March Madness Tips for Your Bracket and Your Finances

March 7th, 2016 | 6 min. read

According to some surveys, during March companies experience nearly $2 billion in hourly corporate losses due to unproductive workers as an estimated 50 million workers participate in office brackets.

However, participating in March Madness doesn’t have to be a total waste. It can actually teach you a thing or two about finance. Check out the March Madness tips below that provide insight for filling out your bracket and managing your money.

1. The odds of filling out a perfect bracket are around one in 9.2 quintillion

It’s not going to happen. You’re statistically more likely to win back-to-back Mega Millions lotteries when buying one ticket each time. The near impossibility of filling out a perfect bracket is primarily why Warren Buffet offered a $1 billion prize to anyone who filled out a perfect bracket in 2014.

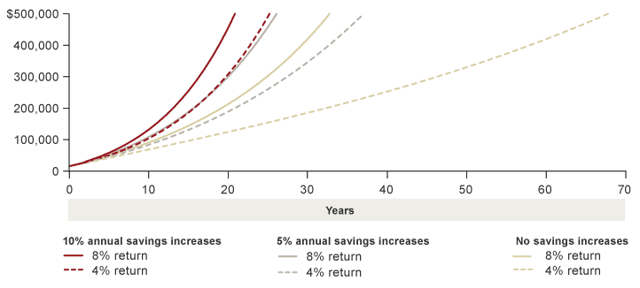

Finance tip: Don’t expect to get rich quick, and be wary of anyone who tells you otherwise. Although not as exciting as a buzzer beater, the surest way to generate wealth is still the old fashioned way: save early and often. The chart below shows how increasing your savings can be a very effective and reliable approach toward wealth.

Saving is the only financial “slam dunk”

Source: Vanguard. This hypothetical example does not represent the return on any actual investment. The calculations assume a starting balance of $10,000, an objective of $500,000, a contribution of $5,000 in the first year, and an annual inflation rate of 2%. Contributions are not adjusted for inflation, but the portfolio balance and the portfolio objective are adjusted for inflation at each year-end.

2. Expect a Cinderella story or two

Everyone’s favorite part about the tournament? The upsets, of course. Under the one-and-done format, anything can happen. Consider that there is almost always a No. 12 seed upset over a No. 5 seed and that all four No. 1 seeds have advanced to the Final Four just once (2008).

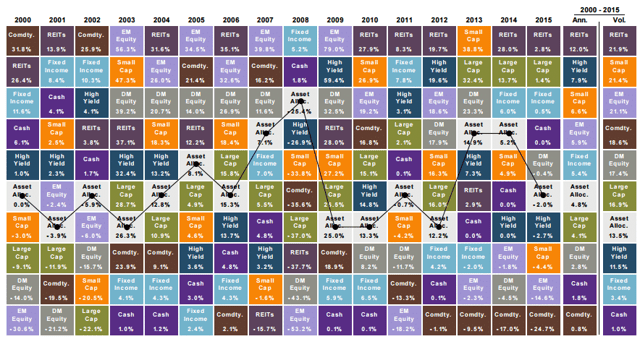

Finance tip: It’s very risky to try to pick winners. In any given year, any investment can perform the best or the worst (as shown in the table below). Often it is against the expectations and predictions of economists and “experts” you see on TV.

Investment madness: annualized asset class returns since 2000

Source: JP Morgan Asset Management. Large cap: S&P 500, Small cap: Russell 2000, EM Equity: MSCI EME, DM Equity: MSCI EAFE, Comdty: Bloomberg Commodity Index, High Yield: Barclays Global HY Index, Fixed Income: Barclays Aggregate, REITs: NAREIT Equity REIT Index. The “Asset Allocation” portfolio assumes the following weights: 25% in the S&P 500, 10% in the Russell 2000, 15% in the MSCI EAFE, 5% in the MSCI EME, 25% in the Barclays Aggregate, 5% in the Barclays 1-3m Treasury, 5% in the Barclays Global High Yield Index, 5% in the Bloomberg Commodity Index and 5% in the NAREIT Equity REIT Index. Balanced portfolio assumes annual rebalancing. All data represents total return for stated period. Past performance is not indicative of future returns. Data are as of 12/31/15. Annualized (Ann.) return and volatility (Vol.) represents period of 12/31/99 – 12/31/15. Guide to the Markets – U.S. Data are as of December 31, 2015.

