What Exactly Is Retirement Income? And Why You Need to Know Your Sources

September 28th, 2022 | 5 min. read

People like to describe retirement as a marathon and not a sprint. That’s because it takes diligent saving over a long period of time to achieve financial independence. But it’s more accurate to think of retirement as a triathlon, because you’ll rely on a variety of vehicles, or retirement income sources, to finish this kind of race.

So, what exactly is retirement income? Are some more important than others? How do you balance these retirement income sources to create a reliable paycheck?

People get retirement income from a variety of sources: retirement savings accounts, Social Security, your home, rental properties, etc. In addition to knowing how much you need in retirement, it’s just as important to understand what retirement income sources you have available to meet that need.

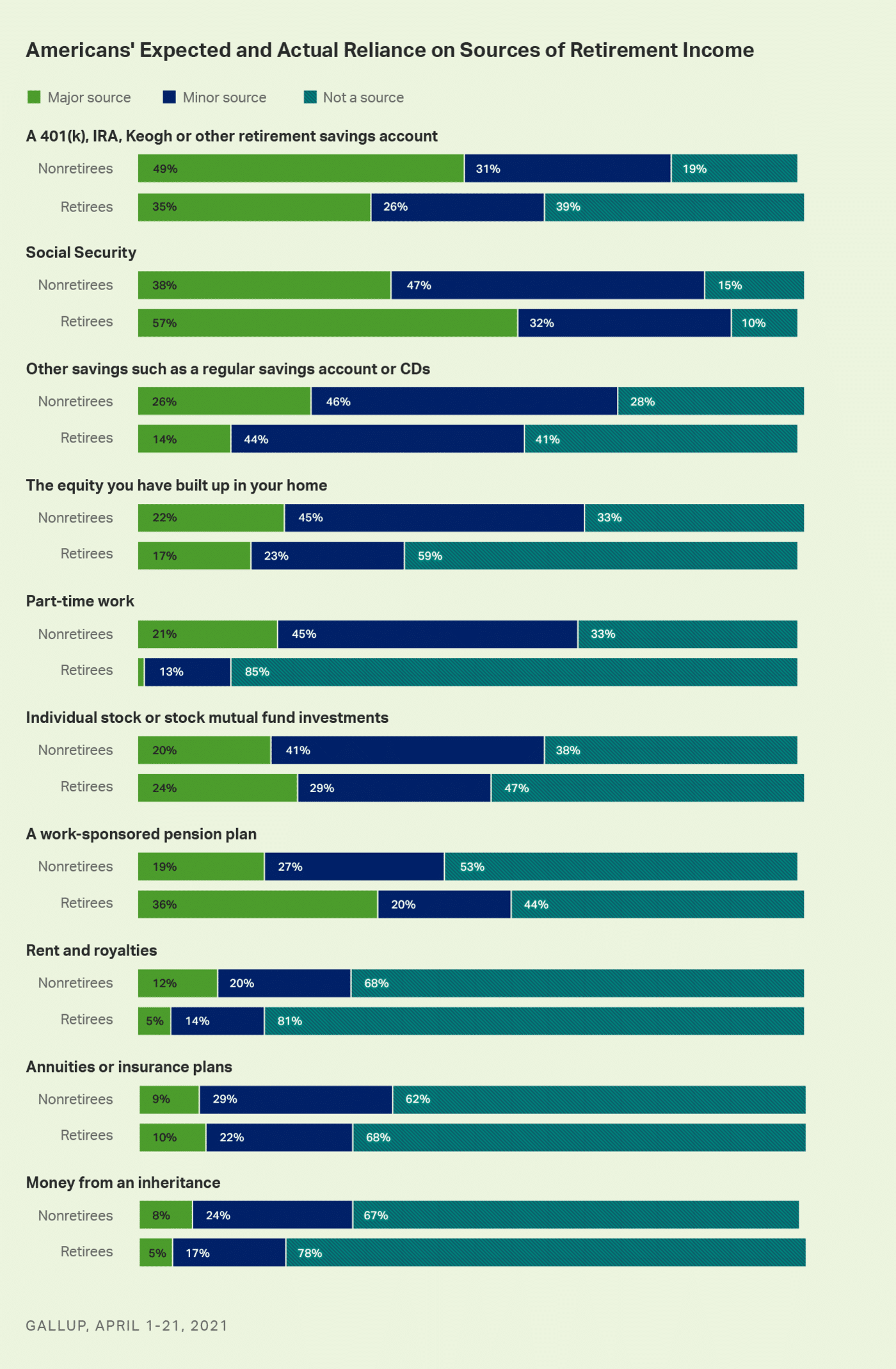

An ongoing Gallup retirement survey shows the top 10 retirement income sources that workers expect to rely on and that retirees actually rely on. This information gives you a good idea of what sources you might have or need in retirement.

So, let’s go through this list of common types of retirement income to answer those questions above.

1. Retirement savings accounts

Most workers (49%) plan to rely on retirement savings accounts, such as 401(k)s and IRAs, as a major source of income in retirement. Retirement accounts are also the third most cited source of retirement income for current retirees (35%). This emphasizes the importance of saving as much as possible during your working years. Additionally, it’s important to get professional guidance to appropriately invest and manage these assets for your specific financial goals.

