Preparing for a Stock Market Recovery

September 8th, 2022 | 2 min. read

Market downturns are emotionally challenging for most investors. Seeing multiple down days can make you feel as if the market will never recover. After all, psychological research has shown people tend to feel the pain of a financial loss twice as intensively as the pleasure of a gain.

While it’s okay to feel nervous, it’s not okay for investors to lose their long-term perspective. That’s because the greatest risk of a bear market may not be the steep decline, but rather missing out on what comes next: a stock market recovery.

Historically, bear markets have often been followed by profitable stock market recoveries. Therefore, long-term investors have been generally rewarded for their patience, discipline and persistence. Whereas investors who try to get out of the market and then back in often intensify their losses.

So, let’s look at what happens when bear markets end and recoveries begin to see the importance of preparing for a stock market recovery.

Stock market recoveries have been quick and strong

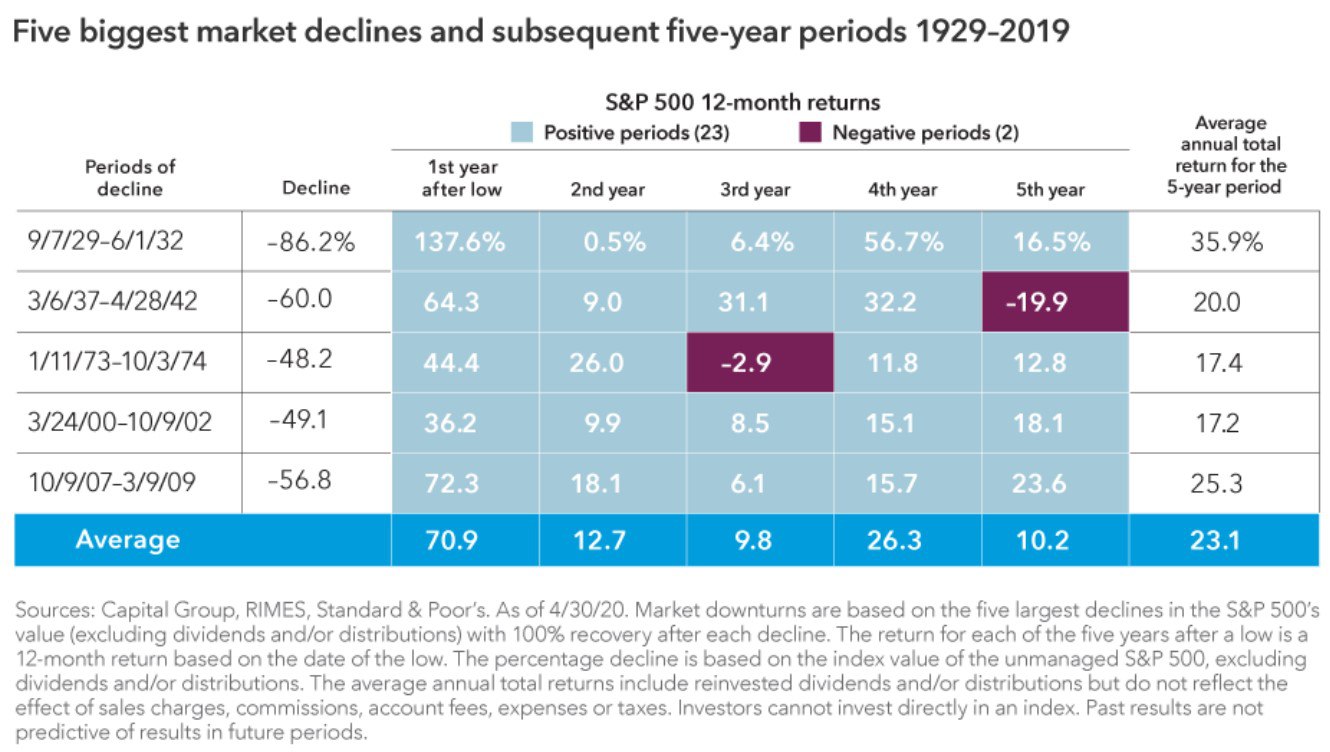

It’s impossible to predict a stock market recovery. But if history is any indication, there’s a good chance any downturn will turn into a period of strong, positive growth. According to Capital Group research, S&P 500 returns were, on average, 18% over the five years following the 18 biggest market declines dating back to the Great Depression.

