Creating a Retirement Income Stream: Savings, Social Security and More

January 25th, 2024 | 4 min. read

Retiring means you stop receiving a regular paycheck and start to generating one from your savings.

But how?

This is where creating a reliable retirement income stream becomes essential. It’s all about making sure your savings last through retirement and support the lifestyle you want. But as people live longer and the cost of living keeps going up, getting this balance right is challenging.

At Advance Capital Management, we know a well-planned retirement income stream is the key to a happier, more comfortable retirement. That’s why our retirement planning service offers advice on more than just your portfolio.

If you’re not sure where to begin – don’t worry. In this article, we’ll provide an overview of important considerations for creating a solid and sustainable income stream for your retirement.

This article covers the following:

- Understanding Your Retirement Needs

- Sources of Retirement Income

- Combining Your Income Sources

- Managing Risks in Retirement

- Pros and Cons of Common Retirement Income Strategies

Understanding Your Retirement Needs

Preparing for retirement begins with a clear understanding of your future expenses and lifestyle goals. Start by estimating day-to-day living costs, healthcare and occasional indulgences like travel or hobbies. Remember, being realistic helps you avoid underestimating your needs.

Inflation is another vital consideration; it will impact your purchasing power over time, so your income strategy needs to address this.

Having a realistic, adaptable retirement plan is essential. It should reflect your personal goals and be flexible enough to adjust to life’s changes and economic shifts. All these calculations and planning steps can be difficult to do on your own, so consider working with a financial adviser to put a plan in place.

Read this blog post, How to Calculate Your Retirement Savings Needs, to learn more.

Sources of Retirement Income

Next, creating a steady income in retirement involves combining different sources. Let’s look at some of the most common:

Social Security: A basic part of most retirement plans, but it typically doesn't cover all expenses. It’s important to decide the best age to start taking these benefits to maximize what you receive. We cover the pros and cons of claiming Social Security early vs. delayed here.

Pensions: Not as common as they once were, but if you have one, understand your options for taking this income. Not sure if a monthly annuity or lump sum is better? Here’s what you need to know.

Retirement Accounts (401(k), IRA, 403(b), TSP, etc.): These accounts can have unique tax rules for withdrawals. The goal is to cover what expenses are not covered with your guaranteed income sources as tax-efficiently as possible. How you invest within these accounts should align with your retirement needs and goals. Additionally, dividends from stocks or mutual funds are noteworthy here. They provide regular payments (often quarterly) that can be used for expenses or reinvested.

Beyond traditional sources, alternative income sources can help provide extra security and flexibility in your retirement income stream:

Part-Time Work: Supplements your income and keeps you engaged. It’s a great way to stay active and earn money simultaneously.

Rental Income: Real estate investments can provide consistent cash flow. Keep in mind, they require active management and maintenance.

Annuities: They can offer guaranteed income. However, annuities come in various forms and can be complex. It’s important to understand their terms and costs, ensuring they fit into your overall retirement plan.

But there’s a wider variety of retirement income sources, such as home equity and inheritances, which we cover in more detail in this article: What Exactly Is Retirement Income? And Why You Need to Know Your Sources.

Combining Your Income Sources

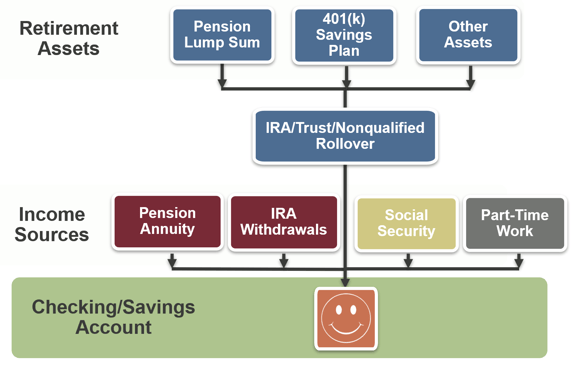

When crafting a sustainable income stream in retirement, the focus should be on effectively managing all your income sources in unison, rather than maximizing each one individually.

This holistic approach allows for a balanced risk-taking strategy and more efficient tax management, ensuring a more stable and prosperous retirement.

Ultimately, a mix of retirement assets and income sources can come together to help you create that retirement paycheck:

Managing Risks in Retirement

As you consider how to effectively use your income sources, it’s important to include certain retirement risks into your decisions:

Longevity Risk: The risk of outliving your savings. Mitigate this by creating lifelong income streams, such as certain annuities or a diversified investment portfolio.

Healthcare Costs: These typically increase with age. Navigating Medicare effectively and assessing your potential need for long-term care are vital steps in safeguarding against unexpected medical expenses in retirement.

Market Downturns: Diversify your investments and maintain an emergency fund to buffer against market volatility and protect your income plan.

Inflation: Counteract inflation’s impact on purchasing power by investing in assets that historically outpace inflation, such as stocks.

Pros and Cons of Common Retirement Income Strategies

Each income source for retirement has its own considerations and complexities that are beyond the scope of this discussion. However, let’s delve into some common retirement income strategies to give you a brief overview of the options available.

These strategies offer both potential advantages and potential drawbacks. The key is to choose a strategy that aligns with your retirement goals, risk tolerance and financial situation, often benefiting from the guidance of a financial adviser.

- Delaying Social Security

You can choose to start receiving Social Security benefits from age 62, but delaying increases your benefit. The longer you delay, up to age 70, the larger your monthly checks.

Pros: Significantly larger benefits for each year delayed.

Cons: Requires you to have other income sources until benefits kick in, potentially draining savings faster.

- Annuities

Annuities are insurance products that you buy, which can then provide you with a steady income stream during retirement. Types of annuities include immediate, deferred, fixed and variable.

Pros: Guaranteed income stream, offering predictability and financial stability.

Cons: Can be complex, with high fees and limited access to funds.

- Systematic Portfolio Withdrawals

This involves regularly withdrawing a set amount from your investment portfolio. The amount can be fixed or vary based on a percentage of your portfolio’s value.

Pros: Offers flexibility and the potential for your portfolio to grow.

Cons: Risk of depleting funds too quickly, particularly in poor market conditions.

- Bucket Strategy

This approach involves dividing your investments into “buckets” based on when you'll need the funds”

- Short-term bucket: Holds cash and equivalents for immediate expenses.

- Mid-term bucket: Contains conservative investments for income in the near future.

- Long-term bucket: Comprises growth-oriented investments for later in retirement.

Pros: Manages risk and offers a structured approach to accessing funds.

Cons: Requires ongoing management and rebalancing to maintain the strategy’s effectiveness.

Bottom Line

Remember, there’s no one-size-fits-all solution when it comes to retirement income planning. To navigate these decisions effectively, consider scheduling a retirement income planning session with an Advance Capital Management financial adviser today!

We can provide personalized guidance, helping you choose a retirement income strategy that aligns with your needs and goals, so you can find comfort and peace of mind in your golden years.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.