What Is the Value of a Financial Adviser?

June 1st, 2023 | 5 min. read

What makes one car with four doors and wheels worth $300,000 and another $30,000? The answer likely differs from person to person.

Value is often subjective and not always easy to define. Yet, it’s important. From cars to homes, we deserve to know if something is worth the cost. If you’re seeking professional financial help, it’s why you’re probably wondering what’s the value of a financial adviser.

As a full-service wealth management firm, we at Advance Capital Management work to provide valuable services to all clients for all stages of their financial lives. So, we know that what adds significant value to your financial life can change over time. In other words, it’s personal.

But that doesn’t mean it’s impossible to place a value on financial advice. In fact, a few sources have come up with reasonable estimates. A Vanguard paper, for instance, concludes that an adviser can potentially add up to, or even exceed, 3% in net returns for clients. Meanwhile, a 2022 Russell Investments study suggests the value of an adviser’s advice is worth 4.91%. Of course, results will vary significantly.

These returns are based on advisers offering a certain set of services each firm has identified as valuable. To help you understand the potential value of working with a financial adviser, let’s explore those services.

This article covers the estimated value you may receive from a financial adviser, including:

- Portfolio rebalancing

- Behavioral coaching

- Customized, holistic financial planning

- Tax-smart planning and investing

- Cost-effective implementation

- Spending strategy

Portfolio rebalancing

POTENTIAL VALUE

Vanguard estimate: 0.14%

Russell Investments estimate: 0.11%

Regularly adjusting the composition of your investment portfolio can help maintain its original mix of assets and keep it aligned with your financial objectives. This process, known as rebalancing, not only ensures that your investments stay in line with your goals but also has the potential to reduce risk.

Let's consider a scenario presented by Russell Investments. Suppose an investor had purchased a hypothetical portfolio consisting of 60% stocks and 40% fixed income in January 2009, and they hadn't rebalanced it since then. By the end of 2021, the portfolio would have undergone significant changes. Instead of being balanced, it would have transformed into a growth-oriented portfolio, with around 84% invested in stocks and only 17% in fixed income. Such a substantial imbalance could expose the investor to the risk of experiencing substantial losses if the stock market experienced a sharp decline.

Behavioral coaching

POTENTIAL VALUE

Vanguard estimate: 2.0%

Russell Investments estimate: 2.37%

Making objective financial decisions can be difficult, especially when emotions come into play. That's where a financial adviser can be invaluable. They can provide advice based on your specific financial goals and risk tolerance.

