Building a Budget

December 8th, 2015 | 2 min. read

A budget not only helps you stay above water, it also helps you build wealth. In the bestselling finance book, The Millionaire Next Door, authors Thomas Stanley and William Danko found that two-thirds of 1,000 millionaires surveyed said they followed a budget.

A budget not only helps you stay above water, it also helps you build wealth. In the bestselling finance book, The Millionaire Next Door, authors Thomas Stanley and William Danko found that two-thirds of 1,000 millionaires surveyed said they followed a budget.

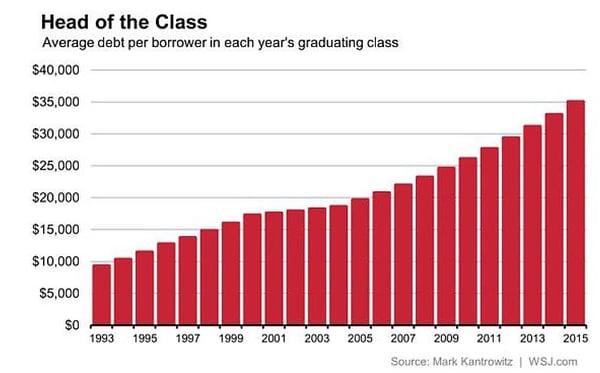

For recent graduates and those in the early to middle stages of their careers, a budget is now more important than ever. Most people begin their working careers in the hole. The chart below shows that the average debt per borrower for college grads in 2015 was more than $35,000.

A budget helps you control your expenses, reduce your debt and focus on your long-term financial goals. It may also help improve your physical and mental health as well as your financial well-being. According to the American Psychological Association, money is the leading cause of stress for Americans.

HOW TO CREATE A BUDGET

The reason many people don’t follow a budget is simply not knowing how to create one. Fortunately, we live in a high-tech world. There are several apps available, such as Mint and Digit, that allow you to track your spending and budget for goals right from your smartphone.

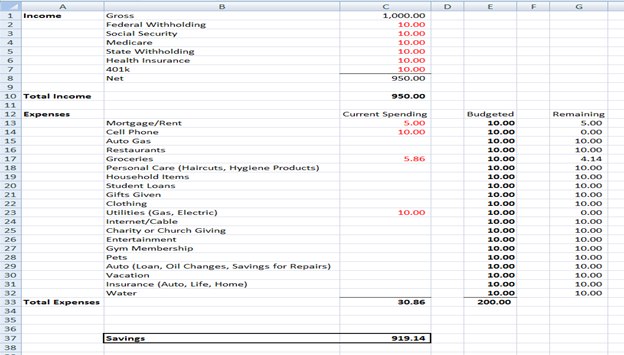

It’s also easy to create your own budget with basic software such as Excel. Even if you choose to use a budget app, you’ll want to first create a list that breaks down your cash flows, expenses and spending limits. You can do this on your computer or a sheet of blank paper.

Below is a sample budget.

As you can see, this budget example shows your net take-home pay and current expenses in common spending categories including rent, utilities and clothing. This format allows you set individual budget limits in each respective category and closely track your spending. The most important benefit is that helps you find out in what specific areas you may overspend. You’ll then know what steps to take to reign in your expenses. For example, you may start to eat out less or consider signing onto Hulu or Netflix to reduce your cable bill.

Everyone’s budget will look different. You’ll likely have your own personal list of categories. Use your most current monthly bank statement to find out how much you typically spend in each one.

Once you have a budget, you can devise ways to reduce your spending and allocate the savings toward your financial goals such as a vacation, new home and retirement.

BUDGET TIPS

Building your budget is only half the story. You still need to take the necessary steps to keep it on track. Here are a few tips to help:

- Be aware that some of your bills, such as water or insurance, may come quarterly rather than monthly. Instead of adjusting your budget when those bills come due, build them into your budget in monthly installments. For example, if your water bill is $150, budget $50 to water each month so that you have the full amount saved on time.

- Avoid becoming a complacent consumer. Many people stick with expensive services because they choose not to shop around. But you may be able to boost your savings by finding less expensive insurance policies or discounted cable service elsewhere. Or, you can contact your current providers and negotiate cheaper rates.

- Expect the unexpected. Nothing can put you back like unexpected expenses such as car and home repairs or major events such as the loss of a job or a medical issue. That’s why you want to include an emergency fund in your budget. A good rule of thumb is to save enough to cover three to six months of expenses.

Whether you’re young or old, rich or not, a budget should always be an essential part of planning for your financial future.

If you need help planning your financial future, contact us today and we’ll help you create a custom financial plan at no cost and no obligation.

Also, if you’d like more information on how to build wealth, watch our webinar: The 4 Essential Traits of Financially Successful People.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.