8 Easy Ways NOT to Achieve a Comfortable Retirement

August 27th, 2021 | 5 min. read

We all want to achieve a comfortable retirement: to have full control over our time to do what we want whenever we want for however long we want. Or, do you?

Maybe you love the 9-to-5 grind. Or, maybe you enjoy the uncertainty of not knowing if you can pay for medical care should you need it. Or, maybe you prefer sleepless nights caused by worrying about how to pay your bills.

If that’s the case, you wouldn’t be the only one who may have to accept a lower standard of living in retirement.

Clever Real Estate, an online education platform for home buyers, sellers and investors, surveyed 1,500 Americans in 2020 about their retirement funds, debt and financial worries. It found the average retiree has only $177,787 in retirement funds. That is far less than most recommended savings targets.

A common rule of thumb is to save around 8 times your salary by ages 60-65. So, a person earning an annual salary of $55,000 should save $440,000 by retirement.

If your goal is to fall far short of that goal, it’s not hard to get there. Here are 8 easy ways to not achieve a comfortable retirement.

Put off saving for retirement until tomorrow

Face it, we all procrastinate from time to time. At its least harmful, procrastination means showing up late to an appointment or letting the weeds grow a little too high. At its worst, it can mean lower odds that you’ll be able to retire.

When you start saving is one of the biggest difference makers in building wealth. The more time you get to take advantage of compounding (the earnings earned on your earnings), the more your account will grow.

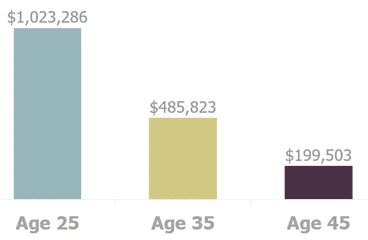

Here is an example of what the difference in ending balances would be at age 60 if you save 15% of a $55,000 salary starting at ages 25, 35 and 45.

Starting at age 25 versus age 45 in this example is a $823,783 difference! In other words, the later you start saving for retirement, the worse off you’ll be.

Set it and forget it

The surest way to build wealth is by saving. It is more important than investment performance.

The annual 401(k) contribution limit is $19,500 (2021). But those 50 and older get the benefit of catch-up contributions, which allows them to save an additional $6,500 per year, for a total allowable annual contribution of $26,500 (2021).

Of course, you are not required to max out your retirement accounts. In fact, most people never come close. Instead, a common mistake is to set a low contribution amount early in your career and then never increase it. Set it and forget it.

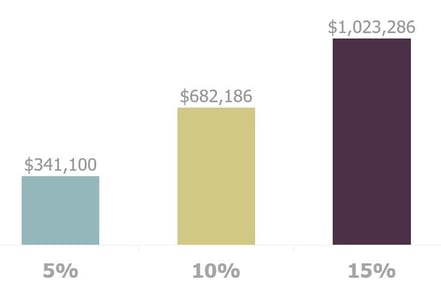

Increasing your savings makes a major difference over time. Consider how much of a difference just a 5% savings increase can have. Below are the ending balances from various savings rates on a $55,000 salary over 35 years (assuming a 6.5% annual return).

If you aim for a low savings target, you can expect to end up with a low savings amount.

Take on too much, or not enough, investment risk

The point of putting your savings into a retirement account is to invest it with the expectation of growing that money. But that growth doesn’t come free. You have to carefully choose investments that offer a reasonable enough return to meet your retirement goals.

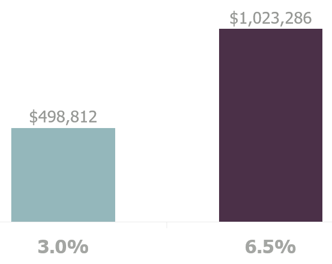

Using our previous example of saving 15% of a $55,000 salary over 35 years, look at the difference in ending balances if we were to assume a rate of return of only 3% compared to 6.5%. It’s reduced by more than half.

