Securing Your Golden Years: Roth Conversions and Backdoor Roths

May 24th, 2023 | 4 min. read

After years of hard work building wealth, you should be able to enjoy the transition into retirement and not worry about where to put your savings. So, let’s explore two strategies people often consider for securing their retirement savings and limiting taxes: Roth IRA conversions and backdoor Roth IRA contributions.

As a financial adviser at Advance Capital Management, an important part of retirement planning involves putting funds in the proper accounts at the right time. Sometimes that means moving assets into a Roth IRA, but not always – it depends on your situation.

To help you better understand if a Roth conversion or backdoor Roth strategy makes sense for you, this article explains what they are and covers some of the key pros and cons of these approaches.

This article covers the following:

- What is a Roth IRA conversion

- When to make a Roth conversion

- Roth conversion benefits

- How a backdoor Roth works

- Potential drawbacks of Roth conversions and backdoor Roth contributions

Roth IRA Conversions - Unleashing the Power of Tax-Free Growth

With a traditional IRA, you must pay ordinary income taxes on the funds you withdraw. Enter the Roth IRA conversion, a process where you transfer those assets to a Roth IRA where they can grow tax-free.

However, there's a catch – the converted amount is considered taxable income in the year of conversion.

But as long as the account is open for five years and you’re over age 59 ½, you can withdraw funds from your Roth IRA tax-free.

Freedom from Required Minimum Distributions (RMDs)

Imagine a retirement without the burden of RMDs. With a Roth IRA, you are also not burdened with RMDs, the minimum amount you must withdraw from certain retirement accounts each year upon reaching age 73. This advantage gives you more freedom to decide when and how much to withdraw, granting you complete control over your assets and potentially reducing your overall tax liability.

This also makes Roth IRAs invaluable estate planning tools, allowing you to leave a lasting legacy while minimizing the tax burden on future generations.

Choosing the Right Moment for a Roth Conversion

Since a Roth conversion is a taxable event, the strategic art of timing can make all the difference. So, when does a Roth conversion make sense?

Low-income years and periods with substantial losses you can write off against your income create perfect conditions for Roth IRA conversions. By capitalizing on these opportune moments, you can minimize your tax burden while laying the groundwork for a tax-free future.

Are you taking the right steps to reach retirement? This free guide is designed to help you no matter where you are in your retirement journey. Download your free copy today!

guide is designed to help you no matter where you are in your retirement journey. Download your free copy today!