Learn more about retirement accounts by reading this blog: Types of Retirement Accounts and Plans

2. Social Security

Many workers seem to underestimate this government provided retirement benefit as a source of income later in life. That’s because nearly half of workers (47%) expect Social Security to be a minor source of retirement income while the majority of retirees (57%) say it is a major source. Therefore, Social Security should be a major part of your retirement planning process. Remember, when you claim affects the size of your benefit. A permanent reduction is applied if you claim at the earliest age of 62. But you increase your benefit by delaying until age 70. However, the goal should be to maximize all your income sources together, which means the right age to claim depends on your personal situation.

Learn more about Social Security by reading this blog: Pros & Cons of Claiming Social Security Early vs. Delayed

3. Other savings accounts or CDs

Surprisingly, more than a quarter of workers (26%) expect a significant portion of their retirement income to come from regular savings accounts and certificate of deposits (CDs). Meanwhile, only 14% of retirees say they are a major income source. Regular savings accounts and CDs work well as places to store some excess cash and build an emergency fund. But considering the low rate of return you’re likely to earn from them, they are not suited for saving large sums of your retirement funds.

Learn more about managing your excess cash by reading this blog: What to Do If You Have Too Much Cash

4. Home equity

For many people, their most valuable asset is their home. Over a fifth of workers (22%) anticipate using the equity they have in their homes as a major source of retirement income. Certainly, downsizing can provide a financial windfall to boost your retirement savings. And it also makes sense as you need less space or a home more suitable to your retirement lifestyle. But the fact only 17% of retirees say home equity is a major source of income and 59% say it is not a source at all tells you that homes are not used as retirement assets as much as people typically think.

Learn more about your home in retirement by reading this blog: Using Your Home for Retirement Income

5. Part-time work

Workers and retirees are at odds when it comes to part-time work. While about a fifth of workers expect to keep working in retirement to cover their income needs, only 2% of retirees claim part-time work actually is a major source of income. A whopping 85% of retirees say part-time work is not a retirement income source. Part-time work can be a great way to stay active and earn some additional income in retirement. But once in retirement, people may find few opportunities to work, or their health may just not allow them to work. In other words, you can’t simply plan to keep working to provide for retirement needs.

Learn more about working in retirement by reading this blog: Don’t Want to Quit Working in Retirement? Here’s How It Can Affect Your Financial Plan

6. Individual stock or stock mutual funds

Individual stocks or stock mutual funds are what you may own in a brokerage account, which is separate from a retirement savings account. About a quarter of retirees consider them as a major income source. When it comes to investing in individual investments, especially individual stocks, it’s important to exercise caution. They can carry a lot of risk, which is generally not appropriate for money you need for retirement income.

Learn more about the risks of investing in individual investments by reading this blog: Should You Invest in Individual Stocks?

7. Work-sponsored pension

The trend toward fewer offered pension plans is reflected in the large portion of workers (53%) who say a pension will not be a source of retirement income. If you’re fortunate to receive a pension, carefully consider the pros and cons between taking a lump sum and monthly payments. You may want to seek the professional help of an adviser to determine which option is best for you.

Learn more about choosing between a lump sum and annuity by reading this blog: The Lump Sum vs. Annuity Pension Debate

8. Rent and royalties

These are generally known as passive income sources. For example, buying a rental property, renting out a vacation home throughout the year or selling things online. Although they do not rank highly for either workers or current retirees, the advent of the “sharing economy” may change that for future retirees.

9. Annuities or insurance plans

Almost an equal number of workers and retirees consider annuities or other insurance products as major source of retirement income. Certainly, annuities can be an option for creating another guaranteed income stream like Social Security or a pension. However, they are not for everyone. They can be expensive and complex, so it’s important to know what you’re buying before you buy.

Learn more about annuities by reading this blog: What Insurance Companies Don’t Want You to Know about Annuities

10. Money from inheritance

Unfortunately, most of us don’t have a rich family member to help fund our retirement lifestyles. Still, a growing number of workers today can expect to receive an inheritance in the form of an Inherited IRA or other retirement account, often from their parents. There are a variety of IRS rules for managing those accounts, so plan accordingly.

Learn more about Inherited IRAs by reading this blog: How to Work an Inherited IRA into Your Retirement Plan

Putting All Your Retirement Income Sources Together

Essentially, when it comes to creating a sustainable income stream in retirement, it’s not about trying to maximize each source but rather managing them all together. It can help you take the appropriate amount of risk and efficiently manage your taxes.

This is a concept known as comprehensive asset allocation. Despite the complicated-sounding name, it’s a relatively simple strategy to understand, and you can learn more by watching this short video:

But if you’re looking for a review of your personal retirement income sources, consider speaking with an Advance Capital Management financial adviser for a complementary financial plan and consultation.

Have you taken the steps necessary to be on track for retirement?

DOWNLOAD THIS FREE PLANNING GUIDE TO FIND OUT!

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.