How Much Should You Really Save for Retirement?

August 2nd, 2017 | 2 min. read

Retirement planning starts with the age-old question: how much do I need to retire? Although there are some common rules of thumb, there is no one-size-fits-all answer. Everyone’s "number" is as unique as their fingerprints. So, how much should YOU really save for retirement?

Retirement planning starts with the age-old question: how much do I need to retire? Although there are some common rules of thumb, there is no one-size-fits-all answer. Everyone’s "number" is as unique as their fingerprints. So, how much should YOU really save for retirement?

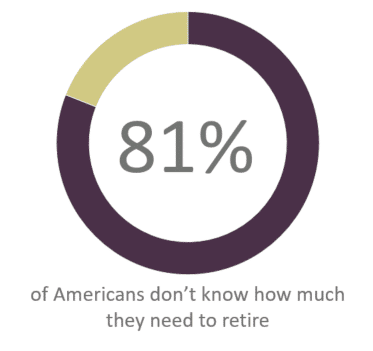

Unfortunately, few do the math. An astounding 81% of Americans don’t know how much they need to retire, according to a study by Bank of America Merrill Lynch.

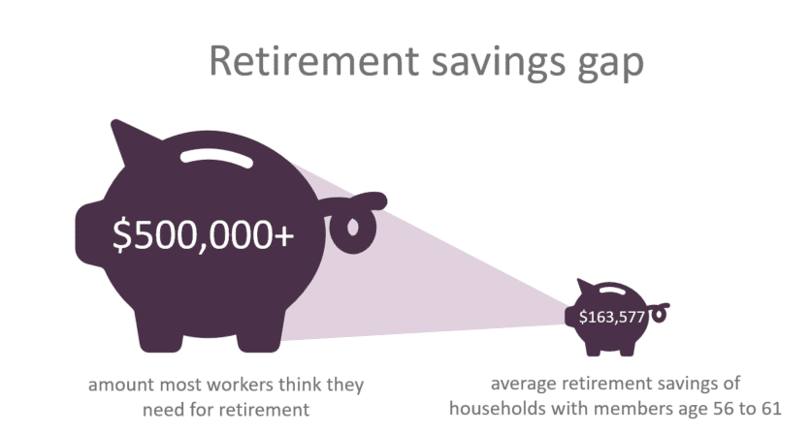

In a study from the Employee Benefit Research Institute, nearly 2 in 3 (64%) workers estimate that they need $500,000 or more by the time they retire, including more than 1 in 3 (37%) who believe they need $1,000,000 or more.

That is much higher than what the average household nearing retirement has saved. The average retirement savings of households with members ages 50 to 55 is $124,831 and $163,577 for households with members ages 56 to 61, according to a report from the Economic Policy Institute.

How to calculate your number

Finding out precisely how much you should really save for retirement can be difficult. There are many unknowns that need to be considered, such as your retirement expenses, future healthcare needs and life expectancy.

You can, however, get a reasonable personal estimate of how much you need to live comfortably in retirement by using your current income as a benchmark with what is known as a replacement ratio.

A common guideline is you’ll need to replace 70-90% of your pre-retirement income to maintain the same standard of living you enjoyed during your career. So, if you earned $100,000 annually, then you would need your portfolio and other income sources to provide $70,000 to $90,000 in income each year plus annual increases to adjust for inflation.

The notion is that in retirement your expenses are generally lower. You’re not saving in a 401(k) or other retirement account and you’re paying less taxes. And, you’re not spending as much money on things like gas or eating out as you did while working.

But, many retirees experience an increase in other expenses, namely healthcare. Or, they choose to live more lavishly in retirement. Therefore, it may be more appropriate to consider a replacement ratio of 100%. At worst, this savings target gives you a little cushion for retirement (who can complain about saving too much?).

You can find the monthly pre-retirement income you need to replace simply by looking at the net-pay on your paycheck.

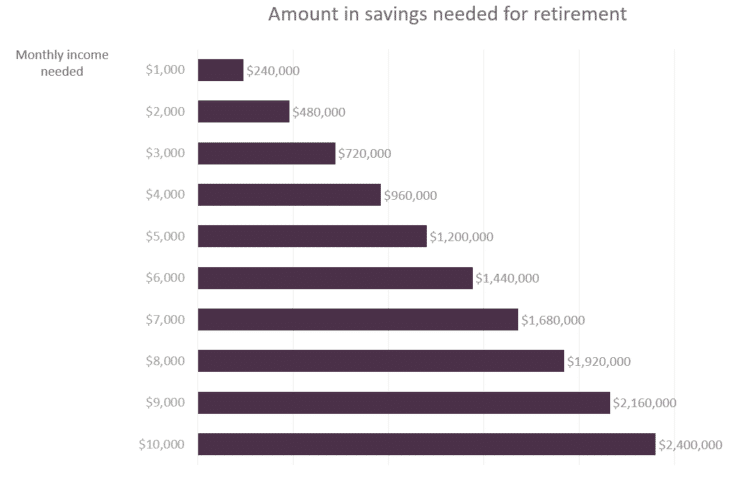

Calculated using the “rule of 20”, which is a general rule of thumb that states you should save $20 for every $1 you expect to spend in retirement. You can reasonably live off this amount for around 25 years or more at a 4-5% withdrawal rate.

5 ways to get on a path toward a comfortable retirement

If you have concerns about your retirement prospects, here are 5 steps to make sure you can live your ideal life:

- Get a written retirement plan. A retirement plan can provide an accurate retirement savings goal and the steps you need to take to reach it. People who have a written retirement plan are 60% more likely to increase their 401(k) contributions and twice as likely to commit to a monthly savings goal than people without such a plan, according to a report by Schwab.

- Work with a financial adviser. An adviser can help you successfully implement key financial planning decisions before and during retirement. In fact, a Morningstar study indicates that getting financial planning help can generate 29% more wealth for retirement.

- Automate your savings. A surefire way to commit to your savings goal is to automate contributions directly from your paycheck into a 401(k), IRA or other retirement account.

- Make catch-up contributions. When you turn age 50, you’re eligible to make catch-up contributions, an extra amount (up to $6,000 in 2017) you’re legally allowed to save in your retirement accounts beyond the annual IRS limit.

- Don’t plan to live off Social Security alone. For someone who has an average salary, Social Security benefits will replace only about 40% of pre-retirement income, according to the Social Security Administration.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.