3. Watch out for teams that catch fire in March

The college basketball season spans five months, but it takes winning just six straight games over a few weekends to be crowned champion. Therefore, keep an eye on teams that are peaking right now, as regular-season dominance doesn’t always mean tournament success. Only seven teams have won the national championship with a perfect record, and the last was Indiana back in 1976. Additionally, the statistical favorite goes into the NCAA tourney with only about a 20-25% probability of winning the championship, according to FiveThrityEight.

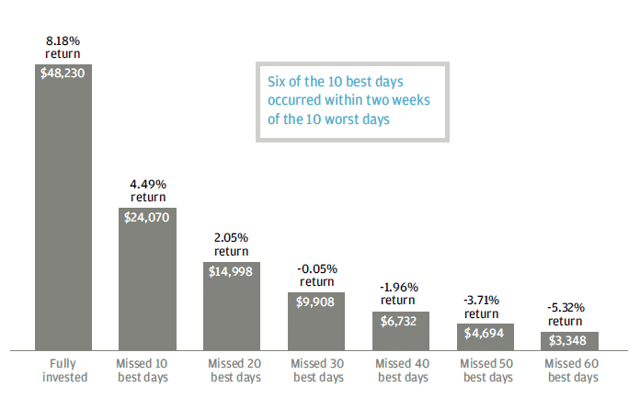

Finance tip: Some of the biggest market gains also occur over a short period of time. The problem is that no investor knows when the madness will happen, which is why it is important to take a long-term approach. The graph below shows that missing just a handful of the best market days can have a major impact on your return. It’s better to stay fully invested rather than attempt to time the market.

Keep playing: performance of a $10,000 investment in the S&P 500 between 1996-2015

Source: J.P. Morgan Asset Management analysis using data from Morningstar Direct. 20-year annualized returns are based on the S&P 500 Total Return Index, an unmanaged, capitalization-weighted index that measures the performance of 500 large capitalization domestic stocks representing all major industries. Past performance is not indicative of future returns. An individual cannot invest directly in an index. Data as of December 31, 2015.

4. Champions usually excel at both offense and defense

Almost every national champion in the last decade ranked in the top eight nationally in adjusted offensive efficiency. Meanwhile, every champion dating back to when Florida won the first of consecutive titles in 2005-2006 also finished the season ranked 21st or better in adjusted defensive efficiency.

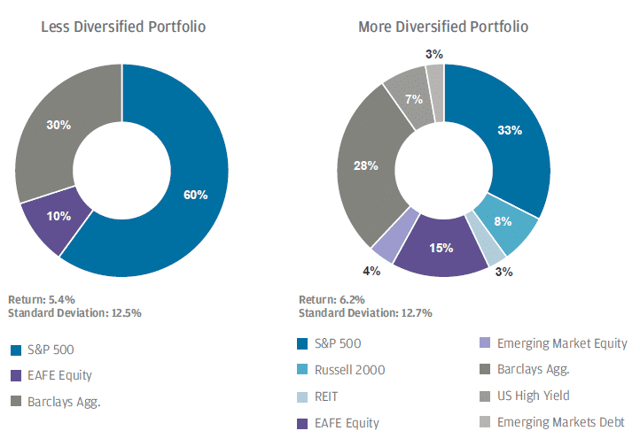

Finance tip: Most investors should play both offense and defense in their portfolios. Broadly diversifying your asset allocation – the mix of stocks, bonds, etc., in your portfolio – may produce a better return with similar risk. Stocks can provide the offense, or growth, while bonds give provide defense, or stability, when the stock market fluctuates.

Diversify your skills: Hypothetical portfolio performance from 2001-2015

Source: Bloomberg, J.P. Morgan Asset Management. Indexes and weights of the less diversified portfolio are as follows: U.S. stocks: 60.00% S&P 500; International stocks: 10.00% MSCI EAFE; U.S. bonds: 30.00% Barclays Capital Aggregate. More diversified portfolio is as follows: U.S. stocks: 32.50% S&P 500, 7.50% Russell 2000, 3.00% NAREIT Equity REIT Index; International stocks: 15.00% MSCI EAFE, 4.00% MSCI Emerging Markets; U.S. bonds: 28.25% Barclays Capital Aggregate, 7.00% Barclays U.S. High Yield; International bonds: 2.75% J.P. Morgan EMBI Global Diversified. Charts are shown for illustrative purposes only. Past returns are no guarantee of future results. Diversification does not guarantee investment returns and does not eliminate risk of loss. Data as of December 31, 2015.