Sneaking in for Tax-Free Growth with a Backdoor Roth IRA

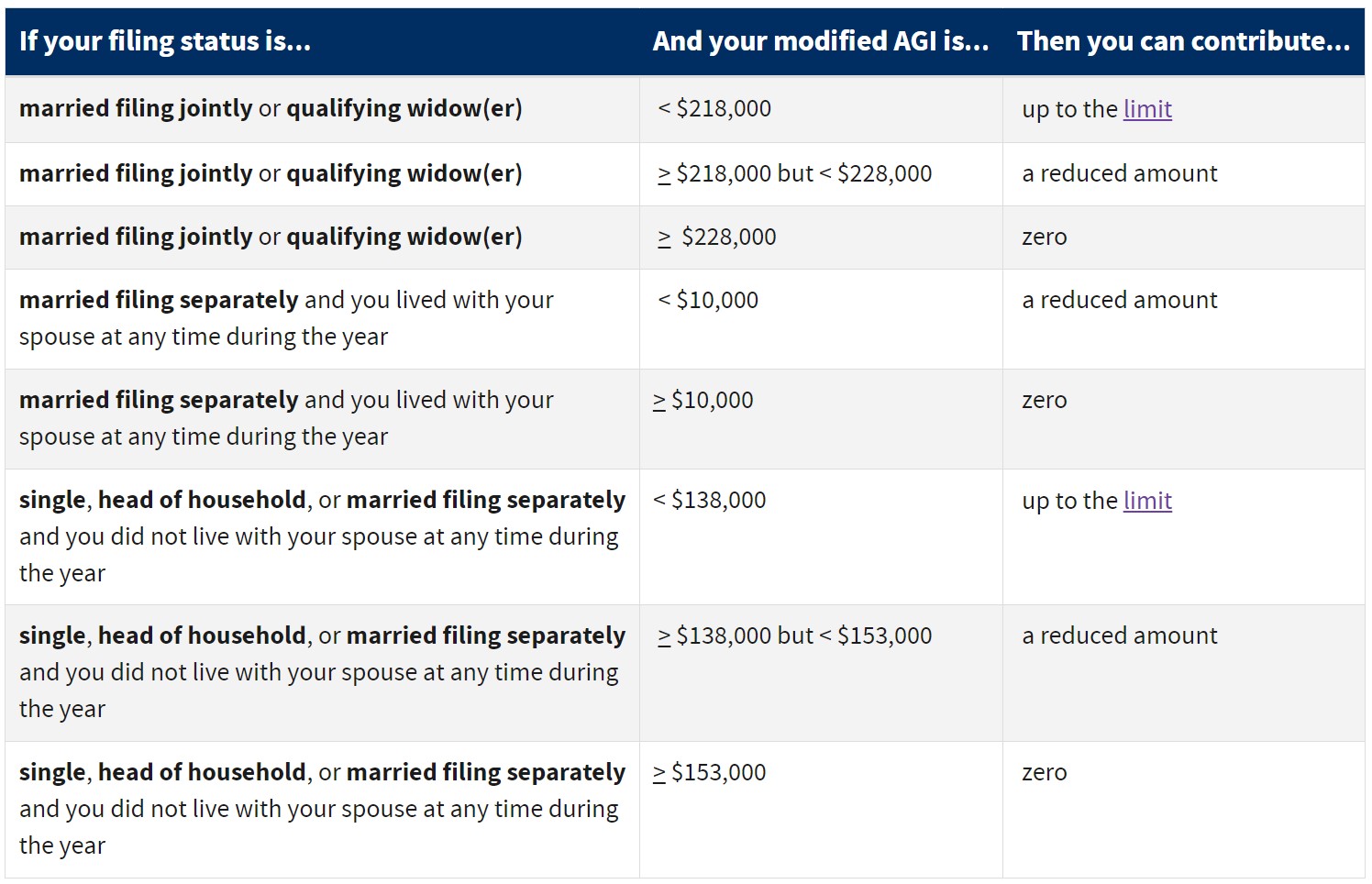

A challenge for many investors is that the IRS sets income limits for direct contributions to a Roth IRA. If your income exceeds these limits, you're typically unable to contribute directly to a Roth IRA.

Roth IRA Contribution Income Limits

Source: Internal Revenue Service

But there’s a strategy around that: the backdoor Roth contribution. This clever maneuver lets you contribute to a traditional IRA, convert it to a Roth IRA, and unlock the full potential of tax-free growth.

You start by making a nondeductible contribution to a traditional IRA. This means you contribute after-tax dollars without receiving an immediate tax benefit. After making the traditional IRA contribution, you promptly convert the funds to a Roth IRA. This involves moving the money from the traditional IRA to the Roth IRA.

This opens the door to long-term tax benefits, regardless of your income.

Beware the Pro-Rata Rule

When making backdoor Roth contributions, you must consider the tax implications. Namely, if you have any pre-existing traditional IRA funds with untaxed assets, a pro-rata rule determines the tax treatment.

This rule calculates the ratio of untaxed assets to the total amount being converted, and only the proportionate amount of the conversion will be tax-free.

Let's break down the example of the pro-rata rule to make it clearer:

Suppose you have an existing traditional IRA with untaxed assets totaling $94,000. All of that money has yet to be taxed. Now, you decide to make a $6,000 contribution to your traditional IRA and immediately convert it to a Roth IRA.

Again, the pro-rata rule comes into play when determining the tax treatment of the conversion. It calculates the ratio of untaxed assets to the total amount being converted.

In this case, the IRS considers that you had a total of $100,000 in the traditional IRA (combining the existing untaxed assets of $94,000 and the $6,000 contribution). Therefore, when you convert $6,000 out of the $100,000, only 6% (equivalent to $6,000 out of $100,000) will be tax-free.

So, even though you made a $6,000 contribution to the traditional IRA, only the proportionate amount that represents the untaxed portion ($6,000 out of $100,000) will convert free of tax. The remaining balance, meaning the previously untaxed assets in the traditional IRA, would be subject to taxes upon conversion.

Considering the pro-rata rule when performing a backdoor Roth IRA conversion is essential, especially if you have existing traditional IRA funds with untaxed assets. Consulting with a financial adviser or tax professional can help you navigate these complexities and make informed decisions.

Watch Out: Potential Impact on Medicare and Social Security

Lastly, there are a couple of pitfalls to be aware of with Roth conversions.

First, if you're over 65 and on Medicare, a Roth conversion could bump you into a higher tax bracket to where you're paying more for Medicare.

Second, if you’re collecting Social Security, only a portion of your benefit is likely being taxed. But converting a substantial amount of your traditional IRA to a Roth IRA could make more of your Social Security subject to income taxes.

I hope this information eases any worries and helps you make informed decisions on maximizing your retirement savings and reducing the tax bite. Remember, timing is critical, and awareness of potential tax implications will ensure you don’t encounter any ugly tax surprises. But considering the complexities of these strategies, I would encourage you to speak with an Advance Capital Management financial adviser to find out if they make sense for your situation.

Bill works closely with people to help them achieve their financial goals. As a financial adviser, he guides clients toward making proper decisions during all stages of their financial lives. He provides comprehensive wealth management services such as retirement planning, tax planning, investment portfolio strategies and 401(k) advice. He is a CERTIFIED FINANCIAL PLANNER™ professional and co-host of the finance YouTube channel, Under the Buttonwood Tree.