How the Election Affects the Market – Who to Vote For

September 29th, 2016 | 2 min. read

If you could use only one word to describe the 2016 presidential election cycle, it would be hard to find one more suitable than “volatile.” Some people would argue it has been the most contentious in history, which has raised concerns among investors that the stock market may suffer from its own bout of higher volatility as a result.

If you could use only one word to describe the 2016 presidential election cycle, it would be hard to find one more suitable than “volatile.” Some people would argue it has been the most contentious in history, which has raised concerns among investors that the stock market may suffer from its own bout of higher volatility as a result.

Yet, every election comes with its own uncertainties and hot-button issues. And during every presidential contest, investors wonder how the election affects the market. It’s generally another way of asking, who should I vote for to protect my finances?

The answer is that you elect the right financial adviser who can help you create a financial plan and stay on track toward your specific goals. You can gain peace of mind for the long term, beyond the next four years.

Need a financial plan? Talk to an Advance Capital adviser today to learn how we can help you achieve a financially secure future.

However, is this year different? Will the market react more favorably to one party over the other? Should it factor into your financial decisions? Let’s take a look some past market research during presidential election years to find out.

Is this year different?

Whoever wins the presidency will face some difficult challenges. The country is struggling through a slow economic recovery. There’s much uncertainty surrounding recent controversial federal programs. And, we are under the threat of a global menace.

But, this could just as aptly describe the year 1936. During that election year, the American economy was still reeling from the Great Depression, the New Deal had just been ratified and the world started to grasp the global ambitions of Germany’s Nazi Party.

Around the world, in any given year, there are always tumultuous events, from war and natural disasters to market declines and recessions. And they all pass. Therefore, financial decisions should be made with your long-term goals in mind rather than short-term events.

Is a Republican or Democrat better for the market?

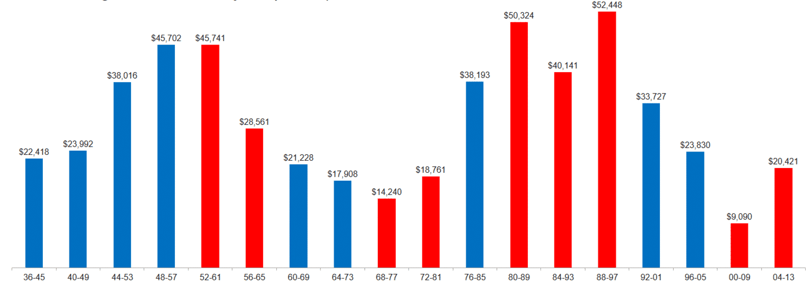

Generally, investors have done well no matter which party held the presidency. The chart below shows the growth of a hypothetical $10,000 investment made in the S&P 500 at the beginning of each election year, starting in 1936. The party affiliation of the president-elect had no bearing on how well that investment performed over 10 years. In all but one period, it grew.

Growth of hypothetical $10,000 investment made at the beginning of an election year (S&P 500 total ending value over 10-year period)

Source: Capital Group.

Each 10-year period begins on January 1 of the first year shown and ends on December 31 of the final year shown. For example, the first period listed (1936-1945) covers 1/1/36 through 12/31/1945. The S&P 500 is unmanaged and, therefore, has no expenses.

Further, stock market returns (as represented by the S&P 500) have been negative in two election years but positive in 12 elections years since 1960.

In the end, the market is more concerned about companies than presidencies.

Who you should vote for

By now the candidate we think you should vote for should be pretty obvious: Vote for who you like best (or dislike least). After all, your journey to retirement and beyond will outlast this presidency and likely several others.

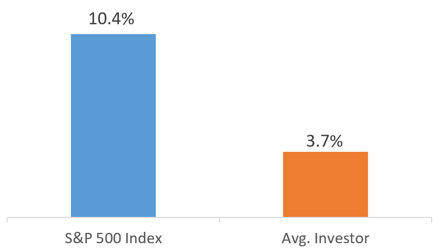

Instead of asking what the president can do for your portfolio, ask what you can do for your portfolio. Consider that the average individual investor has consistently underperformed the market. Over a 30-year period, the average investor has earned 3.7% compared to the 10.4% of the S&P 500.

30-Year Returns (ending 12/31/14)

Source: Dalbar.

That seems to indicate that investors often make poor investment decisions, such as timing the market or chasing performance.

Therefore, to reiterate, vote for who you like, but invest for the long term. With a financial plan and the guidance of a trusted adviser, you can focus on your goals rather than the polls.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.