Could Skipping Your Daily Coffee Run Help You Achieve Retirement?

March 12th, 2018 | 2 min. read

Every morning when I was a child, I would wake to the pungent smell of a fresh pot of Folgers coffee that my parents made from a can of beans they stored in the freezer. Back then, people rarely went out for the sole purpose of a cup of coffee. It was something you just ordered at a diner with breakfast or a piece of pie.

Today, you can find a coffee shop at almost every corner. There are now more than 30,000 coffee shops in America. And, business is good. According to a 2017 study, 36.38 million people visited a coffee house or coffee bar for breakfast, lunch or dinner within a 30-day period. That’s about as many people living in the entire country of Canada.

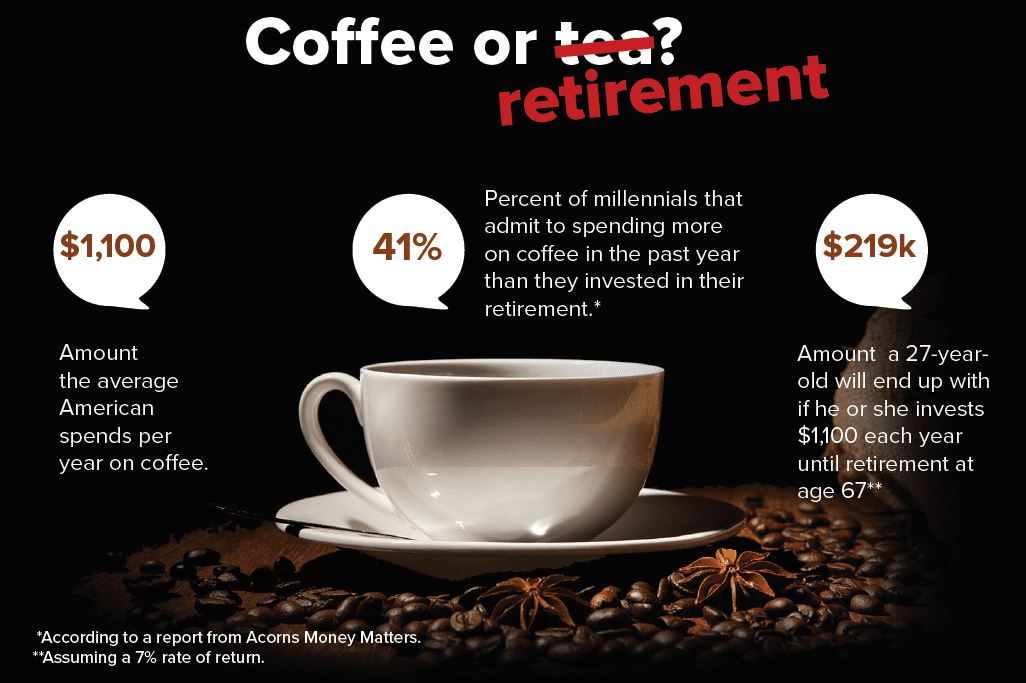

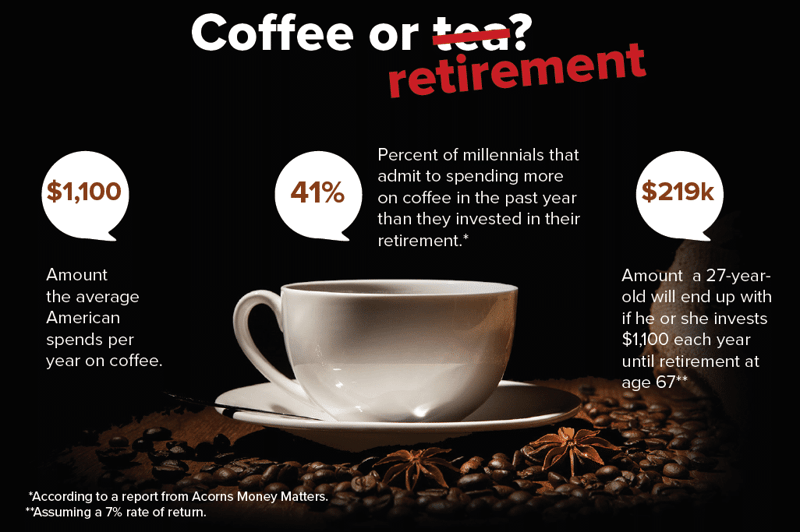

Coffee or retirement?

Alas, going on a daily coffee run can be an expensive habit. Consider the average person spends close to $1,100 per year on coffee, according to an Acorns survey of nearly 2,000 adults between the ages of 18-35. Of those, 41% admitted to spending more on coffee in the past year than investing for retirement.

To put this into perspective, imagine a 27-year-old who skipped their daily coffee run and instead invested $1,100 each year until age 67. He or she would end up with $219,600, assuming a 7% rate of return. If that person continues to spend $1,100 annually on coffee for 40 years, he or she will have spent $44,000 with nothing to show for it, except maybe a good start to the day.

Small budget changes can make a big difference

If you think you can’t afford to save for retirement, or can’t save more, you may be just overlooking potential opportunities. What may seem like a trivial expense, like a daily cup of coffee, can add up over time. As I showed above, small budget cuts can lead to big savings over time.

Therefore, see if you can eliminate some of your small but consistent expenses and apply the savings toward your retirement. This is also a simple way to pay down debt.

Of course, the simple things in life that we look forward to every day are hard to turn down. So, if you can’t cut something from your budget, find ways to reduce your spending on it. Brew coffee at home. Brown bag it to work instead of going out to lunch. Buy some quality workout equipment and skip the monthly gym membership.

The important thing is to make sure you take those savings and apply it toward improving your financial well-being rather than simply spending more money elsewhere.

If you need help planning your financial future and finding more ways to save for retirement, contact us today and we’ll help you create a custom financial plan at no cost and no obligation.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.