How Much Investment Risk Should You Take?

March 23rd, 2020 | 3 min. read

If you feel uncomfortable about fluctuations in the stock market, does that mean it’s time to rethink your investment risk tolerance?

If you feel uncomfortable about fluctuations in the stock market, does that mean it’s time to rethink your investment risk tolerance?

An important tool for any investor is inside information. By that, we don’t mean non-public data to help you front run the stock market. But rather an open-minded view of your personality, coupled with a clear understanding of your financial goals, to help you choose an appropriate level of investment risk.

A basic tenet of investing is that risk and return are related. For higher returns, you must take higher risk. If you take low risk, you can expect low returns. The goal is to take enough investment risk to achieve your financial goals but not so much to ever feel tempted to abandon your investment plan during market downturns.

Since 1980, the stock market has posted positive annual returns 75% of the time. Yet over those 40 years, it has averaged an intra-year drop of 13.8%. It’s easy to say you can handle risk when the market is doing well. But you may feel differently when that inevitable drawdown occurs.

At a market high, cheap stocks sound pretty good. What about when those cheap stocks actually are available after a market crash?

Having a grasp of your emotions during difficult times and a clear set of investment objectives will help you build an optimal investment portfolio and keep you invested for the long term. Therefore, every once in a while, it’s a good idea to review your investment risk tolerance.

So, how much investment risk should you take?

THE DEFINITION OF INVESTMENT RISK TOLERANCE

First, it helps to understand what it means.

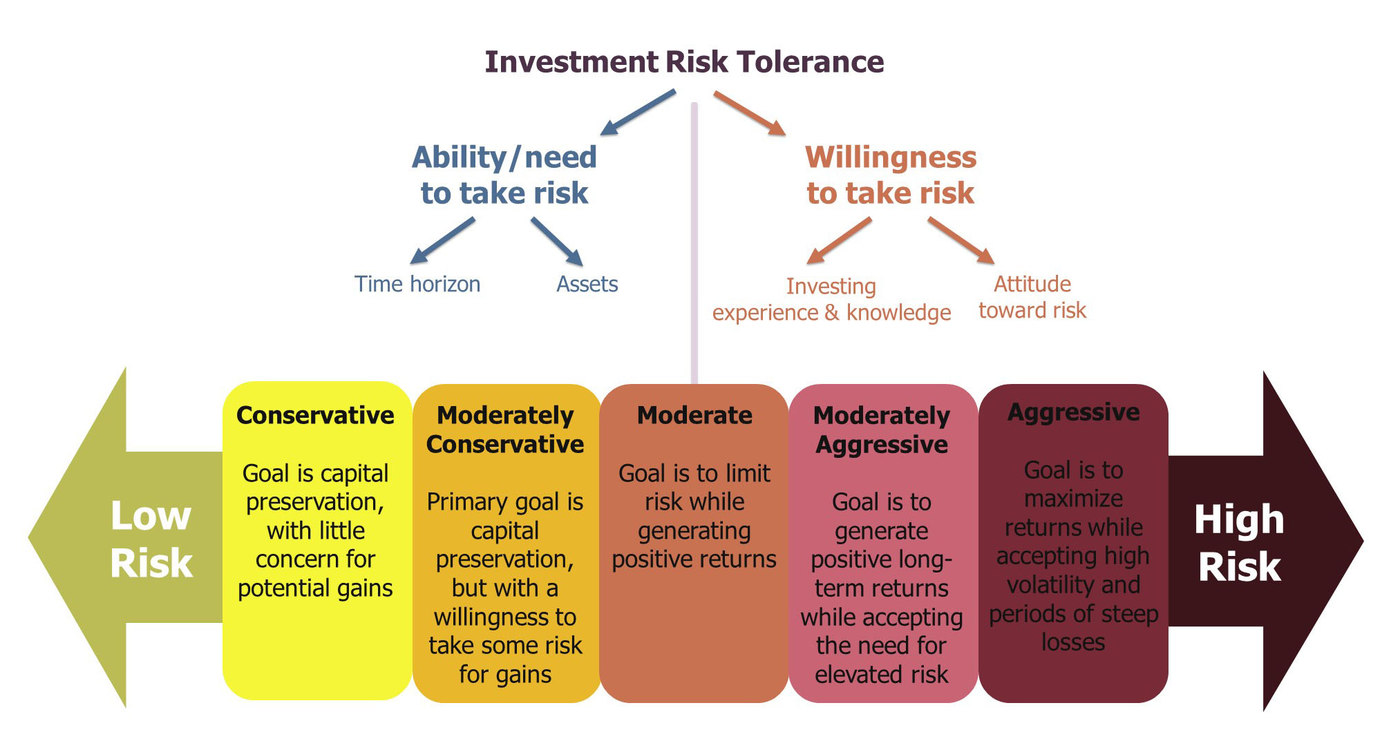

Your investment risk tolerance is one part emotional and one part numerical. Essentially, it is an assessment of the level of risk you’re comfortable with in your portfolio – but that is aligned with the investment return needed to achieve your financial goals.

