Yes, You Can Still Become a 401(k) Millionaire

December 9th, 2020 | 4 min. read

There is no secret strategy to become a millionaire. You don’t need to make brilliant investment trades. You don’t need to earn a six-figure income. Even if you start saving late, it’s still possible to join the growing ranks of 401(k) millionaires.

In its 2020 third-quarter retirement report, Fidelity Investments said the number of 401(k) participants with $1 million or more in one of its plans increased to 262,000 – a new high.

Of course, you may not need $1 million to retire comfortably. Some people may need less, and some may need more. A common rule of thumb is to save about 10 times your salary for retirement. So, if you earn $75,000 per year, you may want to save $750,000 in your 401(k).

Ultimately, how much you need to save for retirement depends on personal factors, such as your expenses, where you live, what you plan to do, etc. That’s why one of the most important steps is to get a financial plan so you know exactly how much to save.

Still, as life expectancies rise, saving as much as possible is never a bad idea. Your retirement could very well last 30 years or more.

Unfortunately, most people face a retirement savings shortfall. The average savings for those nearing retirement (age 55-59) is $223,494, according to Federal Reserve data.

The good news is, if you find yourself behind on your retirement savings, there’s still hope. Maybe you won’t hit the $1 million target. But if you revise your savings strategy now, it’s definitely possible to significantly increase the size of your retirement account.

START SAVING IN YOUR 401(K) NOW IF YOU HAVEN’T

As the popular Chinese proverb says: “The best time to plant a tree was 20 years ago. The second-best time is now.”

When you start saving is one of the biggest difference makers in building wealth. The time you get to take advantage of compounding, the earnings earned on your earnings, the more your account will grow.

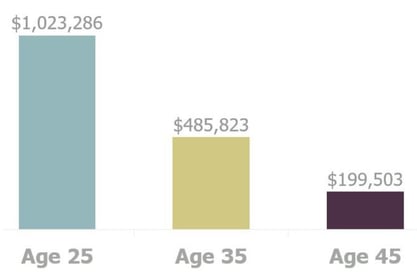

Suppose someone starts their job at age 25 and plans to retire at age 60. Here is an example of what the difference in ending balances could be saving 15% of a $55,000 salary when starting at ages 25, 35 and 45.

Starting early: difference in ending balances saving 15% of a $55,000 salary starting at various ages until age 60 (assuming 6.5% annual return)

Dig a little deeper and you can see how powerful compounding is. Here is the total savings of $1,023,286 taken from the example above split between compounding and contributions.

If you start saving for retirement late, it’s still possible to end up with a sizeable nest egg. Consider someone who starts saving at age 50 by maximizing their 401(k) with catch-up contributions can amass over $1 million by age 70 (assuming an 8% annual return).

SAVE AS MUCH AS YOU CAN IN YOUR 401(K)

There’s no way around it: The surest way to build wealth is by saving. It is more important than investment performance.

The annual 401(k) contribution limit is $19,500 (2020). But those 50 and older get the benefit of catch-up contributions, which allows them to save an additional $6,500 per year, for a total allowable annual contribution of $26,000 (2020).

Of course, saving around $20,000 or more a year isn’t easy or always practical. Generally, you should save about 10-15% of your salary annually, which will allow you to replace 70-80% of your preretirement income. We, however, think it’s a good idea to save enough to replace 100% of your paycheck.

A common mistake is to set a low contribution amount earlier in your career and then never increase it.

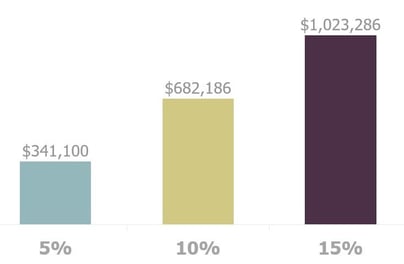

Increasing your savings makes a major difference over time. Consider how much of a difference just a 5% savings increase can have. Below are the ending balances from various savings rates on a $55,000 salary over 35 years (assuming a 6.5% annual return).

INVEST IN STOCKS (APPROPRIATELY)

The whole point of saving in your retirement account is to grow your money, and to do that you need stocks. Stocks have historically outpaced inflation and posted larger returns than more conservative investments like bonds.

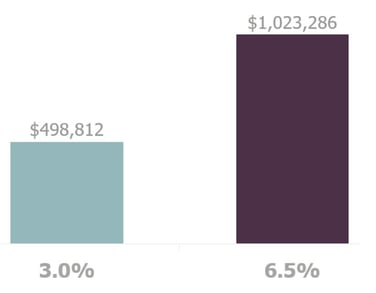

A good rate of return is another key factor in growing a million-dollar 401(k). Using our previous example of saving 15% of a $55,000 salary over 35 years, look at the difference in ending balances if we were to assume a rate of return of only 3% compared to 6.5%. It’s reduced by more than half.

Of course, that doesn’t mean you should just load up on stocks. Though stocks tend to produce higher returns, they also tend to suffer deeper losses. Generally, you should invest aggressively early in your career and then gradually reduce your stock allocation as you near retirement.

What mix is right for you depends on personal factors, such as your retirement date, income and goals. Because there is no cookie-cutter answer, most people find choosing investments a challenge. Instead of making important investment decisions on your own, consider working with a financial adviser. An adviser can review your 401(k) and help implement an investment strategy that is appropriate for your financial goals.

STAY INVESTED

As we discussed, wealth takes time. You won’t become a 401(k) millionaire overnight. That’s why it’s important to focus on the long term and avoid reacting to short-term market events.

Markets are notoriously volatile in the short term. The average intra-year drop in the S&P 500 is around 14% since 1980, according to a JP Morgan report. Yet, annual market returns have been positive for 30 of those 40 years (more than 75% of the time!).

The only way to participate in those positive gains is to stay invested. Just missing the 10 best days of the S&P 500 over a 20-year period, from 2000 through 2019, would have resulted in a 2.44% return, which is 40% lower than the 6.06% return of being fully invested.

AVOID EARLY WITHDRAWALS AND LOANS

Early withdrawals and loans from your 401(k) account are the equivalent of taking two steps backward. Any time you take money from your retirement savings to pay for current expenses, you guarantee having less money in retirement.

Not only does it reduce your balance, but you also miss out on all those potential earnings from compounding. Additionally, there are tax consequences. Withdrawals are taxed at your ordinary income tax rate. And, if you are under the age of 59 ½, you may also be subject to a 10% early withdrawal penalty.

Instead of using your 401(k) as a savings account, build an emergency fund that you can access at any time without penalties or fees.

PUT IT ALL IN A FINANCIAL PLAN

A financial plan is proven to help people save more for retirement. An HSBC study found that people with financial plans amassed nearly 2.5 times more retirement savings than those without a plan.

Further, a plan will help you make important retirement planning decisions. For example, what should you do with your 401(k) once you retire or change jobs? Should you keep it or roll it over into an IRA? If you retire, how should you use those funds along with other retirement income sources to meet your financial needs?

From managing your 401(k) to choosing the right age to claim Social Security, there are many more important financial steps to take in your 50s to help you realize your dreams. You can find them in our free ebook, Your Money in Your 50s: A Retirement Planning Guide for Procrastinators and Avid-Savers. Click the button below to start reading.