Investing in Bull and Bear Markets

February 12th, 2020 | 3 min. read

Bull and bear markets, though diametrically opposed, share one distinct quality. In both environments, people will find reasons why it is not the right time to invest.

When the stock market hits all-time highs, some will argue stocks are overvalued. And, when it enters bear market territory, defined as a 20% drop from the previous high, you can expect to hear predictions that it is going to get worse.

For a while now, there have been growing concerns about the current bull market’s age. It is among the longest in history. You might wonder how a change in the market cycle would affect your ability to achieve your financial goals.

But as a long-term investor, how concerned should you really be about what part of the cycle the stock market is in?

Generally, not as much as several other investment factors, such as account contributions, asset allocation, fees, etc. As they say, age is just a number. Because, historically, the market has gone up more than it has gone down – a lot more. Therefore, what determines how much you earn isn’t when you started but rather how long you’ve been invested.

Comparing bull and bear markets

You can see the benefits of spending time in the market by looking at the history of bull and bear markets.

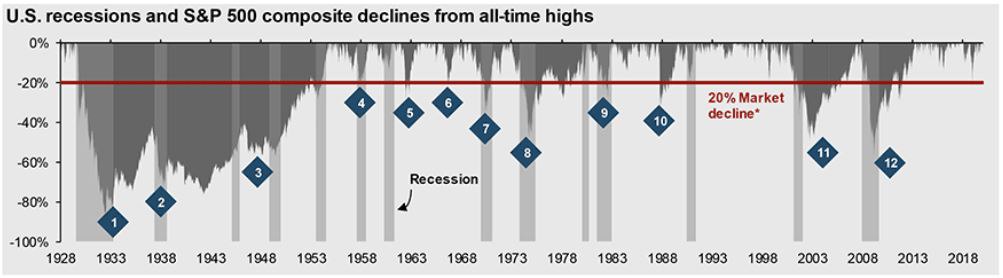

JP Morgan’s Guide to the Markets details the sequence of U.S. recessions and their respective bear markets dating back to 1928. The report counts 14 recessions over those 90 years. This chart shows the relative normalcy of recessions and bear markets, occurring around once every decade.

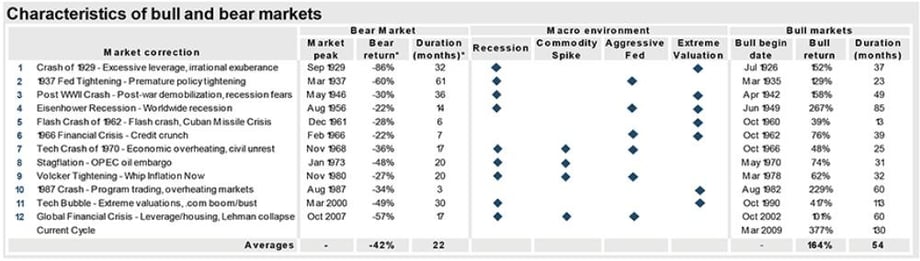

What is more telling are the factors that precipitated those bear markets, how long they lasted and how they compare to their subsequent bull markets.

There are two major takeaways here. Firstly, bear markets are common but what causes them are not, ranging from economic disruptions to government policy to geopolitical conflicts. There is no clear warning sign as to what will kick-off the next one.

Secondly, the market grows far more and far longer than it declines. The average bear market return was -42%, with an average duration of 22 months. Compare that to the average bull market. The average bull market rose by 164% and lasted more than twice as long than the average bear market.

