Should You Stay Invested in Bonds Now?

October 31st, 2023 | 2 min. read

After a decade of modest inflation and declining interest rates, things have changed. Both the federal government and the Federal Reserve threw trillions of dollars at consumers, businesses and the capital markets in the wake of the Covid shutdowns. We are now collectively paying the price for these actions.

On the one hand, higher interest rates have ravaged borrowers and put pressure on their pocketbooks. However, investors can now earn a healthy return on short-term bonds and money market accounts.

Still, the past few years have not been kind to the average bond investor. Many are probably wondering what the outlook is for investing in bonds.

Would it be better to move money from bonds to money market accounts?

Why keeping bonds in your portfolio still matters

Before you think about abandoning bonds, let’s take a moment to analyze the likely path of bond returns going forward.

First, remember that the Federal Reserve’s current hiking cycle is perhaps the fastest and largest on record. They essentially moved interest rates from zero to 5.5% in less than two years.

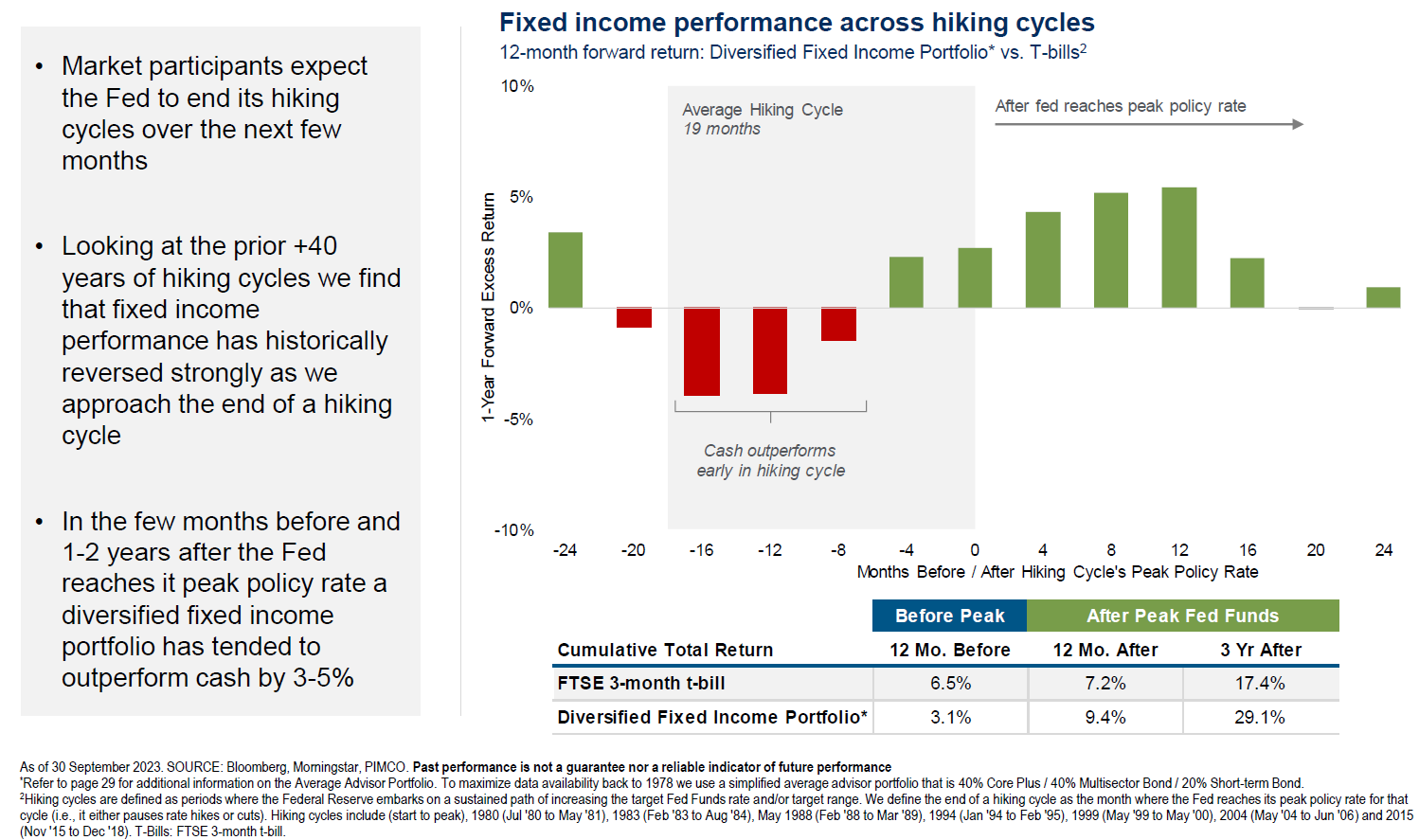

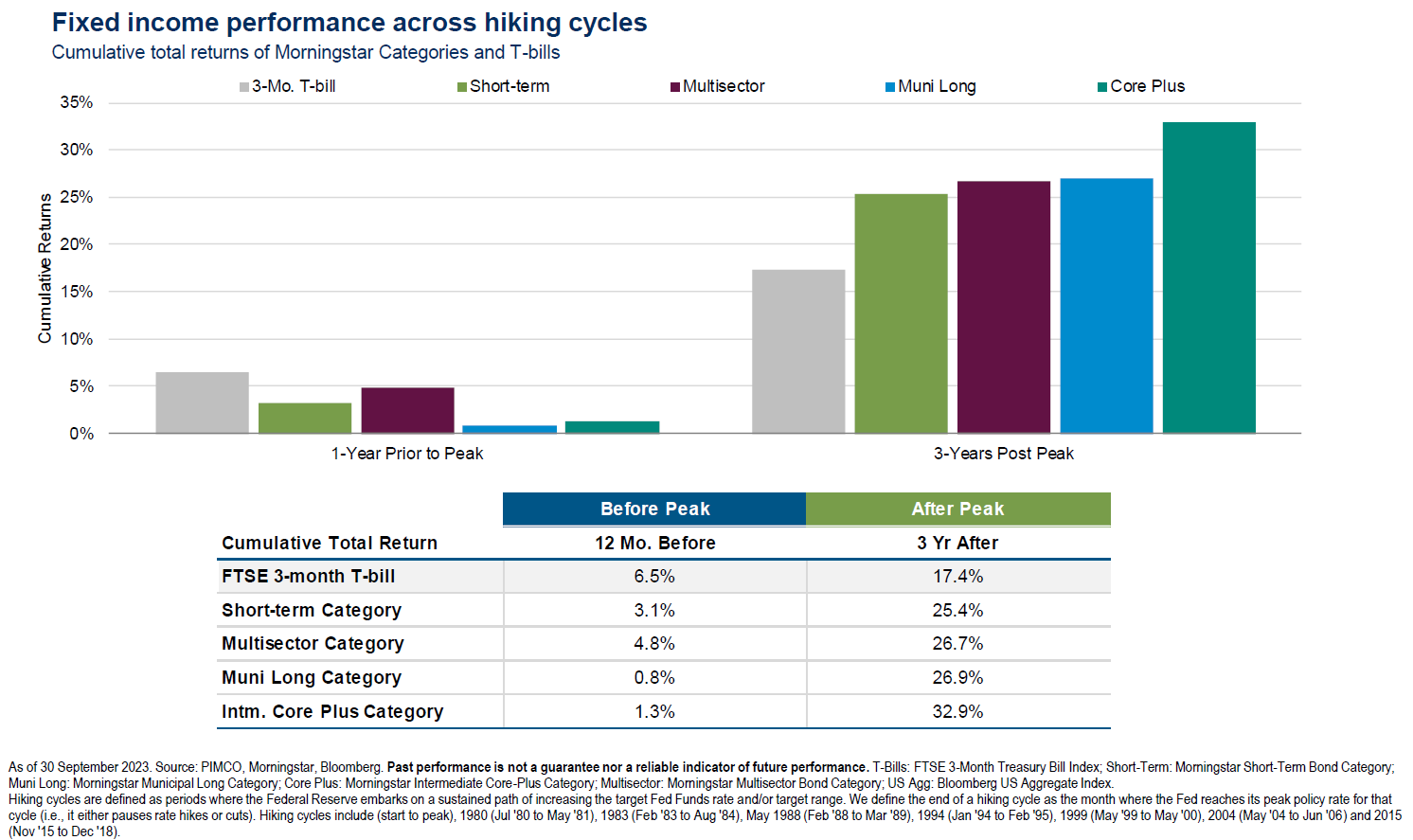

Yes, remaining in cash may have been a better option during this period, but what happens next is key to long-term investing success. Now it appears that the Federal Reserve is near the end of their historic interest rate increases. Bond returns have been historically strong after the Fed ends hikes.

