What to Do If You Have Too Much Cash

October 27th, 2021 | 4 min. read

Yes, you read the title right. Too much cash. Some of you may be thinking: how can anyone have too much cash? To put it one way, cash is a financial asset, but it’s not always an asset to your finances.

Yes, you read the title right. Too much cash. Some of you may be thinking: how can anyone have too much cash? To put it one way, cash is a financial asset, but it’s not always an asset to your finances.

Although cash is king, it is a stingy king. You should have a certain amount of cash that is easily accessible to help cover financial emergencies or immediate financial goals. However, with interest rates so low, you practically earn nothing on your cash when it is saved in a bank account.

Sure, low rates are great if you’re a borrower. For example, if you buy a car or take out a mortgage. But low rates are bad when you’re a saver. Which means, yes, you can have too much of a good thing. Even when that good thing is cash.

So, how much is too much, and what should you do with your excess cash?

It’s all about balance. Here is how you can efficiently manage your cash so that your finances are protected in the short term but also well-positioned for the long term.

How Much Cash to Keep on Hand

Again, liquid cash is a necessity. It doesn’t matter if you are an Average Joe or Jeff Bezos, everyone should have cash on hand for life’s unexpected events (medical emergency, home repairs, job loss, etc.).

The point of that money isn’t to earn a nice return, but rather to just be there when you need it most. For that purpose though, the amount of cash to have is not unlimited.

You may have heard recommendations to set aside 6 or even 12 months’ worth of living expenses in cash. While that provides a wide financial safety net, it could be almost too safe. For a couple who has $7,000 in monthly expenses, as an example, that rule of thumb equates to saving $42,000 to $84,000. That is potentially a lot of money simply sitting there; hopefully in a bank account and not stuffed under a mattress.

Instead, it can make more sense to keep a lower amount of cash on hand, say, 1 to 3 months’ worth of living expenses, and then invest the excess amount.

Let’s explore why.

The Adverse Impact of Inflation on Cash

The biggest risk of having too much cash isn’t the missed opportunity of growth, it is the loss of purchasing power over time. That is the adverse effect of inflation, the rise in price of goods and services. For instance, $10,000 saved at the bank today will not buy $10,000 worth of stuff in 10 years or, perhaps, even one year from now.

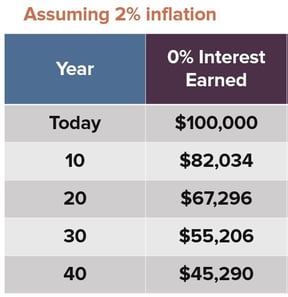

When you combine near-zero interest rates with rising inflation, you can expect your money’s value to gradually decline. Historically, the rate of inflation has been around 3%. But even if we consider a 2% inflation rate, reflecting low inflation in recent times, it still has a significantly negative effect on your purchasing power.

Here is the impact of 2% inflation on $100,000 saved in an account earning 0% interest:

After 40 years, you would still have $100,000 in your bank account. Except you would only be able to buy around $45,000 worth of stuff.

Investing Excess Cash

Keeping the value of your money above the rate of inflation is a major reason for investing money. Therefore, you should consider investing your excess cash – as long as you have a fully funded emergency fund.

