

The alarming figures above may not sound surprising when you consider the many tasks involved in managing the affairs of someone who has passed away. Here are the most important financial steps to take when losing a loved one.

Collect and organize all financial documents

To the best of your abilities, collect and organize all documents and paperwork. If you happen to have an inventory list, utilize it. If you do not, it would be helpful to create one (an Advance Capital Management adviser can provide you with a Personal Record Locator).

What documents to gather:

- Certified copies of the death certificate

- Will/trust

- Birth certificate

- Social Security cards

- Marriage license

- Insurance policies (life, health, accident, property, auto)

- Bank statements and listing of accounts

- Credit card statements and physical cards

- Investment and other financial account statements

- Auto titles

- Mortgages and property deeds

- Income tax returns

- Other assets (business interests, etc.)

With these documents on hand, the process of handling your loved one’s estate becomes easier. It also helps you to start planning your own financial future.

Contact an attorney

An attorney will review your loved one’s will if there was no trust. If there is no will, he or she will then help you through the probate process. The attorney should be able to help determine if all or any debts will be covered by the deceased’s estate and what the liability for any remaining debts may be.

Arrange to pay your bills

Even in our most difficult moments, we can expect the bills to keep coming. Therefore, make it a point to compile all bills (including medical, funeral, mortgage, etc.) and arrange to pay them accordingly. Share those that will be paid through the estate with the attorney or executor so that they can be paid on time. Be sure to locate those that are automatically deducted from a checking/savings account or charged to a credit card. Lastly, change all bills to the appropriate name.

If you are unable to pay a bill on time, contact the creditor about available repayment options due to your circumstances. And don’t forget to cancel any unneeded services including utilities, wireless, gym memberships, etc.

Provide notifications and update information

You will have to notify all insurance providers of the passing. Especially, if the deceased had a life insurance policy. It can take a while for companies to disperse funds, so start the process as soon as you can. Further, contact the various financial institutions (banks, brokerages, credit card companies, etc.) where he or she had an account.

Update information on all mortgages, property deeds and auto titles. You can change the title of your vehicles through your state’s Department of Motor Vehicles. Also, cancelling the driver’s license with the DMV will remove your spouse’s name from their records and help prevent identity theft.

You may have to also contact the Social Security Administration to stop payments and ask about the eligibility of the surviving spouse or dependents for spousal or survivor benefits.

Lastly, update your own will, insurance policies, retirement accounts and all other assets on which the deceased was listed as a beneficiary.

Meet with a financial adviser

Some of these tasks are challenging in themselves much less when on your own. A financial adviser can help carry the load. He or she can help you compile many of the needed financial documents mentioned above. Most importantly, an adviser will help distribute assets from the deceased’s investment accounts to the appropriate beneficiaries. That way your loved one’s wishes are fulfilled.

If you are to receive some or all of these assets, an adviser will help you make any changes to your own financial plan and investments. You will want to appropriately put it toward your goals.

Further, you may want to consider plans for your own estate with the guidance of a financial professional. After going through the process of managing your loved one’s estate, you now know the difficulties involved. You can take the necessary measures to ensure an efficient process for your family when you pass away.

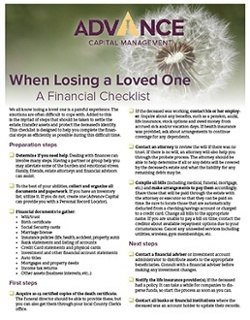

These are just some of the primary steps to take. There is still more to do, and our financial checklist can help.

| Download Advance Capital’s When Losing a Loved One – A Financial Checklist to use as guide for many of the most important financial obligations you may face. |