Let me illustrate with a couple of insightful charts:

As hiking cycles end, historically fixed income outperforms cash

Once the Federal Reserve stops hiking rates, bond returns are typically very good

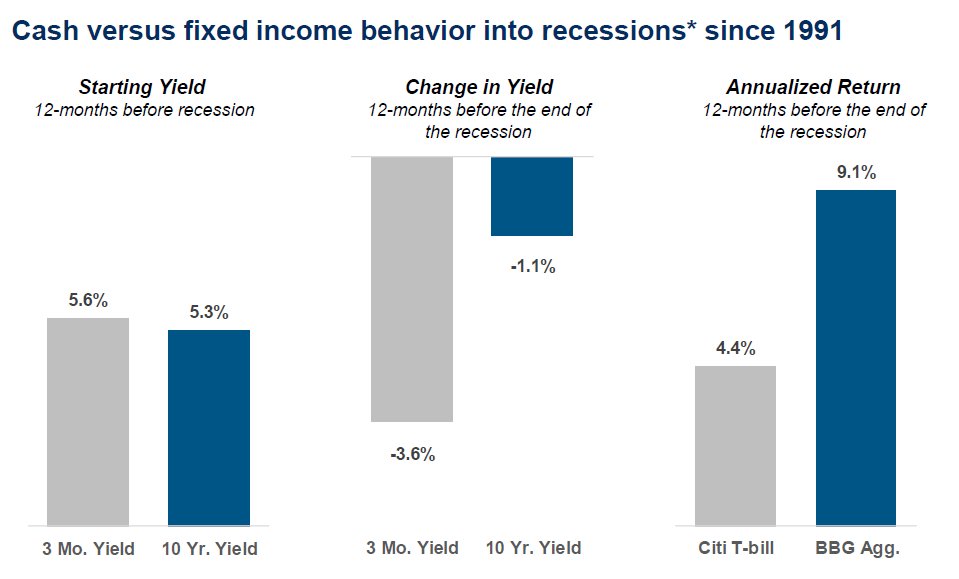

What if there is a recession?

Another piece of the puzzle is the potential for a recession over the next few quarters.

The Treasury yield curve has been inverted now for 11 months, the longest and deepest in 30 years. What does this mean? Essentially, yields on shorter-dated Treasuries are higher than longer-dated ones.

These inversions don’t last forever, as recessions often follow inverted yield curves. During recessions, the Federal Reserve usually drops interest rates and falling interest rates lead to a fall in bond yields and a corresponding rise in bond prices.

Source: PIMCO

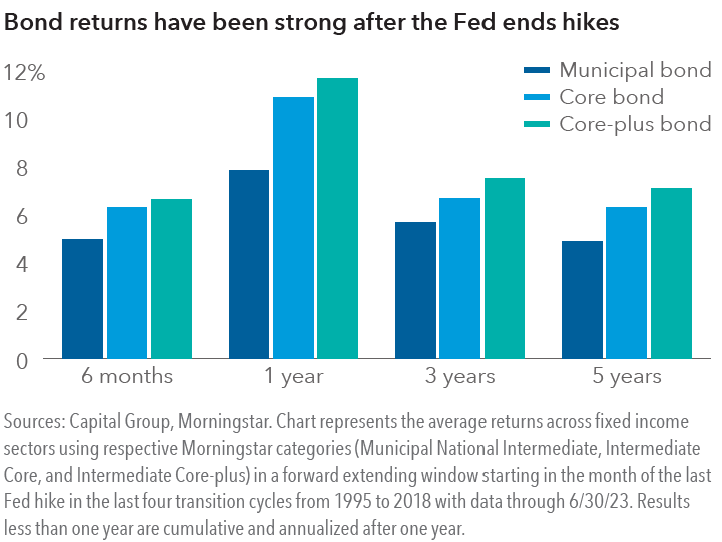

After the Fed’s last four hiking cycles, from 1995 to 2018, core, core-plus (corporate, treasury and mortgage bonds) and municipal bond returns were the strongest in the first year following the Fed’s final interest rate hike and remained moderate thereafter.

The bottom line

Investing in bonds over the past few years has been painful. Exploding inflation as a consequence of unprecedented government and Federal Reserve spending amidst the Covid crisis is mostly to blame.

Now, it appears the worst is likely over and the Fed is positioned to stop further rate increases, as starting bond yields are the highest in over a decade. For investors, now is the time to stay steadfast on bonds and know that brighter days and better returns are coming.

Christopher Kostiz, President & CIO

Chris is the President and Chief Investment Officer (CIO) of Advance Capital Management. As CIO, he directs the strategy and structure of the discretionary model portfolios and leads the investment committee.