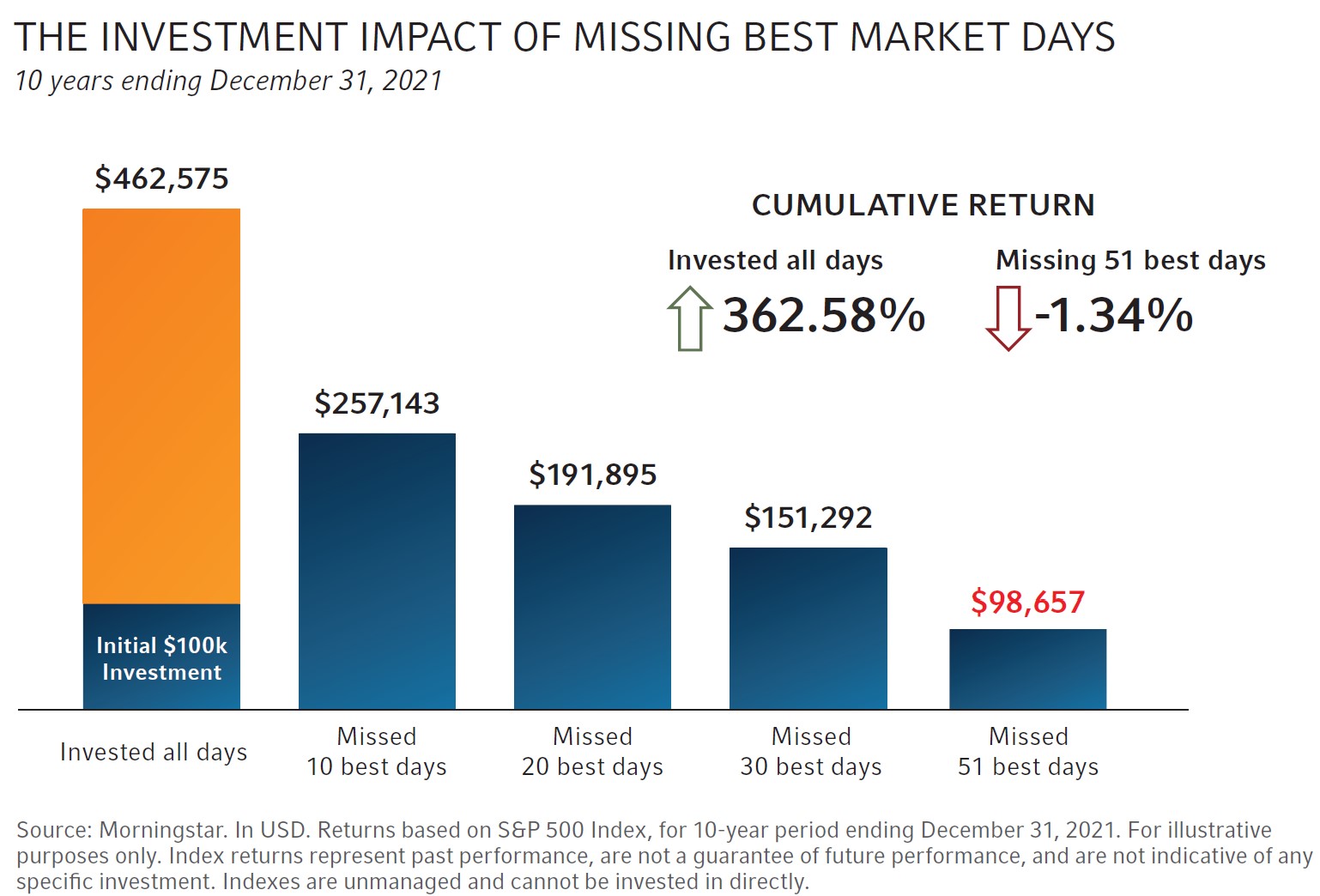

For example, just think about the impact of market timing during the emergence of the pandemic in mid-March 2020. Investors who panicked and exited the market would have struggled to find the right time to re-enter, missing out on potential market gains. This is where the value of behavioral guidance becomes evident in your overall financial results.

As shown in the graph below, even missing a few days of positive market performance can have a significant negative impact on your portfolio.

Source: Russell Investments

Although markets can be unpredictable in the short term, their long-term trend has been upward. In fact, since its inception in 1926, the S&P 500 Index has ended the year in positive territory 74% of the time.

Your ability – with a financial adviser’s help – to stick with your long-term financial plan and avoid behavioral mistakes can be valuable in preventing you from missing out on substantial market gains.

Customized or holistic financial planning

POTENTIAL VALUE

Russell Investments estimate: 1.21%

Behavioral economist Shlomo Benartzi estimate: $4,300+

Financial needs, goals and circumstances vary for every individual. A financial adviser can assist clients in creating a personalized financial plan that considers their specific situation and objectives. This kind of holistic financial planning covers a wide range of needs throughout a person's financial journey, including accumulation, preservation and distribution phases.

Let’s explain what that means:

As your life becomes more complex over time, your financial requirements evolve. During the accumulation phase, you may be planning for milestones like weddings, homeownership, raising children, saving for education and establishing your career. In the preservation stage before retirement, you may need to navigate caring for elderly parents, managing your health and structuring investments for tax efficiency. In the distribution phase of retirement, considerations may include retirement income, long-term care and creating a lasting legacy. These diverse needs necessitate careful planning and expertise.

Russell Investments estimates that by guiding clients through important life events, aligning investments with objectives, providing expertise on taxes, insurance, careers, major purchases, retirement planning, long-term care and legacy planning, among other services, advisers contribute an additional value of approximately 1.21% beyond the asset management they provide.

Additionally, a paper from behavioral economist Shlomo Benartzi says financial advice that covers not only investing but also savings, debt and insurance decisions can provide more than $4,300 in estimated annual value for the typical American household.

Looking for a financial adviser?

Make sure you hire the right one. Click here to download a convenient checklist for comparing and evaluating financial advisers.

Tax-smart planning and investing

POTENTIAL VALUE

Russell Investments estimate: 1.22%

Taxes can be a major obstacle throughout your financial life. In addition to regular income taxes on your earnings, you must navigate taxes on your retirement savings and other assets. Without proper tax management, you could face a huge tax bill.

Furthermore, taxes can be a drag on your investment returns. According to research from Russell Investments, on average, investors lost 2.14% of their returns from U.S. equity products in each of the five years leading up to December 31, 2021. However, those who invested in tax-managed U.S. equity funds experienced a tax drag of only 0.92%. This represents a significant 1.22% difference.

By working with an adviser who offers tax-smart planning services, you can identify and implement solutions to minimize the tax bite in your investment portfolio and other areas of your financial life.

Cost-effective implementation

POTENTIAL VALUE

Vanguard estimate: 0.30%

Vanguard also suggests a financial adviser who focuses on cost-effective implementation of investment strategies can bring significant benefits. One key aspect is keeping expense ratios low.

Expense ratios represent the fees charged by investment funds to manage your money. By working with an adviser who emphasizes low expense ratios, you can potentially save more money over time. Lower expense ratios mean you pay less in fees, allowing more of your money to work for you. These savings compound and have the potential to boost your overall investment returns.

Spending strategy

POTENTIAL VALUE

Vanguard estimate: 1.2%

Finally, a financial adviser can bring significant value by helping clients develop a spending strategy for their retirement accounts.

During retirement, it's crucial to manage your savings wisely to ensure they last throughout your golden years. A financial adviser can work closely with you to understand your specific financial needs, goals and lifestyle preferences. They can then create a customized spending strategy that aligns with your retirement objectives.

By analyzing your retirement accounts, including IRAs, 401(k)s or pension plans, an adviser can help you determine how much you can safely withdraw each year without jeopardizing your future financial security. Vanguard puts the value of this service at 1.2%.

Ultimately, a well-designed spending strategy helps you strike a balance between enjoying your retirement and preserving your nest egg. It ensures that your savings are distributed efficiently, taking advantage of tax benefits and minimizing unnecessary expenses. Additionally, a financial adviser can provide ongoing monitoring and adjustments to your spending plan as circumstances change.

The bottom line

Again, the estimated values offered by these services will vary significantly from person to person. But the data makes a compelling case that there can be a cost from not hiring a financial adviser.

A financial adviser can provide expertise, personalized guidance, time-saving advice, risk management and long-term planning, which can all contribute to a more secure and successful financial future.

If you want to learn more about how a financial adviser can help you, schedule a free consultation with Advance Capital Management.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.