Emergency Fund: What It Is and Why You Need It

October 3rd, 2017 | 1 min. read

By Jared VanDenberg, CFP®, NSSA®

By definition, an emergency is an “unexpected situation requiring immediate action.” Hence, an emergency fund is an account with cash set aside specifically for those financial curveballs life throws your way. These costly unexpected events include job loss, severe medical problems, car troubles and major home repairs, among others.

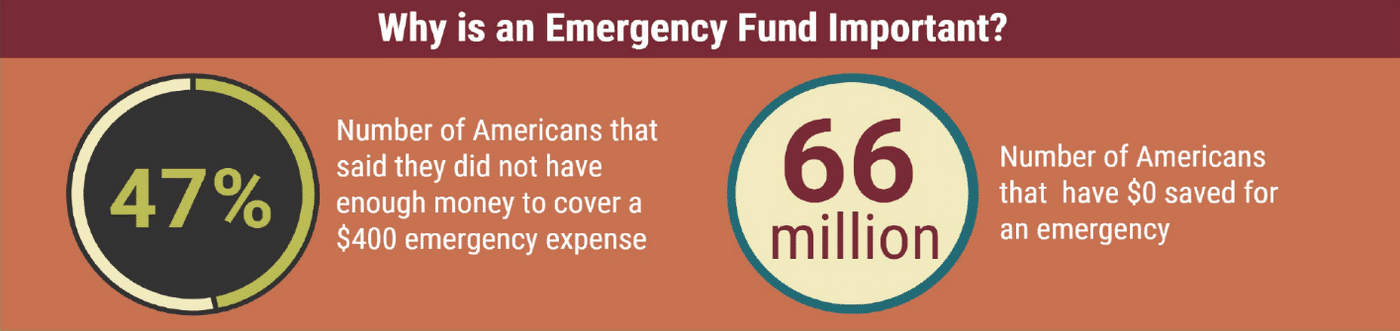

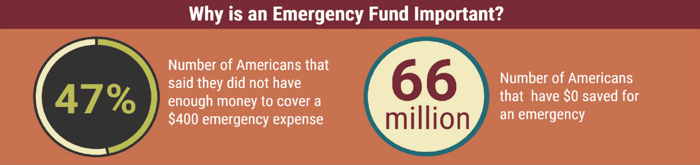

We can’t predict when an emergency will arise, but we can be certain that one is likely to occur at some point. According to Money Magazine, “78% of Americans will have a major negative financial event in any given 10-year period.”

Emergency funds are so important, you will find them twice within the beginning stages of Dave Ramsey’s Seven Baby Steps.

How much you should save in an emergency fund

A good rule of thumb is to save a minimum amount equal to one month of expenses, but most people will need to save enough for 3-6 months. The optimal amount you should save depends on personal factors, such as your income and career prospects like job security and marketable skills.

If you have low job security or will have difficulty finding new work, you should save a larger amount of money for emergencies. Whereas, an individual who has a secure job or could quickly find a new one does not need to save as much. Generally, the more stable your household financial situation is, the less you need saved in an emergency fund.

Where you should you keep an emergency fund

Your emergency fund should be kept in a place where you can access it easily and quickly. After all, you don’t know when an emergency may pop up. This money is there to be readily available when it’s needed.

A checking account or savings account, separate from those you use daily, are great places for an emergency fund. They are both liquid and easily accessible. Some individuals naturally have a hard time seeing the savings just sit there, but it truly is accomplishing a purpose. It provides peace of mind, and should not be viewed as lost opportunity.

When you should use an emergency fund

Dave Ramsey says there are three questions to ask yourself to determine if you need to tap into your emergency fund:

- Is it unexpected?

- Is it necessary?

- Is it urgent?

The more you answer “yes,” the more likely it’s an event that justifies using money from your emergency fund.

By definition, the word “smart” can pertain to a person who is mentally alert, shrewd or quick in action. Building an emergency fund is one of the smartest financial moves you can make.

Jared provides comprehensive wealth management strategies to help people optimize their financial lives. As a financial adviser, he works closely with clients to make smart decisions that can help them reach their financial goals. He is a CERTIFIED FINANCIAL PLANNER™ professional.