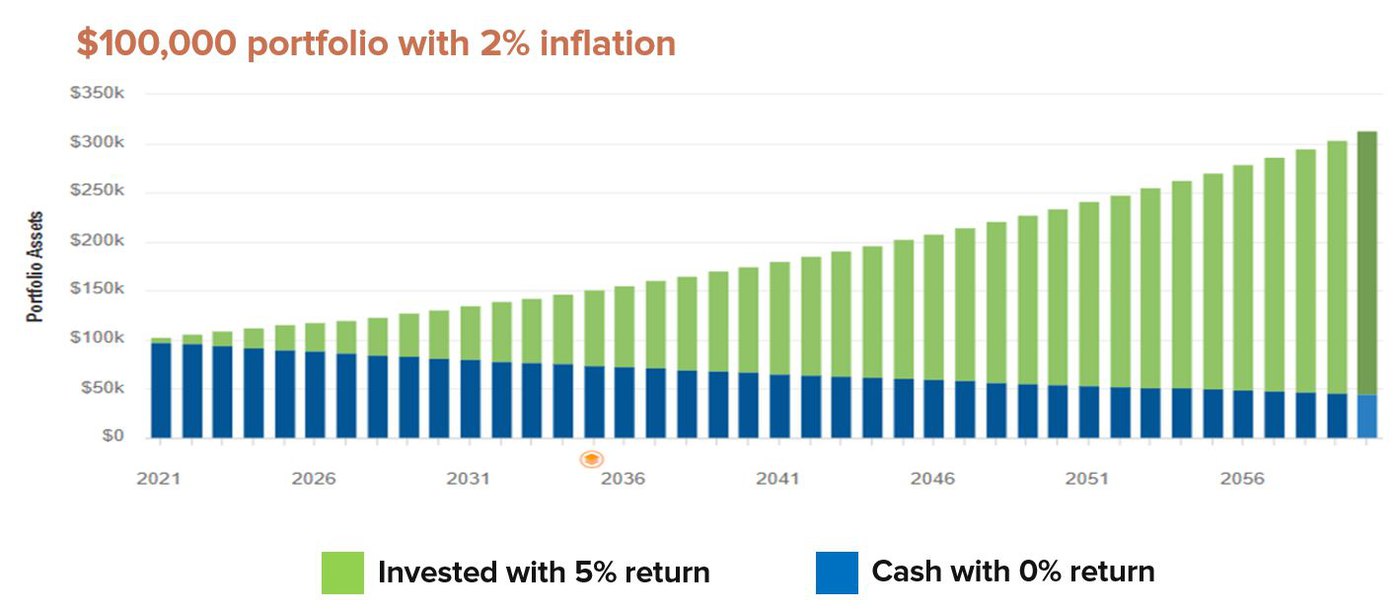

To better illustrate why, let’s say you took the $100,000 from the example above and instead invested it, earning an annual return of 5%.

Here is a comparison of $100,000 earning a 5% return versus a 0% return, assuming a 2% inflation rate:

It’s not hard to see the stark difference. The money that is invested steadily grows over time. Whereas, the money sitting in cash gradually goes in the opposite direction.

Investing your excess cash doesn’t mean putting it in a retirement account, especially when we’re talking about after-tax dollars (money you’ve already paid taxes on). Rather, you can invest your excess cash in a non-qualified investment account. This is a typical investment account; just not a 401(k) or IRA. It is essentially like a savings account within which you can invest. You can put as much money into it that you want, and then withdraw that money whenever you want (though you would owe taxes on any capital gains).

As with any investment account, what type of investments you should buy and how much risk you should take, depends on your personal situation and may be done with the professional help of a financial adviser.

The Emotional Benefits of Saving Cash

Advance Capital Management is all about looking at the whole picture and providing guidance that is suited to each individual. We know that one factor of your financial life that deserves as much consideration as what the data say is what your emotions say.

Therefore, there are always good exceptions to what makes the most sense from a purely financial perspective.

For example, the Employee Benefit Research Institute’s (EBRI) Spending in Retirement Survey evaluated the spending habits and well-being of 2,000 Americans ages 62 to 75. The majority of respondents (57%) wanted to spend down only a small portion of assets, spend none at all, or grow their assets.

When asked about the rationale for not spending down their assets, more than a third (31%) said they “simply feel better when account balances remain high.”

Turns out, a lot of older adults not only feel more comfortable but happier when saving money. A surprising 64% of survey respondents agreed that saving as much as they can makes them feel happy and fulfilled.

Peace of mind is important. Whatever helps you sleep at night should not be underestimated.

But at the same time, giving in to your emotions should not come at the expense of living out your financial goals – which is the point of accumulating this money in the first place! The goal is to strike a balance between using your money to enjoy life, which often requires growth, without the risk of finding yourself empty handed when one of life’s financial curveballs comes your way.

Ultimately, the ideal amount of cash to keep on hand and what you should do with any excess cash is a personal decision, one that you should consider talking over with a professional financial adviser.

Learn more about what it takes to build your comfortable retirement by downloading our free ebook: Your Money in Your 50s: A Retirement Planning Guide for Procrastinators and Avid-Savers.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.