Should You Invest in Individual Stocks?

July 21st, 2020 | 3 min. read

One look at the stock market and you wouldn’t think we have experienced a global pandemic and record rise in unemployment. After the end of the second quarter, it was essentially flat for the year.

It can be foolish to ascribe reasons for the stock market’s performance when so many variables are at play. But in this case, it’s pretty clear what has been helping keep the market afloat: tech stocks.

As Bloomberg columnist Barry Ritholtz explained: For the past five years, a small group of tech stocks has had an outsized influence on U.S. markets. Two-thirds of the gains in the S&P500 have been driven by just six U.S. companies -- Facebook, Amazon, Apple, Netflix, Google (Alphabet) -- the so-called FAANG stocks -- and Microsoft. An index of those six stocks is up more than 62% since the March lows, while the S&P 500 is up about 40%.

One could ask: If a handful of companies are leading the charge, why not just invest in individual stocks?

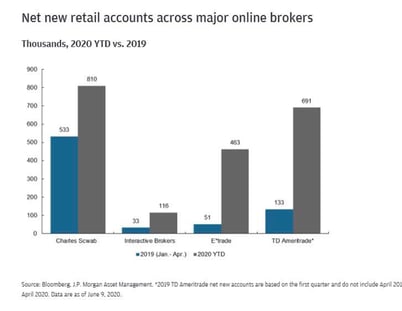

Whether it’s boredom during quarantine without sports or the enticement of striking it rich, more people have started trading stocks. New account openings by retail investors have skyrocketed across brokerage platforms from this same time last year, according to data from JP Morgan Asset Management.

The Robinhood trading app has opened 3 million new accounts this year.

The Robinhood trading app has opened 3 million new accounts this year.

There is nothing inherently wrong with buying and selling stocks. The problem lies in the strategy, if you are a long-term investor (saving for retirement, college, etc.). There are significant advantages to investing in broadly diversified funds versus picking individual stocks.

Under these circumstances, it is worthwhile then to revisit the reasons why long-term investors should generally avoid investing in individual stocks.

It is hard – very hard – to predict market winners

Unless you have that rare skill of predicting the future, stock picking is like finding a needle in a haystack. The success of companies such as Apple and Microsoft only seems obvious today because we have the benefit of hindsight.

