Understanding Retirement Accounts and Plans

April 27th, 2017 | 2 min. read

When saving for retirement, one of the first steps is determining where to put your money. Look up retirement plans and you’ll find a peculiar medley of letters and numbers, such as IRA, 401(k), Roth IRA, 457, SEP IRA and 403(b). What may sound like a list of secret societies or highway interstates is essentially government code for retirement accounts and plans available to American workers and savers.

When saving for retirement, one of the first steps is determining where to put your money. Look up retirement plans and you’ll find a peculiar medley of letters and numbers, such as IRA, 401(k), Roth IRA, 457, SEP IRA and 403(b). What may sound like a list of secret societies or highway interstates is essentially government code for retirement accounts and plans available to American workers and savers.

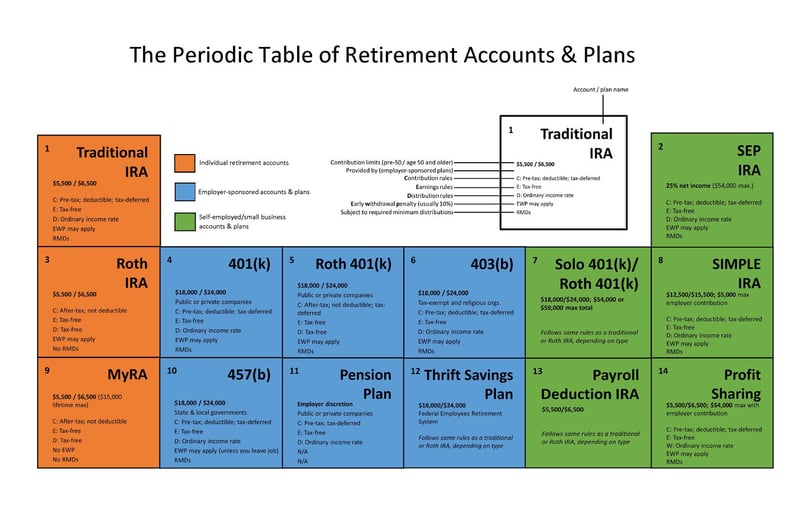

Generally, there are three main types of retirement accounts and plans:

- individual retirement accounts (IRAs), which most people are eligible to open at a financial institution;

- employer-sponsored retirement accounts and plans, most of which are now defined-contribution plans;

- and retirement accounts and plans designed for self-employed workers and small businesses.

Which type of account or plan is right for you depends primarily on your employer, including if you are your own employer.

Each retirement account is subject to its own set of rules as established by the U.S. government. One of the primary differences between retirement accounts though is in how they are taxed.

For example, contributions to a traditional IRA are made with pre-tax dollars, whereas contributions to a Roth IRA are made with after-tax dollars. Further, traditional IRA withdrawals are taxed at your ordinary income rate. Withdrawals from a Roth IRA are tax-free. If choosing between the two, you would want to base your decision on when you think you’ll have the lowest tax burden. Pick a traditional IRA if you expect your tax rate to drop in retirement when you’re withdrawing money; and choose a Roth IRA if instead you expect your tax rate to increase in retirement.

There are other important differences. The amount of money you can contribute annually varies between retirement account types. Additionally, there are income limits that may affect your eligibility to use certain accounts. Further, some retirement accounts provide more flexibility than others. IRAs, for example, offer a much wider range of investment options than you’ll find in an employer-sponsored account like a 401(k).

Most people will stick to what’s readily available to them through an employer’s retirement plan. Overall, you should seek to maximize your savings in your employer’s plan, mainly to take advantage of any employer match offered.

You are, however, not necessarily limited to one account. If you’re an avid saver and max out your 401(k), you can invest additional savings in an IRA.

Understanding the rules surrounding retirement accounts can not only help you determine which retirement account is right for you, but also make sure you get the most out of those accounts you already have.

As a basic reference tool, we’ve created the Periodic Table of Retirement Accounts & Plans. It’s important to note that this provides a limited overview of the rules of each account and plan type. There are many exceptions that are too complex to discuss on a general level. You can find more rule and tax information on the IRS website. But, you should seek the advice of a financial professional to determine what best aligns to your specific situation.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.