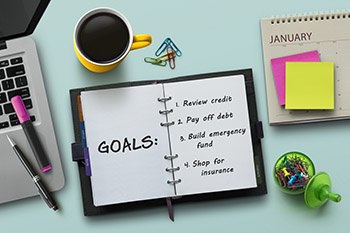

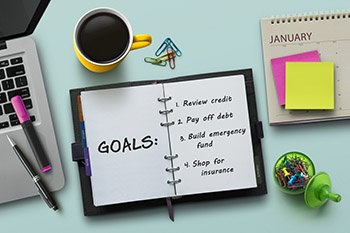

6 Simple Resolutions That’ll Help Make You Financially Successful in 2018

December 18th, 2017 | 3 min. read

By Jeff Lido

by Jeff Lido, Financial Adviser and Smartvestor Pro

Often after the holidays, when our pants feel a bit tighter and our wallets a little lighter, we experience a newfound sense of determination to get in shape. As a new year begins, most people start thinking about resolutions. Around 45% of Americans make New Year’s resolutions and many of them focus on our bad habits, especially as they relate to money. That’s why it’s unsurprising that financially themed resolutions tend to be among the most popular.

Often after the holidays, when our pants feel a bit tighter and our wallets a little lighter, we experience a newfound sense of determination to get in shape. As a new year begins, most people start thinking about resolutions. Around 45% of Americans make New Year’s resolutions and many of them focus on our bad habits, especially as they relate to money. That’s why it’s unsurprising that financially themed resolutions tend to be among the most popular.

The disappointing fact is that only about 8% of resolution makers achieve their goals. But, don’t let that derail you trying to improve your financial habits. Instead, use it as encouragement to be one of the few who accomplishes their stated goals.

To help, we’ve compiled 6 simple financial resolutions to set for 2018, along with some guidance for achieving them.

1. Review your credit report and sign up for credit monitoring or a credit freeze.

With the recent Equifax breach, credit fraud has been top of mind for millions of people. If you didn’t take action and check your credit report or implement any protection yet, don’t worry. It’s not too late. Everyone can check their credit report annually for free.

It’s important to periodically check your credit report for several reasons. As many as one in four people have a credit report containing an error that could affect their credit score, according to research by the Federal Trade Commission. Furthermore, reviewing at least one of your major credit reports on a regular basis will enable you to spot signs of fraud before they get too serious.

Of course, no one can keep tabs on their credit around the clock. That’s where 24/7 credit monitoring comes in. Signing up for a credit monitoring service, some of which are offered for free, will let you receive instant notifications anytime there is an important change to your credit report.

A credit freeze is another way to prevent any fraudulent activity from occurring. A freeze does just what it implies. It does not allow new lines of credit to be opened on your report. For those seeking to avoid fraudulent credit to be opened in their name, there is no better solution available today.

2. Pay your bills right after receiving your paycheckTaking care of fixed expenses (rent, car payment, etc.) before discretionary expenses (dining out, shopping, etc.) is a helpful budgeting strategy. It gives you a better sense of what you can truly afford and what you can’t. It also helps you develop better spending habits, so you can meet your long-term saving goals.

3. Build a debt snowballIf you are hesitant to open your bank or credit card statement after the holidays, then you likely did not appropriately budget and keep your spending in check. Remember, the borrower is slave to the lender. All those dollars you pay in interest could instead be in your pocket. The good news is that the New Year is a perfect time to start fresh and commit to tackling your debt.

There are different methods for paying off debt. One of the easiest to follow is the snowball method, where you start with the lowest balance and pay minimums on all other debts. Then, work your way toward the highest balance, applying savings from each previously paid debt as you go. The benefit of this method is that it can increase your dedication to reducing debt because you start to see results faster.

4. Re-evaluate your emergency fund

Nearly half of Americans can’t come up with $400 for an emergency, according to a recent study. An emergency expense you can’t cover can lead to stress, family arguments and debt. Building up some monetary reserves, therefore, should be one of your primary financial goals.

The right level of cash to have in an emergency fund is different for everyone. But, a good starting goal is $1,000, and ideally building up to something more comfortable, about 3-6 to months’ worth of expenses.

5. Shop around for insurance and reassess your insurance needs

A little-known insurance tidbit: insurance companies will fight for your business. Shopping around among various companies can help you save money on your premiums. Using a broker who can do this for you with multiple carriers will save you a lot of time, too.

Have kids? Have a job? Then you probably should have life and disability insurance. You don’t have to have life and disability insurance, unlike auto and homeowners, but ask any widow/widower with young children or a disabled individual who has these, and they will tell you how important they are.

6. Start thinking about your future

I don’t mean in the philosophical sense, but from a retirement standpoint. Do you want to work forever? No? Then start the planning process today. One day you will be of retirement age, and if you fail to plan then you already have a plan to fail.

There are many reasons why people don’t plan for retirement: “I’m too busy”, “It’s too soon”, “It’s too late”, “I don’t have enough to get started”, “I don’t know how”. And the best one, “THE GOVERNMENT WILL TAKE CARE OF ME”. The fact is no one can get you to start thinking about your future other than yourself. Fortunately, there are SmartVestor Pro’s who can assist you along the way.

It’s okay if you are unable to keep all these resolutions. Just working on one or two of them will help get you in better financial shape than you were last year. Good luck!