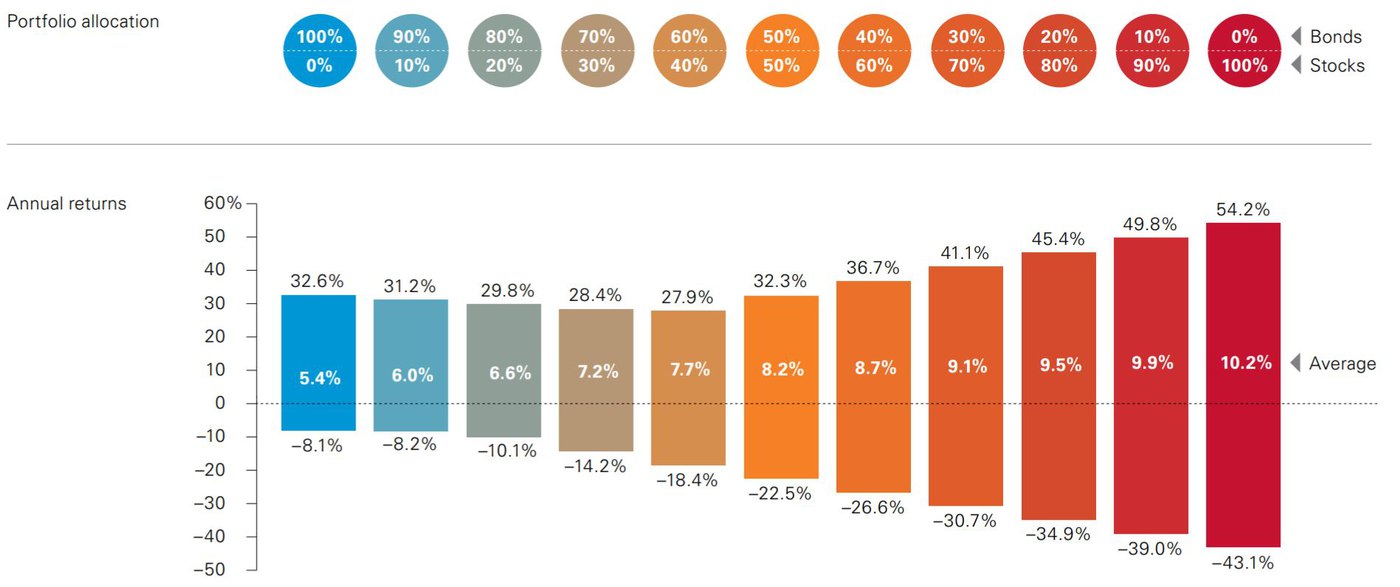

Your risk tolerance is a key factor in selecting the mix of investments in your portfolio, known as your asset allocation. How much you have invested in stocks is generally a representation of risk in your portfolio, as stocks are generally riskier than bonds. Therefore, the more you have allocated to stocks, typically the higher your level of risk.

Here’s a simplified example. Perhaps, an average return of 9% will help you retire earlier, so you consider investing in a 70/30 stock/bond portfolio. But you feel uneasy about the potential for a 30% decline. So, you instead choose a more conservative 50/50 portfolio with expectations of an average return around 8% and the intention to save more so you can still retire at your desired target date.

Best, worst and average returns for various stock/bond allocations (1926-2016)

MAIN FACTORS FOR YOUR INVESTMENT RISK TOLERANCE

These are the main investment risk tolerance factors. Because this is ultimately a personal decision, it is advised you work with a financial adviser to help determine how much investment risk is right for you.

1. Your emotional comfort with risk

Your emotions are difficult to quantify. You may not know how much risk you can handle until you experience a market downturn. The goal is to avoid exposing yourself to a level of risk that causes you to abandon your investment plan, which can lead to mistakes that reduce the chances of achieving your financial goals.

A simple, albeit unscientific, way to test your feelings toward risk is to imagine a severe market decline. Subtract various percentages off your portfolio balance. How much do you think you could withstand losing in one year -- 5%? 10%? 30%? – as you wait for the market to rebound (which, it is important to note, the market has historically always done)?

2. Your time horizon

When you expect to achieve your goal, or your time horizon, is an indicator for how much risk you should have in your portfolio. Take retirement, for example.

Younger workers have many years before retirement. They can withstand a higher level of risk as their portfolios have more time to recover from any potential losses. In addition, younger workers have a greater need for risk to grow their savings.

Conversely, investors in or near retirement should have lower risk tolerances. They are withdrawing from their portfolios, which makes it harder to recover, and they can no longer simply earn more income. At this stage, the objective should be asset preservation rather than growth.

3. Your ability to take risk

The amount of risk you can take pertains to how much you have in your portfolio and how much you have to invest in the first place. How much can you afford to lose without jeopardizing your financial goals? Do you have money left over after expenses to save and invest?

4. Your need for risk

Depending on your financial goals, you may need to accept a certain level of risk in order to generate enough growth. Again, this also depends on how far you are from reaching your goals.

Essentially, all investors should take a minimum amount of risk to beat inflation, which historically has been around 3%. You don’t want to be so risk-averse that your buying power continually decreases.

WHEN TO ADJUST INVESTMENT RISK IN YOUR PORTFOLIO

Again, thinking about a market crash is much different than actually experiencing one. Especially, when you consider the reasons behind past bear markets – war, global financial crises, pandemics, et. al.

If you find yourself feeling uneasy when the market fluctuates, then you may want to consider investing more conservatively rather than fully changing your investment plan or stop investing completely.

Market downturns are simply a part of investing, which is why you get rewarded for taking risk in the first place.

For most investors, the only reason to adjust risk is when you near your financial goals or your financial life circumstances significantly change. That could mean reaching retirement or experiencing a divorce.

Your risk tolerance provides an inside look into what it’ll take to reach your long-term financial goals. But choosing how much investment risk makes sense for you isn’t an exact science, so it helps to get an outsider’s opinion from a financial adviser.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.