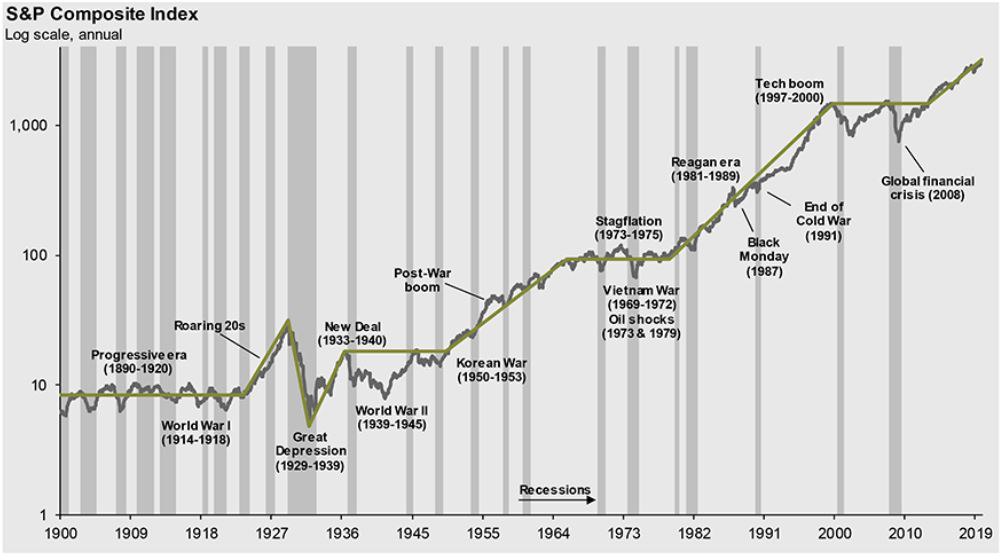

This is also reflected in the historical upward trajectory of the stock market, even among some heady historical events.

How today’s bull market will run out of steam is anyone’s guess. High valuations generally indicate lower future returns, but bull markets don’t end simply because they’ve run too long. The important thing to remember is that regardless of the market cycle, over time, you can expect to earn more than you lose.

What about economic expansions and recessions?

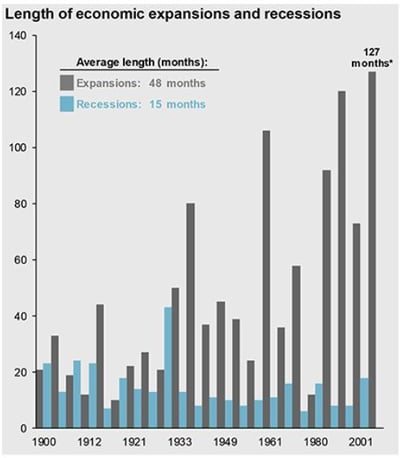

Similarly, the current economic expansion is unlikely to last forever. With the Great Recession still vivid in many people’s memories, some would argue we are long overdue a recession along with a market correction.

Perhaps so, but the same long-term trend in market cycles is found when comparing economic cycles. Economic expansions on average last more than three times as long as recessions.

This is more evidence as to why it is important to maintain a long-term investment perspective in relation to your financial goals. You can create a personalized financial plan with reasonable expectations rather than trying to guess when it is the optimal time to invest your money.

When to adjust your investments

Of course, some market history may provide little comfort as your portfolio declines during a market downturn.

The trick is to make long-term investment decisions irrespective what the market is doing during the short term. Choose your investments based on your needs and goals. Your portfolio should reflect the amount of risk you can take to maximize your potential to achieve your goals. But also the amount of risk you’re comfortable with so that you don’t abandon that portfolio.

Over time, you can gradually reduce risk as you near or achieve your goals, or as your needs change. For example, lowering the stock portion of your portfolio from 60% to 40% when you retire.

Instead of worrying about the fate of bull and bear markets, which you cannot control, you can focus on the things that aren’t left to chance: how you save, how you build your portfolio, who you choose to help guide you and how much you pay in fees.

Because people inherently fear a loss more than appreciate a gain, it’s easy to hold a pessimist view of the market’s future. But we do not know the future. What we do know is that the good times have historically outweighed that bad times. That’s why you invest in the first place and that’s why you can confidently stay in the game, irrespective of beginnings and ends.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.