Investment Strategies for a Secure Retirement

December 1st, 2023 | 5 min. read

Retirement should be a time of joy and purpose, an era defined more by ease and less by worry.

But with longer life expectancies and rising living costs, the need to build a robust financial nest egg for post-work years has never been more critical. This reality, coupled with the volatility of capital markets and the unpredictability of economic policies, places a significant emphasis on individual responsibility for retirement savings.

We’re here to help. Since 1986, Advance Capital Management has guided individuals in planning for a secure retirement. Check out our retirement planning services to learn how. We understand the importance of clarity in retirement goals and are dedicated to helping you map a precise path to your financial future.

With that goal in mind, this article aims to inform you about sound investment strategies designed to help you pursue a financially stable retirement.

Understanding your retirement goals

A successful retirement plan starts with clearly understanding your personal retirement goals. These goals are not one-size-fits-all but vary significantly based on your aspirations, lifestyle choices and financial circumstances.

Age plays a pivotal role in shaping these goals. Younger investors have a longer time horizon, allowing them to absorb more risk for potentially higher returns, whereas older individuals might prioritize capital preservation. Your envisioned retirement lifestyle – whether it involves traveling the world, pursuing hobbies or simply enjoying a peaceful life at home – also determines the size of the financial cushion you’ll need. Find out how to calculate your retirement savings needs here.

Furthermore, your current savings and income levels influence the aggressiveness or conservatism of your investment strategy. Recognizing these factors underscores the necessity for a personalized approach to retirement planning. It’s about aligning your investment decisions with your unique life path, ensuring that your golden years are both financially secure and aligned with your vision of retirement.

Asset allocation & diversification: the keys to risk management

Asset allocation and diversification are foundational principles in creating a retirement portfolio.

Asset allocation involves dividing investments among different categories, or asset classes, such as stocks, bonds and real estate. This strategy is based on the premise that different asset classes react differently to market conditions.

Diversification, a complementary concept, involves spreading investments within these asset classes to minimize risk. For example, rather than investing solely in the stocks of technology companies, a diversified portfolio would include stocks from various sectors, government and corporate bonds, and perhaps real estate investment trusts (REITs).

The power of diversification lies in its ability to balance risk and reward. While stocks generally offer higher growth potential, they come with increased volatility. Bonds, on the other hand, provide more stable returns but with lower growth prospects.

Investing always carries the risk of financial loss. Fortunately, you can mitigate one specific risk—the danger of putting all your funds into a single company that fails—by diversifying your investment across many different securities.

Additionally, there is no universally “ideal” asset allocation. Much like how the “perfect” weather varies from person to person, the right investment mix depends on what aligns with your comfort level and gives you the chance to achieve your financial goals.

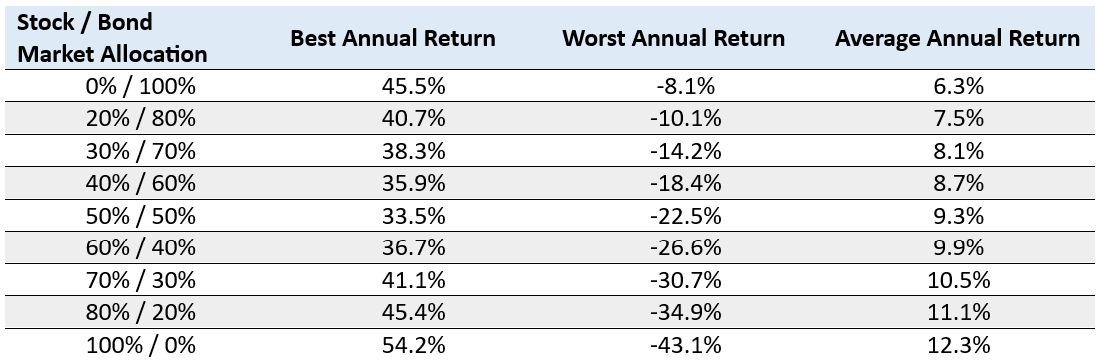

To illustrate the variable risk and return characteristics of different asset classes, the table below charts the best, worst and average market index returns for various stock/bond market allocations over a 95-year period (1926-2021). Although this example covers an unusually extended holding period, it shows why a 20/80 stock/bond market allocation might have a very different outcome than an 80/20 mix.

Stocks had an average return of 12.3%, the highest among the allocations, but with significant fluctuations, ranging from a low of -43% to a high of 54% annually.

The 60/40 stock/bond market allocation had an average return of 9.9%. Learn more about the potential benefits of a 60/40 portfolio here.

Lastly, bonds averaged 6.3% in annual returns. Again, bonds are often used to counterbalance stock market losses, typically showing a negative correlation with stock performance.

By diversifying across different asset classes, investors can mitigate the risk of significant losses in any one area while still positioning themselves for overall portfolio growth. This balanced approach is especially crucial for retirement planning, where preserving capital becomes as important as growing it.