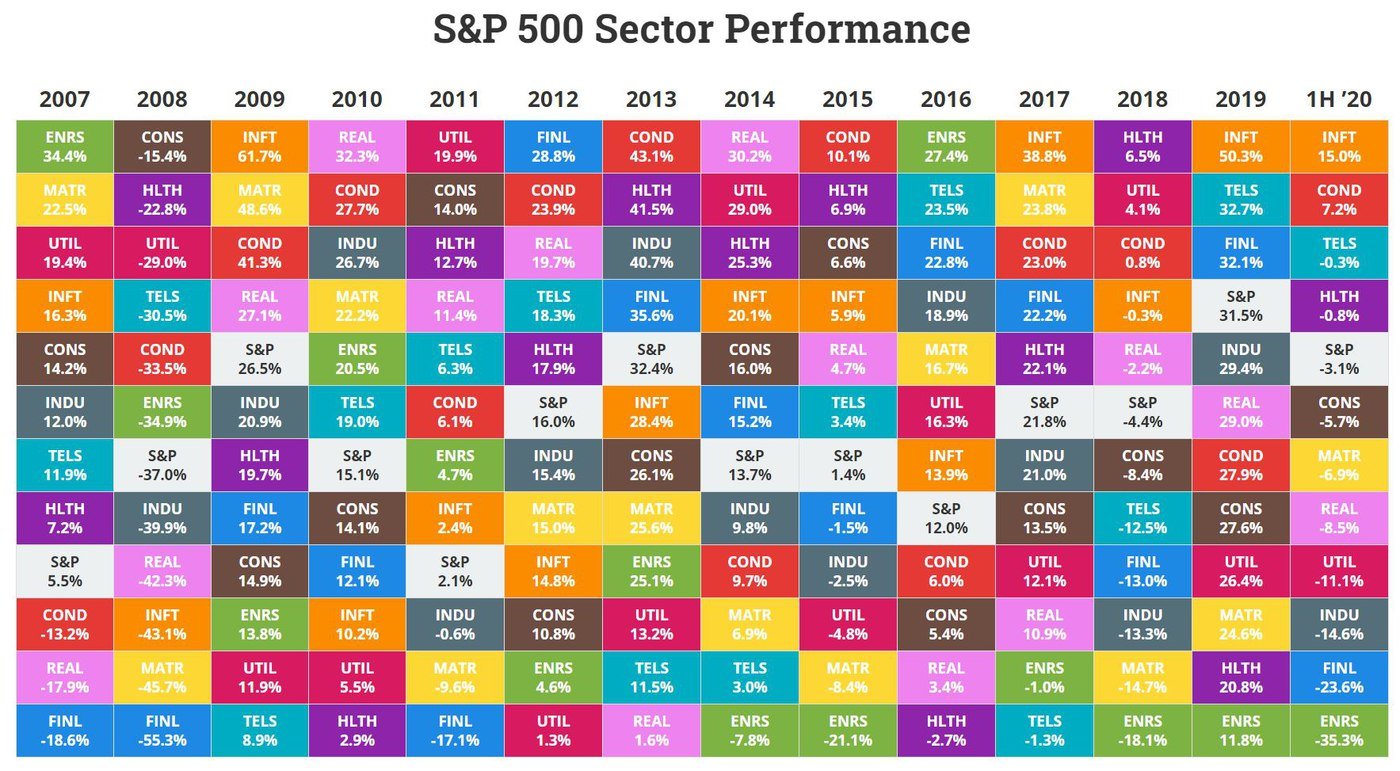

Even when we take a higher-level view and look at stock market sectors (energy, real estate, health care, etc.), it is difficult to predict which will come out on top. The chart below shows the quilt-like performance of each sector from the S&P 500 over the past 12 years. Often today’s winners are tomorrow’s losers, and vice versa.

Source: Novel Investor. S&P 500 Consumer Discretionary Index; S&P 500 Consumer Staples Index; S&P 500 Energy Index; S&P 500 Financials Index; S&P 500 Health Care Index; S&P 500 Industrials Index; S&P 500 Information Technology Index; S&P 500 Materials Index; S&P 500 Real Estate Index; S&P 500 Communication Services Index; S&P 500 Utilities Index; S&P 500 Index. All data are as of 6/30/20.

Simply researching individual stocks requires a lot of time and effort. You would need to have a serious conversation with yourself to find out if you really believe you can accurately and consistently pick stocks to fund your long-term goals. Should you choose wrong, and the odds are highly against you, it could prove catastrophic for things like your retirement.

Individual stocks are risky

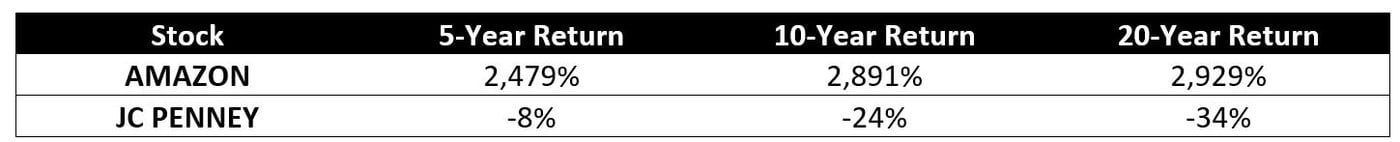

Individual stocks are high risk investments. It’s not only because their prices fluctuate a lot; it is because their prices can go to zero. Companies go bankrupt all the time. For every Amazon, there is a JC Penney.

Source: Barchart. All data are as of 7/16/20.

The risk of falling to zero is reduced when you add more companies into the mix. As a whole, stocks have been a reliable source of growth over the long term. Over more than 90 years, the average annual total return of the S&P 500 is above 9%.

This highlights the importance of the never-putting-your-eggs-in-one-basket investment strategy known as diversification. Which brings us to mutual funds and exchange-traded funds (ETFs). By investing in hundreds or thousands of companies, you avoid the risk of losing everything if your investment goes under.

You can safely own top performers without the guesswork and cost

As legendary investor and Vanguard founder John Bogle said: “Don't look for the needle in the haystack. Just buy the haystack.”

Mutual funds and ETFs pool together money from shareholders to build a diversified portfolio of securities, allowing investors to diversify without having to purchase and manage individual assets. In other words, you don’t have to guess which stocks will do well when you have access to most or all of them.

Owning stocks of different sized companies and in a variety of industries helps even out the ups and downs. In a fund, if one group of stocks decline, the others may hold up and reduce the impact.

Further, funds give you exposure to the returns of large, rising stocks, such as Google or Tesla, that would otherwise be unaffordable on an individual basis.

For investors who are attracted to the allure of beating the market, you can still safely trade stocks. Set aside a pool of money that you don’t need for anything else and wouldn’t mind losing. Put it into a brokerage account and treat it as a “play” fund.

Investing is personal. What investments work for you may not work for someone else. It depends on your financial goals and circumstances – how much risk you can take, how high of a return you need and when you need the money. But for everyone who is saving and investing for specific long-term needs, you’re better off avoiding individual stocks.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.