How to Shop for Michigan Medicare Supplemental Coverage

November 4th, 2016 | 4 min. read

There are many services and supplies Medicare doesn’t cover. You can avoid the surprise out-of-pocket costs from these gaps with a supplemental insurance policy. But, there are many plans to consider. So, what should you know when shopping for Michigan Medicare supplemental coverage?

There are many services and supplies Medicare doesn’t cover. You can avoid the surprise out-of-pocket costs from these gaps with a supplemental insurance policy. But, there are many plans to consider. So, what should you know when shopping for Michigan Medicare supplemental coverage?

The goal is to find a plan that meets your needs at a price you can afford. Begin this process well before your effective Medicare start date to ensure that your supplemental insurance kicks in at the same time.

When you are planning your retirement health care expenses, talk with your financial adviser about how to integrate the costs into your overall financial plan.

Want to choose affordable supplemental Medicare coverage that aligns with your needs? Speak with an Advance Capital adviser to for help exploring your options.

The first step, however, is to understand the basics – what is and what isn’t covered – of Medicare.

The Basic Parts of Medicare

When you turn 65, Medicare becomes your primary health care provider and any private insurance you have becomes your secondary payer. You are required to enroll in Medicare on time or you may be subject to late-enrollment penalties and unpaid insurance claims.

This enrollment is only for Part A and Part B. Part A covers hospital services, including inpatient care, skilled nursing facility care, hospice care and home health care. Meanwhile, Part B provides medical coverage such as doctor visits, outpatient services, home health care, durable medical equipment and some preventive services.

Finally, there is Part D, the prescription drug coverage portion of Medicare. It is provided by private insurers. Anyone who has enrolled in Part A and Part B is eligible. You are not required to sign up for Part D if you have creditable coverage that is expected to pay, on average, at least as much as Medicare’s standard prescription drug coverage.

What Part D is infamous for, however, is what has commonly referred to as the “donut hole coverage gap.” Generally, after you enroll in a Part D plan, you’ll have a separate deductible of up to $360. After you pay your deductible, you’ll share some of the total costs up to $3,310. Here, there is a coverage gap (the “donut hole”) where you’re responsible for all costs between $3,310 and $4,850. Once your total costs exceed $4,850, you enter catastrophic coverage, at which point your Part D insurance will pay for almost all your drug costs.

Choosing the Right Supplemental Coverage

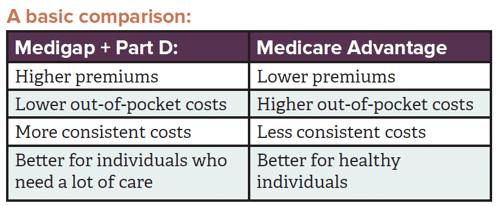

There are generally two supplement coverage options to choose from:

Medigap

This plan is designed to cover the gaps Medicare does not, such as deductibles, co-payments and coinsurance amounts. There are dozens of companies offering over 100 plans; however, Medigap plans are all coded by variety with a letter system ranging from A to N. All plans with the same letter have the same coverage. This means the F plan (most comprehensive), for example, will cover the same items from provider to provider.

The difference is in costs. Therefore, you want to shop by first selecting the plan type you need, and then pick the insurer and premium that works for you.

Medicare Advantage – Part C

These plans (known as Part C) are offered by private insurers and are another way to receive Medicare. Medicare pays a per-capita amount to insurers who offer these plans. They act as an alternative to purchasing Medigap and Part D. If you opt for one of these plans, you’re essentially getting an all-in-one insurance policy. Your policy will take the place of Part A and Part B as well as fill the coverage gaps. It will cover a specific amount of your deductibles and co-pays, and will usually include medications. Some plans also include dental, vision and/or hearing, but for an extra cost.

In the advantage plans, you have to select an HMO, HMO-POS or PPO. As always, you’ll have to decide if you want a lower price but less flexibility, or a higher price and greater flexibility.

Premiums can change significantly from one year to the next so make sure you fully review what you have each enrollment period.

To participate in Medicare Advantage you must enroll in Part A and Part B on time and pay Part B premiums, in addition to any premiums that are charged by the insurer’s plan. If you have a Medicare Advantage plan, you may not apply for a Medigap supplemental insurance policy.

Where to Shop for Supplemental Insurance

For most, the best place to start shopping for supplemental plans is on Medicare’s own website, www.medicare.gov. You can search for Michigan Medicare plans by using the Medicare Plan Finder. If your former employer still provides some coverage, you may be able to shop through a private exchange.

Managing Your Medicare Plan

Planning doesn’t stop after you enroll in Medicare. It is important to periodically review your plan. This review can help ensure that you have the appropriate amount of coverage and that you are not paying too much in premiums.

Here are a few tips to help you manage your plan:

- Private insurers offering Part D, Medigap and Medicare Advantage plans can change their premiums and coverage terms. Therefore, you want to compare plans and shop around to get the same, or better, policy for a lower price.

- If you have a Part D prescription or Medicare Advantage plan, watch your mail in the fall each year for plan announcements regarding changes in prices and benefits.

- Remember, the annual coordinated election period is from October 15 to December 7 each year. If you decide to switch plans, you will need to contact the new plan before December 7 to guarantee that your new coverage will take effect by January 1. Make sure you apply and are accepted into your new plan before you cancel your old plan. Also, make sure you understand all the costs associated with the new plan.

Shopping for Michigan Medicare supplemental coverage is easier the more information you have. You can find additional information by visiting the Medicare website at www.medicare.gov or calling 1-800-MEDICARE (1-800-633-4227). You should also contact your financial adviser to discuss what Medicare plans may best fit your financial plan.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.