Furthermore, in the first year after the five biggest bear markets since 1929, investors saw an average return of 71%. Over the following five years, the average annual total return was 23%. Of course, there’s no guarantee of how quickly or strongly a stock market recovery will occur. But this emphasizes the benefit of sticking to your investment plan and ignoring thoughts of getting out of the stock market and “going to cash”.

Positive stock markets have lasted much longer

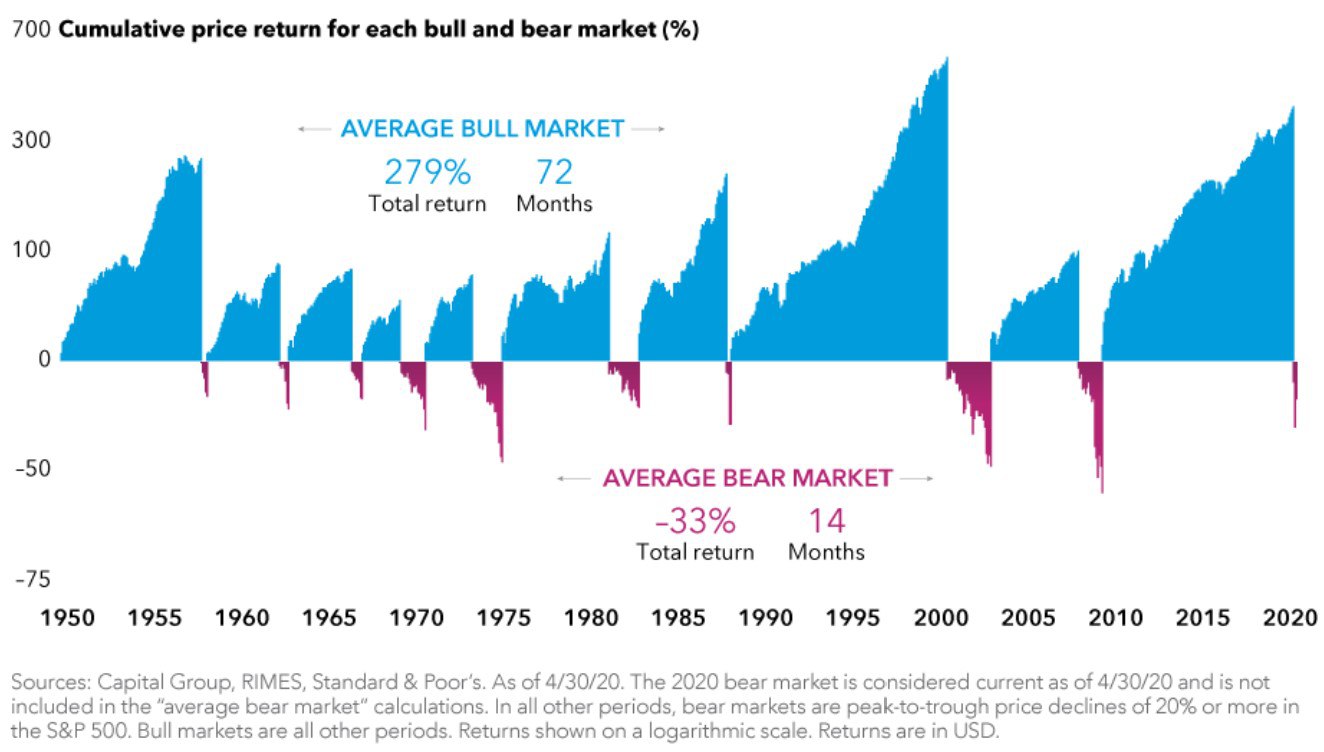

A stock market recovery is often comprised of periods of ups and downs. But overall, bear markets on average are much shorter and weaker than bull markets. Since 1950, the average bear market has lasted 14 months with a total return of -33%. Compare that to the average bull market, which has lasted 72 months with a total return of 279%.

With that in mind, investors who avoid making dramatic changes during market declines are often in better position to take advantage of a stock market recovery.

