Playing It Too Safe? What a Safe Withdrawal Rate Should Really Mean

September 1st, 2021 | 3 min. read

A variety of events can adversely impact your retirement, from unexpected expenses, such as high medical or caregiving costs, to a stock market downturn. So can the fear of spending in retirement. If you don’t use your retirement savings, you can almost guarantee living a lower lifestyle than you could otherwise. That’s why a safe withdrawal rate isn’t 0%.

Unfortunately, many retirees don’t have a viable spend-down strategy in place that allows them to enjoy life without outliving their assets.

Around 80% of retirees wait to withdraw money from their retirement accounts until required minimum distributions (RMDs) start, according to a study from J.P. Morgan Asset Management and the Employee Benefit Research Institute. Further, of those who have reached RMD age, 84% took no more than the minimum amount.

In other words, they are letting RMDs dictate how much to take from their retirement accounts, which could be a big mistake.

RMDs are the amounts the government mandates you to withdraw annually from your traditional retirement accounts after turning age 72. Your RMD is calculated by dividing the prior December 31 balance of each retirement account by your life expectancy.

Considering most people retire in their 60s, age 72 is a long time to wait before tapping an important source of retirement income. Further, withdrawing only the bare minimum from your retirement accounts could mean passing away with a sizeable nest egg left over.

Would you rather someone else enjoy the money you worked so hard to save? If not, what is a safe withdrawal rate that allows you to enjoy a comfortable retirement?

Outliving your savings vs. your savings outliving you

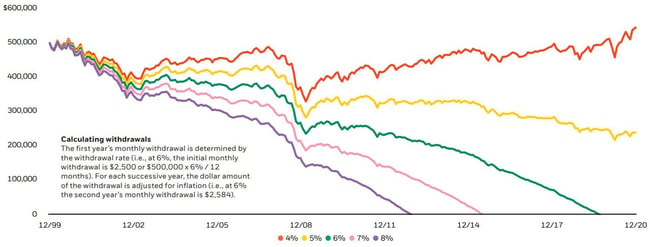

Your withdrawal rate directly affects your portfolio’s longevity. The chart below shows the sustainability of a $500,000 portfolio made up of 50% stocks and 50% bonds over a 20-year period (2000 – 2020).

Source: BlackRock

What’s clear is that the lower your withdrawal rate, the longer your portfolio will last. The portfolio under a 4% withdrawal rate even grows beyond the beginning balance.

While that may sound nice, there’s a potentially significant downside to an overly conservative withdrawal rate. That is the opportunity cost of not using any of that money to enjoy retirement even though you safely could.

Retirement isn’t meant to be a time for accumulating assets. It’s meant to be a time for spending down assets so that you can realize your long-term financial goals – that RV trip across the country, the vacation home along the beach, etc.

That doesn’t mean every retiree should start thinking about spending more. But rather, it highlights the fact that a plan for how you spend down your assets is just as important as a plan for how you grow those assets. It’s all about flexibility.

A safe withdrawal rate without sacrificing your lifestyle

There is a lot of uncertainty in retirement. From your health to your interests to the financial markets, a lot can change.

The best way to adapt to personal and market changes in retirement is to be flexible with your withdrawal rate. Consider it your power to rewrite your retirement story as your life or the financial setting changes. In other words, a safe withdrawal rate is a flexible withdrawal rate.

Essentially, you allow yourself to withdraw a little more some years and a little less other years. One year, you might increase your rate to take that overseas vacation or remodel your home. Then, you may choose to reduce it during a prolonged bear market (as long as your necessary expenses are covered).

Of course, the percentage of your savings that can be sustainably spent each year in retirement depends on many personal factors: your level of wealth, annual expenses, sources of guaranteed income (pensions, Social Security, etc.), age when you retire and market conditions.

With so many moving parts, it helps to partner with a professional financial adviser.

Financial advisers can provide detailed assessments by using financial planning software that run thousands of simulations to show how your portfolio would hold up under a variety of scenarios. You can learn the probability of your portfolio surviving under different withdrawal rates and then create a retirement income strategy that is most comfortable for you.

Greater confidence comes from implementing a retirement income strategy as part of your retirement plan. According to a retirement study by Franklin Templeton, 82% of people with a written plan have a strategy to generate income that could last 30 years or more. But that doesn’t have to come at the cost of enjoying life. A Northwestern Mutual survey found that 71% Americans working with a financial adviser say they “are happy with their life” compared to 50% of those without a financial adviser.

A balanced and well-diversified portfolio should provide the growth and preservation you need over the long term. It’s a flexible withdrawal rate that will then help you improve the likelihood you live a safe and fulfilling retirement.

You start building your comfortable retirement by downloading our free ebook: Your Money in Your 50s: A Retirement Planning Guide for Procrastinators and Avid-Savers.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.