Managing Your Financial Assets to Avoid Probate Court

January 25th, 2018 | 3 min. read

When you choose to leave a legacy, your hope is to leave something to help enrich the lives of your loved ones. No one wants to leave legal bills, wasted time and unnecessary stress. That’s why many people take steps to help their families avoid probate court.

When you choose to leave a legacy, your hope is to leave something to help enrich the lives of your loved ones. No one wants to leave legal bills, wasted time and unnecessary stress. That’s why many people take steps to help their families avoid probate court.

Probate court is the legal process that deals with the assets and debts left behind after someone dies. Each year, millions of dollars are spent on attorney and court fees associated with probate proceedings.

There are ways to ensure your financial assets are in the hands of those who matter most to you – and not the government. Here are options for ensuring that your heirs can avoid probate court.

Create a living trust

Most people already understand they should have a will, but it’s also important to consider setting up a living trust. A living trust is created while you are alive with instructions on how your assets are to be managed and then distributed by a trustee upon your death. Any asset you own can be placed in a trust, including investments, banks accounts, real estate and vehicles.

Trusts generally cost more to create than wills. But, a will may have to go through the probate process while trusts pass outside of it, saving your heirs time and money. Be sure to seek the counsel of an estate attorney who can help set up a trust that’s appropriate for your situation.

Name beneficiaries to your assets

All the benefits you have earned and accumulated — pension plan, life insurance, 401(k) and IRA accounts, etc. — can be passed on to a beneficiary after you pass away. Beneficiary designations are particularly useful in probate avoidance. In fact, they even override your will. That’s why it’s important to keep them up to date. Naming the wrong person(s) or failing to update your documents can create a mess for your heirs and leave your wishes unfulfilled.

For non-retirement investments accounts, you can register them in transfer-on-death (TOD) form. Not to be confused with TOD deeds, but they work the same way in that the beneficiary you name will inherit the account automatically upon your death.

Designate your bank account as payable on death

You can also designate beneficiaries for your bank account. Called a payable-on-death (POD) designation, you can name a beneficiary who has no rights to the money while you’re alive but who can claim the money directly from the bank once you pass away.

Use joint ownership with “rights of survivorship”

Assets under joint ownership avoid the probate process provided this ownership includes the “right of survivorship.” Under this arrangement, the surviving owner automatically owns the asset – be it a bank account or investment account or real estate – when the other owner dies, completely bypassing probate. Types of joint ownership with rights of survivorship are “joint tenancy” and “tenancy by the entirety,” which is for married couples.

Establish a durable financial power of attorney

You should designate a durable financial power of attorney, which gives someone the legal authority to help manage your assets in the event you are unable to properly handle them yourself. This document can prevent the probate court from having to appoint a conservator to handle your affairs. Further, a durable financial power of attorney, who may access your financial information, could help monitor your finances and protect you from becoming a victim of financial fraud or scams.

Set up a transfer-on-death deed for property

A transfer-on-death (TOD) deed is a legal document that allows real estate owners to name who they want to inherit their property once they pass away. Further, it allows the real estate described in the deed to be transferred to the named beneficiaries outside of probate. To go into effect, the deed must be properly signed and recorded.

Different states have different rules, and not all states recognize TOD deeds. For example, Michigan recognizes what is commonly referred to as a “Lady Bird Deed.” This is an enhanced-life-estate deed, which works in a similar fashion as a TOD deed. Consult an estate attorney to learn what deeds are recognized in your state and if one is right for you.

As you can see, there are several tools at your disposal to avoid probate court. However, which are appropriate for you depend on personal factors such as your financial situation and the state in which you live. That’s why you should seek the help of an estate attorney, with input from your financial adviser. A good estate plan will allow you to give your loved one’s peace of mind during a difficult time.

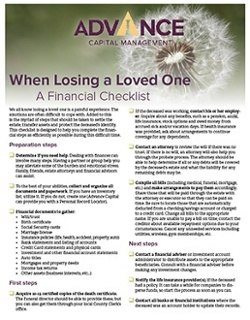

And as the person who has lost a loved one, it can become even more difficult when managing the deceased’s estate and all the financial obligations that come with it. Our financial checklist can help.

Download Advance Capital’s When Losing a Loved One – A Financial Checklist to use as guide for many of the most important financial obligations you may face.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.