5. Strength of schedule may matter more than overall record

Going far in the tournament requires teams to quickly adjust their game plans to counter opponents with different philosophies. This likely favors teams from the major conferences, which generally play tougher schedules that provide exposure to various styles of play. It may explain why only two mid-majors (depending on the definition) have ever won the national championship – Louisville and UNLV.

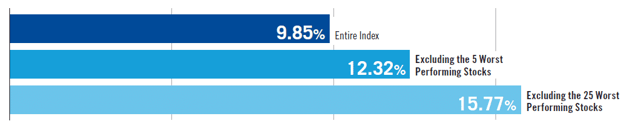

Finance tip: Since markets are dynamic, it can make sense to follow a dynamic investment strategy. A tactical investment strategy gives you the flexibility to actively adjust your asset allocation to try to capture more of the upside and limit the downside so you stay on track toward your long-term goals. For example, excluding just the five worst-performing stocks would have generated a higher return than tracking the entire S&P 500 index over a 20-year period.

Change your game plan when necessary: S&P 500 Index Average Annual Total Returns over a 20-year period ended December 31, 2014

Source: Franklin Templeton. Analysis excludes the 5 and 25 worst contributors (by factoring in a stock’s index weighting) to the S&P 500 Index total return on an annual basis. Indexes are unmanaged and one cannot invest directly in an index.

6. A good coach makes a major difference

Sure, having NBA talent can be the defining factor between going home early and cutting down the nets, but a Hall of Fame caliber coach is just as important. The top college basketball programs are led by the best coaches, who typically do one thing a lot: win. In the past 12 years, seven programs have won it all.

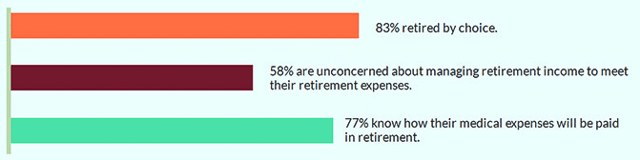

Finance tip: The coaching provided by a financial adviser can’t be discounted. It can make a tangible difference in achieving your financial goals. An adviser helps create a financial plan, select the most appropriate investments and manage your cash-flow needs. They also provide guidance and reassurance to overcome any financial challenges you face along the way.

The impact of a good financial coach. Of retirees surveyed who worked with an adviser:

Source: Franklin Templeton 2015 RISE Overview: The State of Retirement

7. It’ll cost you – A LOT – to attend the tournament

Okay, this won’t help you correctly pick this year’s Final Four. But, you should know that filling out a bracket and going to work each day will save you much more money than attending the tournament. In 2015, the average ticket price to both Final Four games and the championship game was $2,245. A single-game tournament ticket, on average, would have cost you $344.

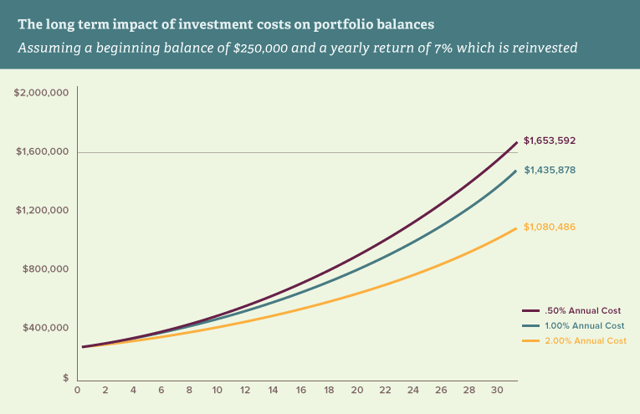

Finance tip: Costs matter. Research has shown that fees are a better indicator of an investment’s future returns than past performance. While you can’t control how an investment will perform, you can control the costs you pay to play. The less you pay in costs, the more you keep of your return, which can help your portfolio grow.

Not a sports fan? You can find plenty of sports-metaphor-free finance tips in our e-book:

The Personal Investor’s Pocket Guide to Good Financial Thinking.

Disclosures: The views and opinions expressed in this article are not a recommendation nor should the article be construed as investment advice. Investment advice can only be dispensed after each client’s unique financial circumstances have been examined.

All investments carry a certain degree of risk, including possible loss of principal. It is important to review investment objectives, risk tolerance, tax liability and liquidity needs before choosing an investment style or manager.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.