What to Consider Before Buying a Fixed Annuity

August 24th, 2022 | 3 min. read

For some people, the road to a comfortable and secure retirement leads them toward buying an annuity. These insurance products are heavily marketed for attractive features, such as income for life and protection from market declines.

When the stock market or economy declines, interest in fixed annuities grows as a possible solution to preserve retirement savings.

But annuities can be complex. They can come with various strings attached and steep unseen costs. That’s why it’s important to consider the following things before buying a fixed annuity.

How a Fixed Annuity Works

Fixed annuities are contracts sold by insurance companies that act very much like a certificate of deposit (CD). The insurance company guarantees a set rate of return and payout.

Fixed annuities can be paid at a fixed rate immediately or at a later date. An immediate annuity pays fixed amounts throughout retirement, depending on your age and the size of your annuity. A deferred fixed annuity, to be paid out later, grows at a regular rate of interest.

Benefits of a Fixed Annuity

Again, fixed annuities offer guaranteed rates of interest. This makes them attractive as a predictable investment to help supplement other forms of retirement income.

In addition to guaranteed income payments, a fixed annuity may offer guaranteed minimum rates. Further, a fixed annuity’s earnings grow and compound tax deferred. So, annuity owners are taxed only when they take money from the account.

Drawbacks of a Fixed Annuity

Rates may change – for the worse

The rates of return may be fixed for only a certain period. Afterward, the rate may drop. If you don’t like the new rate and choose to cancel, withdrawing your money early likely results in hefty surrender charges. Read the terms carefully to determine if the insurance company is allowed to adjust rates.

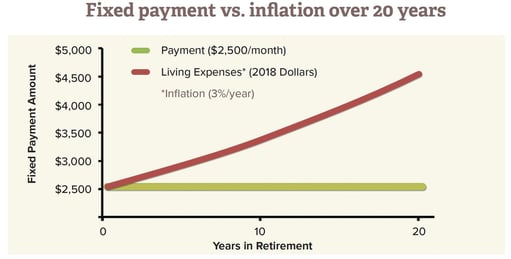

Fixed annuity payments do not keep pace with inflation

Many people buy fixed annuities as a reliable stream of fixed lifetime payments. What is often overlooked is that those lifetime payments are not adjusted for inflation. Over time, inflation will significantly reduce the buying power of those payments. This means a fixed annuity can’t match the potential inflation protection offered by traditional investment accounts, such as an IRA.

Additional Things to Know about Buying a Fixed Annuity

Annuities can be expensive

Most attractive annuity features, such as lifelong payments and death benefits, are additional features called “riders.” Each of these riders comes with added fees, which increases the total cost of the annuity and reduces your return.

Insurance brokers earn commissions on the sale of annuities

Therefore, be aware of the potential conflict of interest. An insurance broker’s recommendation may be made out of self-interest, so seek a second opinion before buying a fixed annuity.

Surrender charges

These are fees that are incurred when you withdraw money before a specified period of time (surrender period) after you buy it, usually seven to nine years. Your principal is protected only if you hold the annuity through the surrender period. If you need money for an emergency, you may have to pay hefty charges to access your money. Further, if you’re under age 59 ½, you may also have to pay a 10% tax penalty.

The annuity depends on the solvency of the insurance company

Guarantees in an annuity are only as good as the ability of the insurance company to meet them. There is a risk that future contract guarantees might not be paid if the insurer becomes insolvent. Unlike your bank account, there is no FDIC insurance on your annuity. In addition to carefully looking at the terms of an annuity, research the financial stability and bond ratings of the company underwriting it.

Consider a second opinion before buying a fixed annuity

Everyone’s financial situation is different, so every financial product isn’t right for everyone. Annuities can offer attractive features, but they also come with critical disadvantages that are easily lost in the fine print. Investors can receive the same benefits provided by an annuity through other financial products that are more appropriate to their financial needs and goals.

Considering the complexity and costs involved, it’s important to ask your broker and, preferably, an objective third-party such as your financial adviser, lots of questions to determine whether buying a fixed annuity is right for you.

Learn more about annuities by downloading our easy-to-understand guide: Is an Annuity Right for You? What to Know Before You Buy. You’ll learn how annuities really work and gain a deeper understanding of three of the most common types: Fixed Annuities, Variable Annuities and Equity-Indexed Annuities.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.