Using Medicaid to Pay for Long-Term Care

July 8th, 2020 | 4 min. read

The purpose of retirement planning is to optimally use your assets to fund your retirement goals, but also cover all the needs that may arise as you age. One of those needs for a growing number of Americans is long-term care. More than half of those turning age 65 today will require some form of long-term care, according to the U.S. Department of Health and Human Services.

If not properly planned for, this can create a financial, physical and emotional strain on you and your loved ones.

A common misconception is that older adults can rely on Medicare for long-term care needs. But Medicare pays for “medical services,” whereas long-term care primarily consists of “custodial services.”

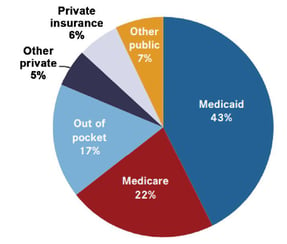

Medicaid, a government program designed to provide medical care for those with limited resources, is the primary payer for formal long-term care, covering about 43 percent ($146 billion) of all long-term care spending in 2013.

Unlike Medicare, Medicaid does provide for custodial care, including long-term care services in nursing homes and services provided at home, such as visiting nurses and assistance with personal care. Medicaid programs and the services provided vary state by state.

Source: Congressional Research Services

The qualifications for Medicaid – assets, income, and medical need – also vary by state. Some states require relative impoverishment to qualify for Medicaid, while others allow money set aside for a surviving spouse to be exempted from consideration to pay for long-term care.

Many people start paying for care out-of-pocket and “spend down” their income and assets until they are eligible for Medicaid. However, you may have to use up most of your assets paying for your long-term care before Medicaid is able to help. Hence, Medicaid is commonly considered the option of last resort.

Qualifying for Medicaid

Generally, Medicaid is for those who have limited savings and cannot afford long-term care insurance or were denied coverage. Typically, to qualify for Medicaid, an individual is only allowed to have $2,000 in countable assets. For married couples, the spouse who isn’t applying for Medicaid benefits may keep up to half of both spouses’ joint liquid assets, but only up to $128,640 (2020) in what is called “the community spouse resource allowance.” It’s important to note that Medicaid qualification guidelines vary from state to state and may change from year to year.

Look Back Rules

Still, others reposition their assets to work around Medicaid limitations and gain access. One strategy is to transfer assets to a family member. However, such Medicaid planning techniques have been made more difficult as states limit the transfer of assets to avoid using them to pay for long-term care. So called “look back” rules prevent people from gaming the system by requiring assets to have been liquidated a certain amount of years prior, usually five years, to applying for Medicaid. Further, federal law requires states to collect from a person’s estate the costs of the Medicaid benefits received.

Medicaid Asset Protection Trusts

Another way people can qualify for Medicaid benefits yet may still be able to protect some of their assets is to create a Medicaid Asset Protection Trust. Here, an individual or couple (the grantor(s)) transfers assets to an irrevocable trust that is managed by another person (the trustee).

This type of trust then pays the income from those assets to the individual or couple who established the trust for life. The principal cannot be applied to benefit the grantor(s). Upon death, the principal is paid to the designated beneficiaries. This way, the funds in the trust are protected and the income can be used for living expenses.

For Medicaid purposes, the principal in such trusts is not counted as a resource, provided the trustee cannot pay it to the grantors for either of their benefits. However, if an individual grantor moves to a nursing home, the trust income will have to go to the nursing home whereas for couples, the income is paid to the healthy spouse.

There are drawbacks to such an arrangement. For one, an individual or couple who fund an irrevocable trust will likely be ineligible for Medicaid benefits for a limited period of time. Further, grantors cannot gain access to the trust funds even if that money is needed for some other purpose. The assets are essentially locked away.

For these reasons, such Medicaid planning techniques are not right for everyone and should be only considered with the help of a professional, such as an elder law attorney.

Medicaid Partnerships

As a way to relieve pressure on the Medicaid program, some states offer “partnership” long-term care insurance policies. In these states, policyholders who use up their long-term care insurance benefits can keep a specified amount of assets and still be eligible for Medicaid.

For example, a purchaser of this policy has a benefit of $150,000. That amount in assets is protected from Medicaid and can be passed on to beneficiaries. So, if the policyholder were to go into a nursing home and spend down the entire benefit, he or she would become eligible for Medicaid and would be able to keep an additional $150,000 over the asset level required to qualify for Medicaid.

Partnership policies can cost about the same as standard long-term care insurance policies with comparable benefits, but they may be less expansive and with shorter terms than regular policies. State standards for these policies vary as well, and the way they work in conjunction with a state’s Medicaid program can be tricky, so consumers considering such insurance should thoroughly research their state’s rules and/or seek professional guidance.

Benefits of Medicaid for Long-Term Care

Medicaid makes it possible for all eligible people to receive some form of long-term care. People with very limited financial resources or who were denied insurance coverage, at least have one long-term care funding option available to them.

Drawbacks of Medicaid for Long-Term Care

Often, people who use Medicaid for long-term expenses have no other options. Those with the financial means to pursue other options are likely better off doing so, rather than attempt to move their assets around to circumvent Medicaid restrictions.

- Qualifying for Medicaid generally means exhausting one’s assets.

- Attempting to work around restrictions to gain access is difficult and may result in relinquishing assets with no benefit.

- May receive a lesser level of care than those using other options.

Options for Funding Long-Term Care

Medicaid is generally only for those who have few assets and/or have exhausted all other options, or who can’t qualify for long-term care insurance. Since Medicaid has imposed rules that make it harder to qualify, it is also more difficult to strategically transfer assets to gain access.

As of now, there is not a one-size-fits-all option for funding long-term care. The personal factors involved – such as income and assets, current health, family medical history, etc. – make everyone’s situation unique.

As a result, the way to improve your chances of making the right decision is to plan as early as possible. Have a discussion with your loved ones about how you want to be cared for if long-term care is necessary. And, considering the complexity and costs of long-term care, it’s beneficial to work with a professional, such as a financial adviser or elder law attorney, who can help determine what option is most appropriate for you.

For more information on ways to cover the costs of long-term care, download our white paper Options for Funding Long-Term Care Expenses.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.