6 Crucial Financial Steps for Couples in Case One Spouse Dies

October 14th, 2020 | 4 min. read

One of life’s greatest joys is to plan for a future with someone you love. But no plan is complete without planning for what could go terribly wrong. For married couples, that is often the loss of the other.

It is worth thinking the unthinkable because you never know when it might be too late.

A LegalZoom.com survey found a significant increase in the number of people creating wills because of the coronavirus pandemic. Of people ages 18 to 34, 32% said Covid-19 was the reason they got a will, with 21% doing so because they or some they know had the virus. And more than a quarter of Americans with a will said they got one out of fear of a coronavirus-related illness or death.

Losing a loved one is an overwhelming experience. It can be more painful to those who are unprepared to handle the numerous financial obligations, too.

Close to 70% of widows and around 50% of widowers reported experiencing significant financial troubles after losing their spouse, according to a survey by New York Life Insurance.

Therefore, one of the best things you can do for the person you love is to make sure they’ll okay if something happens to you. Here are 6 financial steps couples can take to help to make the potential transition easier.

1. Manage your finances together

Sure, not everyone enjoys handling money issues. But that is not a good excuse for only one spouse managing a couple’s finances. To have one spouse in charge of all the financial decisions is a financial risk for the other spouse.

Managing finances together doesn’t have to mean sharing every account. Rather, it is an open discussion of every aspect of your finances, so that each spouse fully understands your cash flow – what comes in and what goes out – as well as the assets – bank accounts, retirement accounts, insurance policies, property, etc. – you own and where they are located.

This way, a surviving spouse is not suddenly left in charge of what they know nothing about.

2. Get the right amount of life insurance

Life insurance is an important piece of any married couple’s finances. How much coverage you need depends on your income and assets, and whether you have children.

Both of you may receive life insurance through your employers. However, your primary life insurance shouldn’t come through your employer. If you lose your job, then you lose your coverage. Plus, you may need more coverage than your employer provides. Instead, consider purchasing a term-life insurance policy from a separate provider.

You may want to work with a financial adviser or insurance broker to determine what policy is right for your situation and to avoid buying more than you need.

3. Understand your spousal survivor benefits

Since surviving spouses may experience a drop in income, it is important that each spouse knows what benefits are available to them.

Some of your financial assets likely have survivor benefits. Pension plans, for example, often have joint and survivor benefits that provide payments to surviving spouses.

Of course, not every couple has a pension these days. But we all have Social Security benefits.

Generally, surviving spouses can receive full benefits at full retirement age or reduced benefits as early as age 60. You can receive survivors benefits at any age, if you have not remarried and you have a child who is under age 16 or is disabled and receives benefits on your spouse’s record. Additionally, your children under age 18 can receive survivor benefits from Social Security.

4. Create an estate plan

You cannot rely on just telling your spouse about your wishes. Instead, you must include your spouse in your estate plan to make them legal. What documents you need depends on the size of your estate and your situation.

As most people know, a will is an essential document that specifies your wishes for when you pass away. It can help streamline the process as your estate moves through probate court, which can be a very time-consuming and expensive experience for your loved ones.

In addition to a will, you may want to consider a living trust, which dictates how your assets will be managed by a trustee if you are incapacitated or pass away. A trust passes outside of probate court, which can save time and money.

Another important estate document is a living will, also known as an advance health care directive, which details how you want to be cared for if you suffer from a medical emergency and wind up on life support.

Each spouse should also establish a durable financial power of attorney. This gives someone the legal authority to help manage your assets in the event you are unable to properly handle them yourself. This document can prevent the probate court from having to appoint a conservator to handle your affairs.

Further, make sure you designate the right beneficiaries on your benefits and assets – pension, life insurance, 401(k)s, IRAs, etc. Beneficiary designations can override your will. Naming the wrong person(s) or failing to update your documents can create a mess for your spouse and heirs.

5. Establish an emergency fund

Upon the death of a spouse, you may need cash immediately to cover funeral expenses and other bills as you cope and potentially take time off work.

Consider that 47% of Americans don’t have enough money saved to cover a $400 emergency expense.

Building an emergency fund should be one of your first financial goals after marriage. The fund provides greater financial security by acting as a safety net of cash to cover emergency expenses so you don’t have to use valuable assets or take on high-interest debt. A good rule of thumb is to save 3-6 months’ worth of expenses.

6. Seek professional help

Managing your financial plan can be challenging no matter how many people are involved. So, it can pay to have a financial adviser’s assistance. An adviser can ensure you have the right steps in place and don’t pay for more than you need to.

Perhaps most importantly, a financial adviser can help guide a surviving spouse through any money decisions regarding insurance, wills, debt and the like if the unthinkable occurs.

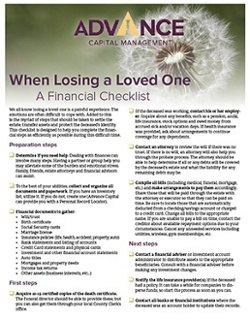

There can be more than 100 tasks involved in managing the affairs of a lost loved one. Our financial checklist can help. Download Advance Capital’s WHEN LOSING A LOVED ONE -- A FINANCIAL CHECKLIST to use as a guide for many of the most important financial obligations you may face.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.