What to Know About the New Tax Law to Prepare You for Next Year

April 13th, 2018 | 3 min. read

By Dan McHugh

By Dan McHugh, Financial Adviser and Smartvestor Pro

With your 2017 taxes now in the books, it’s a good time to start preparing for next year’s taxes. That’s because all the changes implemented by the recent Tax Cuts and Jobs Act will apply. This is the biggest tax overhaul in 30 years, which means there are plenty of changes that will likely impact your tax situation.

With your 2017 taxes now in the books, it’s a good time to start preparing for next year’s taxes. That’s because all the changes implemented by the recent Tax Cuts and Jobs Act will apply. This is the biggest tax overhaul in 30 years, which means there are plenty of changes that will likely impact your tax situation.

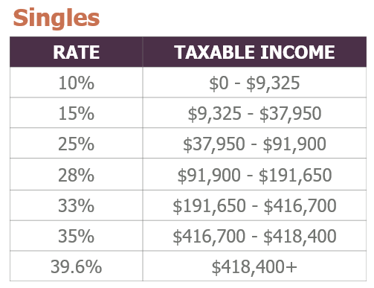

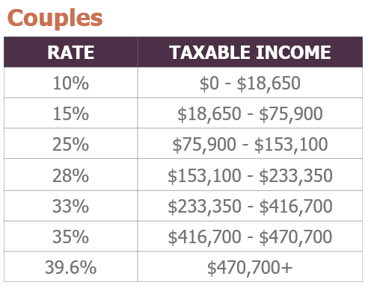

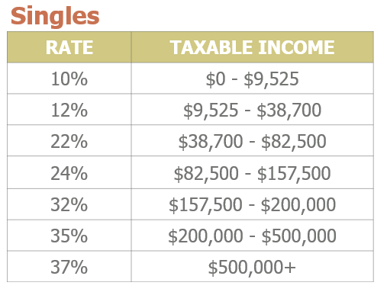

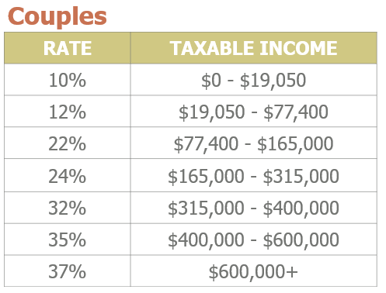

1. You may be in a different tax bracket

The new tax law lowered tax rates nearly across the board. As a result, many Americans may find themselves in a different tax bracket.

2017 tax brackets

2018 tax brackets

For example, individuals with incomes between $38,701 and $82,500 will see their tax rate fall from 25% to 22%. Meanwhile, couples earning between $165,001 and $233,350 will receive a rate reduction from 28% to 24%.

Lower rates could mean significant savings for taxpayers. Consider a couple with $125,000 in taxable income could potentially reduce their tax liability by more than $3,000.

2. The standard deduction is increased and the personal exemption is eliminated

Next year, the standard deduction is almost doubled, from $6,350 to $12,000 for singles and from $12,700 to $24,000 for joint-filing married couples. Further, the additional standard deduction for those age 65 or older or blind goes up slightly. At the same time, the personal exemption goes away. The overall effect is that more people will take the standard deduction rather than itemize deductions.

3. The child tax credit is doubled from $1,000 to $2,000

The child tax credit is available to you if you have a child who was under age 17 and living with you at the end of the year. Also, the earnings limit for the family tax credit increases to $200,000 and $400,000 for singles and couples, respectively. Large families are in position to benefit greatly from these changes.

4. The Alternative Minimum Tax (AMT) remains in place

The AMT was preserved after original proposals called for it to be eliminated. However, the exemption is increased to $70,300 for singles and $109,400. Further, the phase-out threshold is increased to $500,000 for singles and $1 million. This means fewer people will likely pay the AMT.

5. Pass-through business owners get a new tax deduction

Owners of pass-through entities may now deduct up to 20% of their net business income. It begins phasing out at $157,500 for singles and $315,000 for married couples filing jointly.

6. You can no longer deduct tax preparation fees and other expenses

The ability to write off the previous year’s tax preparation fees, unreimbursed employee expenses, investment advisory fees, and other expenses has been eliminated.

7. Medical expense deduction goes up

Previously, out-of-pocket medical expenses had to exceed 10% of your adjusted gross income to write them off. That threshold has been reduced to 7.5% of your income, letting you deduct more of your medical expenses.

8. Lower limit on mortgage interest deductions

The limit on home mortgage interest payments you can deduct is reduced from $1 million of debt to $750,000 of new debt.

9. Home-equity loan deductions are eliminated

You will no longer be able to write off any of the interest on home-equity lines of credit.

10. A cap is in place for state and local tax deductions

All state and local deductions are now limited to $10,000. However, several states have creatively implemented their own tax law changes to help preserve these deductions.

11. The individual health mandate is eliminated, but not starting until 2019

The new tax law gets rid of the individual health care mandate penalty tax, but not until the start of 2019. Therefore, the penalty tax is still in effect for the 2018 calendar year.

12. Eligible expenses from 529 accounts have been expanded

Previously, 529 college savings plans were restricted to higher education expenses. Now, they can be also used for tuition at public, private and religious schools, grades K-12.

13. You can no longer write off moving expenses

Previously, if you were relocating for a job, you could deduct your moving expenses. Now, only military members will be allowed to do so.

For a deeper look at the new tax law and how it may change the way you file next year, check out the webinar I hosted, “Deconstructing the New Tax Law – How It Affects You.” Also, be sure to contact the Advance Capital SmartVestor Pro in your area to see if you need to adjust your financial plan in response to these recent tax changes.