The Simple Answer to How to Invest? There Isn’t Just One

August 6th, 2019 | 4 min. read

What does learning how to invest have to do with a medieval friar? The philosophical principle known as Occam’s razor, which was devised by William of Ockham, a Franciscan friar and logician, in the 14th century.

What does learning how to invest have to do with a medieval friar? The philosophical principle known as Occam’s razor, which was devised by William of Ockham, a Franciscan friar and logician, in the 14th century.

Occam’s razor is commonly expressed as the simple answer is often the correct answer.

The rule often applies to investing, where simplicity trumps complexity. There are a handful of simple investment principles the average person should follow. Diversify your portfolio. Don’t take more risk than you want or can afford to. Keep your costs low.

The average person saving for retirement doesn’t need to invest in complex investments such as stock options. Nor should the average investor attempt to outsmart the market by trying to pick winning stocks.

Unfortunately, many people are not taught these basic investment principles. Nearly 60% of Americans don’t own stocks, according to a Bankrate report. A quarter of respondents in the survey say the reason they don’t invest in the market is because they don’t understand stocks.

Not investing can keep you from achieving your retirement goals. Consider a Federal Reserve study that says the median working-age couple has saved only $5,000 for retirement.

However, there is a kind of paradox at play. Although everyone should keep it simple, everyone’s financial picture is unique. So, technically, there is no one right answer when it comes to the appropriate way for you to invest. It depends on personal factors, such as your income, tolerance for risk, time horizon (when you need the money), current assets and future financial goals.

That’s where things can get a little complicated. What works best for you may not work for me, and vice versa. The question isn’t how to invest, but rather how to invest for your specific goals.

Below are basic, but important, investing principles that can help you find an answer.

TYPES OF INVESTMENTS

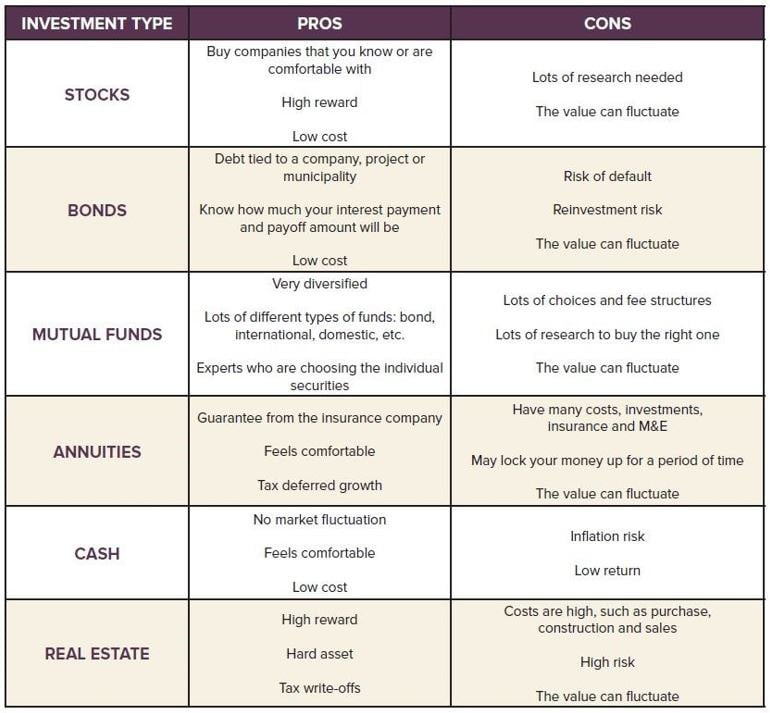

First thing’s first. You should familiarize yourself with the various types of investments available and their characteristics. Although there many different types, the table below provides pros and cons of the most common investments.

DETERMINING YOUR ASSET ALLOCATION

Now that you know what’s out there, the next step is determining what mix of investments – known as your asset allocation – makes the most sense for you in a portfolio. One way to think of asset allocation is to imagine your portfolio as a box of donuts. How many glazed donuts do you have compared to sprinkled, powdered, etc.

Something you may have noticed in the table in the last section is that each investment has its own risk and return characteristic. It’s important to know the relationship between risk and return.