But if a reasonable rate of return is not your thing, you could do one of two things: Go for broke or play it really really safe. Stocks have historically outpaced inflation and posted larger returns than more conservative investments like bonds. As a riskier investment though, they also tend to suffer deeper losses, which means you could lose money by taking on too much risk. On the flip side, if you invest too conservatively, you may not earn a high enough return to grow your money at all.

Generally, you should invest aggressively early in your career and then gradually reduce your stock allocation as you near retirement. That is, if you actually want that.

Spend like there is no tomorrow

You can’t save for retirement if you spend all your money or spend more than you actually have. High levels of debt will certainly put a comfortable retirement out of reach.

Unfortunately, too many people carry debt into retirement, which is dangerous when you live on a fixed income. According to the Employee Benefit Research Institute’s 2021 Retirement Confidence Survey, half of workers say their non-mortgage debt negatively impacts their ability to save for retirement in general and 4 in 10 say it negatively impacts their ability to participate in a workplace retirement plan. Further, more than half of workers and a third of retirees call debt a major or minor problem for their household.

But if you’d rather fund the lifestyle of credit card company executives than your own retirement, consider this the way to go.

Just wing it

A financial plan is proven to help people save more for retirement. An HSBC study found that people with financial plans amassed nearly 2.5 times more retirement savings than those without a plan. According to the Charles Schwab Modern Wealth Survey 2021, over half of Americans who have a written financial plan feel “very confident” about reaching their financial goals, while only 18% of those without a plan.

A comfortable retirement inevitably requires careful planning. So, anyone who prefers financial surprises can just skip this step and wing it.

Treat your 401(k) like an ATM

Early withdrawals and loans from your 401(k) account are the equivalent of taking two steps backward. Any time you take money from your retirement savings to pay for current expenses, you are guaranteed to have less money in retirement. Not only does it reduce your balance, but you also miss out on all those potential earnings from compounding.

Additionally, there are tax consequences. Withdrawals are taxed at your ordinary income tax rate. And, if you are under the age of 59 ½, you may also be subject to a 10% early withdrawal penalty.

Hope Social Security and Medicare will pay for it all

Social Security is an important source of income for almost every retiree. The EBRI Retirement Confidence Survey reports more than 90% of retirees say Social Security is their top source of retirement income.

But Social Security replaces only a portion of your income. It can be as low as a quarter for high-income earners. Consider the estimated average monthly Social Security payment in 2021 is $1,543. For most people, that will not be enough to meet all of their needs in retirement, especially when you factor in higher health care costs.

Two common myths about Medicare are that it is completely free and will cover all medical costs. In fact, there are premium costs associated with the original Medicare programs, Part A and Part B. Plus, you will likely have to add on additional coverage for things Medicare doesn’t cover, including prescription drugs, dental work, vision treatment and long-term care.

Therefore, those who believe their retirement needs will be met with Social Security and Medicare face an uncomfortably rude awakening.

Frequent steak dinner sales pitches

When you reach a certain age, you can expect to be invited out to dinner – a lot. That’s because some companies hope to sell financial products by winning people over with fancy dinner seminars. Of course, not all of them are bad. But you have to be careful. Financial professionals are not all alike.

For example, registered investment advisors (RIAs), are regulated under the fiduciary standard, which means they are legally required to always act in their clients' best interests. Other financial professionals, such as stockbrokers and advisers working for insurance firms, are non-fiduciaries. They may operate very differently, from how they charge for services to how they disclose conflicts of interest, than a fiduciary adviser.

Or they may try to sell complex financial products such as annuities, which may come with layers of fees, restricted access to your money and penalties for withdrawing your money early.

But if you really enjoyed the steak and feel that bad for eating on their dime, then go ahead and buy what they’re selling… just don’t expect it to guarantee you a comfortable retirement.

Now, if you decide that you do want to retire successfully, you can generally do the complete opposite of the steps above. And if you are guilty of some of these steps, that’s okay. Here’s the good news: it’s not too late to get on the right track.

You start building your comfortable retirement by downloading our free ebook: Your Money in Your 50s: A Retirement Planning Guide for Procrastinators and Avid-Savers.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.