5 Alarming Facts That Should Get You Planning for Long-Term Care

November 15th, 2017 | 3 min. read

November is national Long-Term Care Awareness Month. For most Americans, it doesn’t evoke the same level of engagement as other month-long observances for terrible diseases such as breast cancer or ALS. But, it may be time that it should.

November is national Long-Term Care Awareness Month. For most Americans, it doesn’t evoke the same level of engagement as other month-long observances for terrible diseases such as breast cancer or ALS. But, it may be time that it should.

Long-term care refers to a range of services to meet the personal health care needs of someone suffering from chronic illness or disability over an extended period of time. Primarily, this type of care consists of help with daily activities, such as eating, bathing, dressing, etc. Care is provided at home, in an assisted living facility or in a nursing home.

The need for long-term care can dramatically change your life as well as the lives of people close to you. And, that need is growing nationally as life expectancies continue to rise. That’s why everyone should consider having some kind of plan in place for long-term care.

So, when should you start planning for long-term care? Like your other retirement planning needs: the earlier, the better. Many people though don’t start until they’re in their 50s. If planning for long-term care isn’t yet on your radar, these facts should do the trick.

You or someone you love will likely need long-term care

An estimated 70% of people reaching age 65 today will need some form of long-term care in their lifetime, according to the U.S. Department of Health and Human Services.Therefore, there’s a good chance you or someone you love will be affected.

The growing demand for long-term care can be attributed to the fact people live longer. With age comes greater risk of experiencing debilitating conditions, like strokes and dementia, that leave individuals especially vulnerable.

Long-term care is expensive

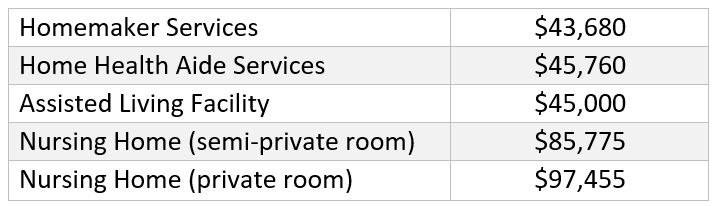

Long-term care costs vary based on the services provided, where care is provided and how long care is provided. The national median hourly rate for care at home by a homemaker service is $21, and $22 for a home health aide. That adds up to more than $43,000 and $45,000 a year, respectively, assuming 40 hours of care per week.

Outside the home, care at an assisted living facility may cost around $3,750 per month, for a yearly cost of $45,000. Nursing home costs differ between semi-private and private rooms, with the national median daily rate at $235 and $267, respectively. That works out to more than $85,000 annually for a semi-private room and more than $97,000 annually for a private room.

Median Annual Cost of Long-Term Care

Source: Genworth, Cost of Care Survey 2017

The high cost of long-term care is why many people often find themselves relying on family and friends to provide care, which can create a financial, emotional and physical burden on loved ones.

Medicare doesn’t cover long-term care

A common misconception is that older adults can rely on Medicare for long-term care needs. But, Medicare pays for “medical services,” whereas long-term care primarily consists of “custodial services.”

Medicare provides support only on a limited basis for skilled services in a nursing home or at a patient’s residence, with a maximum benefit period of 100 days. However, full benefits last only 20 days. Considering most recipients need care for one to three years, Medicare is not a viable option to cover long-term care expenses.

You likely won’t be able to get insurance if you wait

Long-term care insurance is one way to hedge against the high cost of care. Basically, long-term care insurance pays a daily amount, up to a predetermined limit and length of time, for qualified services. Those factors, along with any optional benefits, generally determine the cost of premiums.

Age and current health, however, are also major factors. The average long-term care insurance buyer is age 56, with most policyholders falling in the range of ages 50-69. The older a person is, the more expensive the policy will be. Insurers can also reject or place care limitations on those who are in poor health or have preexisting conditions.

Qualifying for Medicaid means liquidating most of your assets

Generally, Medicaid is for those who have limited savings and cannot afford long-term care insurance or were denied coverage. Typically, to qualify for Medicaid, an individual is only allowed to have $2,000 in countable assets. For married couples, the spouse who isn’t applying for Medicaid benefits may keep up to half of both spouses’ joint liquid assets, but only up to $119,220 (in 2016) in what is called “the community spouse resource allowance.” It’s important to note that Medicaid qualification guidelines vary from state to state and may change from year to year.

Still, some people try to reposition their assets to work around Medicaid limitations and gain access. However, such Medicaid planning techniques have been made more difficult as states limit the transfer of assets to avoid using them to pay for long-term care. So-called ‘look back’ rules prevent people from gaming the system by requiring assets to have been liquidated a certain amount of years prior, usually five years, to applying for Medicaid. Further, federal law requires states to collect from a person’s estate the costs of the Medicaid benefits received.

For information on ways to cover the costs of long-term care, download our white paper “Options for Funding Long-Term Care Expenses.”

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.