The role of investments in your retirement portfolio

Let’s dive deeper into the specific roles certain investments play in retirement portfolios.

Stocks and bonds

Adding to what we covered above, stocks and bonds serve complementary roles. Stocks are the growth engines, offering the potential for higher returns through capital appreciation and dividends. However, this comes with higher volatility and risk. Bonds, conversely, provide a stabilizing influence. They offer regular income and are typically less volatile than stocks, making them crucial for risk management.

The right balance between stocks and bonds hinges on individual factors like age and risk tolerance. Younger investors might favor stocks for long-term growth, while those nearing retirement could lean towards bonds for stability.

Alternative investments

Beyond stocks and bonds, alternative investments like real estate, commodities and private equity can diversify portfolios and tap into new growth avenues. Real estate, for instance, can provide both rental income and appreciation potential. Commodities like gold or oil can hedge against inflation and market volatility.

Meanwhile, emerging trends like ESG investing integrate environmental, social and governance factors, aligning investments with personal values while potentially tapping into sustainable growth areas. The digital asset space, including cryptocurrencies and blockchain ventures, represents a frontier of innovation but comes with considerable risk.

Investors should approach these alternatives with caution, recognizing their higher risk profiles and the need for professional advice. Including these in a retirement portfolio offers potential benefits but requires careful consideration to avoid excessive exposure to volatile markets.

Active investing

Active investing involves a hands-on approach where investments are carefully selected and managed with the goal of outperforming the market. Unlike passive strategies that mimic market indices, active investing relies on market research, economic forecasts and individual security analysis to make strategic buying and selling decisions.

For retirement planning, active investing can offer several benefits. It allows for tactical adjustments in response to market conditions, potentially capitalizing on short-term opportunities or avoiding downturns. This approach can be particularly advantageous in volatile or bear markets, where active managers may navigate risks more adeptly than passive strategies.

However, it requires effort and time, making it suitable for more experienced investors or those who work with knowledgeable financial advisers. When executed skillfully, active investing can enhance portfolio returns and provide a tailored fit to individual retirement goals and risk profiles. Read this article to learn more about the pros and cons of active vs. passive investing.

Regular review, rebalancing and adjustment

Regularly reviewing and rebalancing your investment strategy is essential for maintaining a portfolio that aligns with your evolving financial situation, retirement objectives, and risk tolerance.

Rebalancing involves adjusting your portfolio’s asset allocation to its original or updated target, countering the drift caused by varying performance across different assets. This process not only ensures that your investment approach remains consistent with your current life stage and goals but also allows for strategic responses to market fluctuations.

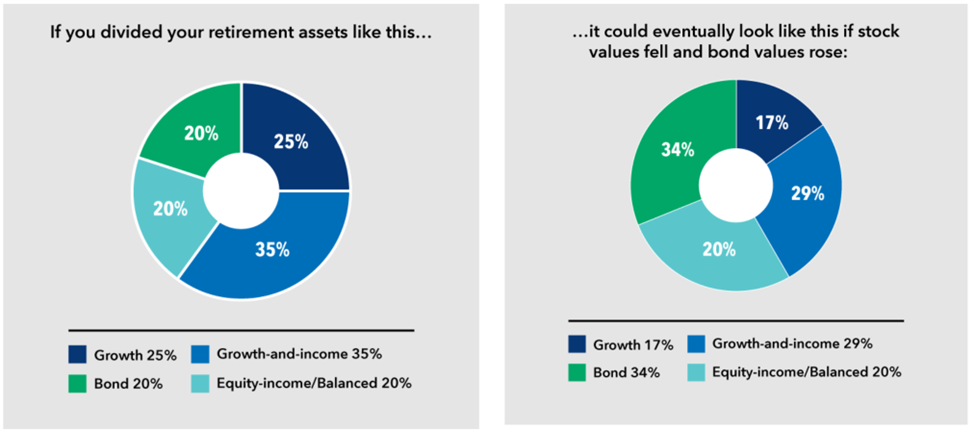

Your investments will naturally fluctuate in value as market conditions change. Over time, certain investments may outperform others, leading to a shift in your portfolio’s original asset allocation percentages. You may need to transfer funds between investments to maintain your intended balance. The example below illustrates this concept.

Source: Capital Group. These charts are for illustrative purposes only. The hypothetical examples are not intended to show the performance of any particular investment. Your results will be different.

Source: Capital Group. These charts are for illustrative purposes only. The hypothetical examples are not intended to show the performance of any particular investment. Your results will be different.

By periodically recalibrating your investments, you can maintain the desired risk level and stay on track toward a secure retirement, effectively navigating both personal life changes and economic conditions.

Bottom line

A secure retirement is built on well-planned investment strategies that encompass clear goals, a balanced mix of assets, and adaptability to change. Whether through stocks, bonds or alternative investments, effective diversification and regular portfolio reviews are critical.

For a strategy tailored to your unique needs, consulting with a financial adviser is highly recommended. Explore your investment options during a free consultation with an Advance Capital Management adviser – schedule yours today!

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.