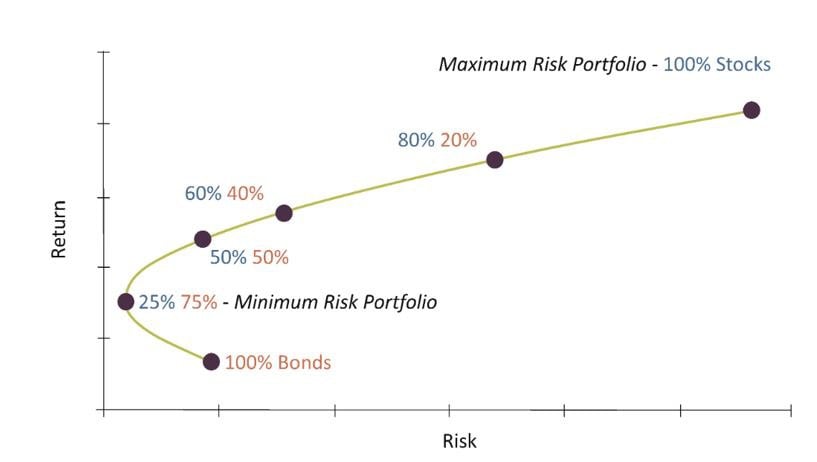

Generally, the greater the risk, the greater the expected return. Conversely, the lower the risk, the lower the expected return. This relationship is best expressed by what is known as the “efficient frontier,” shown in the image below.

This is a rather technical concept, but don’t worry, it’s not important to study it in detail. But, there is a key takeaway that we wanted to emphasize to you, which is that in most cases the more stocks you own, the higher your return potential but also the higher your risk.

You can see this risk-return relationship play out in the historical returns of various bond/stock asset allocations in the chart below. Remember, returns change a lot from year to year. However, they are rather steady over the long term, as evidenced in the average return from the last 40 years. As you can see, the average return gradually rises with proportion to the allocation of stocks.

Note: This is for illustrative purposes and not indicative of any particular investment. An investment cannot be made directly in an index. The 40 year returns for the bond/stock ratio portfolios are compounded annual returns. The data assumes reinvestment of all income and does not account for taxes or withdrawals. The above returns assume the bond/stock ratio is reallocated quarterly. Past performance is no guarantee of future results.

Source: Bonds are represented by the Barclays US Aggregate Bond Index. Stocks are represented as 66.7% S&P 500 and 33.3% MSCI ACWI ex US NR for their portion of the ratio.

Choosing the appropriate mix of investments can generate sufficient growth, retirement income and preservation for your specific financial goals. Just keep in mind there are tradeoffs. A 100% bond portfolio, for example, may maximize your income and offer the safest return. Such a conservative allocation though may not allow for much growth, or preservation because its low return may not outpace inflation. On the other end of the spectrum, by maximizing your return potential with a 100% stock portfolio you must accept increased volatility and the lack of a steady income stream that bonds can provide.

A 60/40 bond/stock allocation provides a reasonable starting point for most retirement investors. If your retirement date is more than five years away, then a higher allocation of stocks is reasonable. Whatever asset allocation you choose, the important thing is to stick with it.

RULES OF THUMB FOR HOW TO INVEST

Again, the right way to invest is personal. However, there are a handful of general rules of thumb that are applicable to all investors, including:

Start aggressive then reduce risk as you near retirement. If you’re young, then growth should be your primary investment objective. Therefore, you should have a greater allocation to stocks for their higher return potential. Over time, gradually scale back risk by allocating your portfolio to lower-risk investments like bonds.

Avoid investing too conservatively. After the 2008 financial crisis, many investors fled the stock market. Unfortunately, many of these investors missed out on the gains when the stock market rebounded. It’s important to diversify your investments and maintain some level of risk for potential growth. This is especially true for older workers and retirees who are drawing down their portfolios, so your money doesn’t lose value to inflation.

Don’t try to pick winners. Often, investors make the mistake of picking funds that have the highest historical returns or were the most recent winners. They ignore the high risk associated with these funds and the difficult odds of choosing future winners. This strategy may work for those who have a high risk tolerance, but is not recommended for those saving for something as important as retirement.

Keep your costs low. Research has shown that cost is a better indicator of future returns. While you can’t control where markets will go, you can control the costs you pay for the ride. The less you pay in investment costs, the more you keep of your portfolio’s return. A single digit fee may not sound like much, but it can add up over time. A 1% fee on a $100,000 portfolio that earns 4% growth annually would mean paying nearly $28,000 in fees over two decades, according to an example provided by the Securities and Exchange Commission.

So, now that you’ve learned the basics on how to invest, what makes the most sense for you? That is impossible to answer in a blog. Perhaps, the simplest answer is to work with SmartVestor Pro who can walk you through an investment strategy that can meet your specific needs.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.