How Work Earnings Affect Your Social Security Benefit

October 31st, 2019 | 2 min. read

The conventional definition of retirement may itself need to be retired.

Many older adults today expect to work late into their 60s and beyond. AARP’s Life Reimagined survey found more than half of respondents plan to work past the traditional retirement age of 65. Eleven percent say they expect to keep working into their 80s or beyond. Currently, 40% of people ages 55 and over are working or looking for work, according to the St. Louis Federal Reserve.

Not all people plan to work because they need the money. In several studies, older workers and retirees say they choose to work for nonfinancial reasons, including to stay mentally active and to have a sense of purpose.

This trend reflects how people experience retirement differently today, as a dynamic transition in which people re-invent themselves.

However, those work earnings can create unintended financial consequences for those who also collect Social Security. Therefore, it’s a good idea to learn how working may temporarily affect one of your most important retirement income sources.

Rules of Working and Collecting Social Security

- If you receive work earnings and Social Security income before the year you reach Full Retirement Age (FRA), which is age 66 for most people, $1 is withheld for every $2 earned above a certain threshold – $17,640 in 2019.

- The threshold is higher in the year you reach FRA ($46,920 in 2019), with $1 withheld for every $3 earned above the threshold until the month your reach FRA.

- If you work and have reached your FRA or older, you may keep all your benefits, no matter how much you earn.

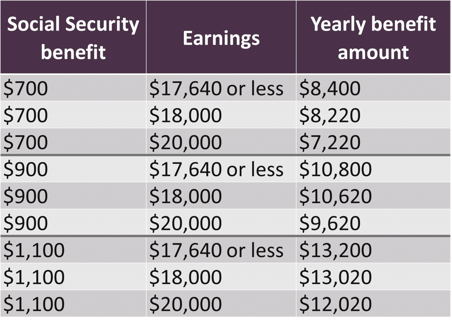

The following table illustrates how your monthly Social Security benefit would be impacted in 2019 based on your monthly benefit amount and your earnings.

Individual younger than full retirement age during the full year

Social Security Administration

- If some of your monthly benefits are withheld because of your earnings, your monthly Social Security income will be increased permanently to reflect the months that your benefit was reduced.

- Only your wages count toward the earnings limits. For those who are self-employed, only your net earnings from self-employment count. Income that does not count toward the earnings limit include other government benefits, investment earnings, interest, pensions, annuities and capital gains.

- You pay Social Security taxes on work earnings, even when your benefit is reduced.

- The reduction only applies to earnings after you retire and begin receiving Social Security. In 2019, a person younger than full retirement age for the entire year is considered retired if monthly earnings are $1,470 or less.

- The same temporary reduction applies to a spouse working before FRA and receiving a spousal benefit. Your earnings can also reduce the spousal benefit payable to your spouse.

- People who retire mid-year may have already earned more than the annual earnings limit. For them, a special rule applies for the first year you retire, under which you can receive a full benefit check for any whole month you’re retired, regardless of your yearly earnings.

- You get a “do over” if you notify the Social Security Administration within 12 months of claiming Social Security that you’re working and pay back the benefits you’ve already received.

The Bottom Line

Which Social Security rules apply to you depends on your personal situation. And, in any given year, those rules can change. That’s why you should consider consulting with a financial adviser to decide when best to file for Social Security and where work fits into your overall financial picture.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.