Those who stay invested are best prepared

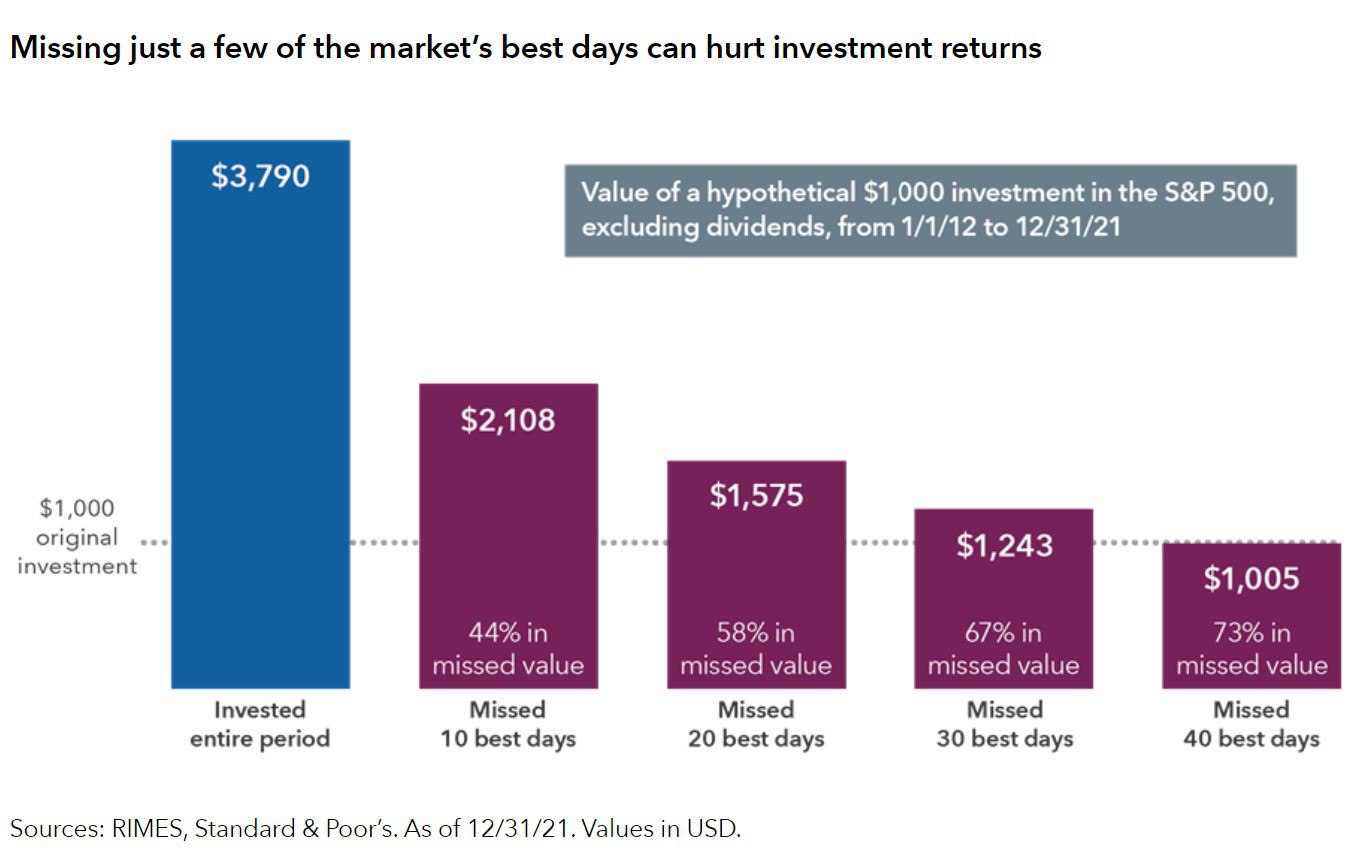

Missing even just a handful of days during a stock market recovery can prove costly over time. That’s why taking money out of the market during a decline in hopes of getting back in at the exact right time is almost never a good investment strategy.

Investors who try to time their way back into the stock market are unlikely to experience the full benefit of the recovery. Consider a hypothetical investor who tried timing the market and missed just the 10 best days of the stock market recovery, resulting in earning 33% less than having stayed invested. Missing more of the best days means an even greater loss in value.

Portfolio diversification is still important during a stock market recovery

One thing investors can do to ensure they’re prepared for a stock market recovery is to get a portfolio review. After major swings in the stock market, you may want to check whether your portfolio is still properly diversified and aligned with your investment goals. If you need help, an Advance Capital financial adviser can provide a complimentary portfolio review and consultation.

Even if you’re confident a stock market recovery is on the horizon, a diversified portfolio is important for your long-term success. Bull markets don’t move in straight lines. They often experience market corrections and steep declines.

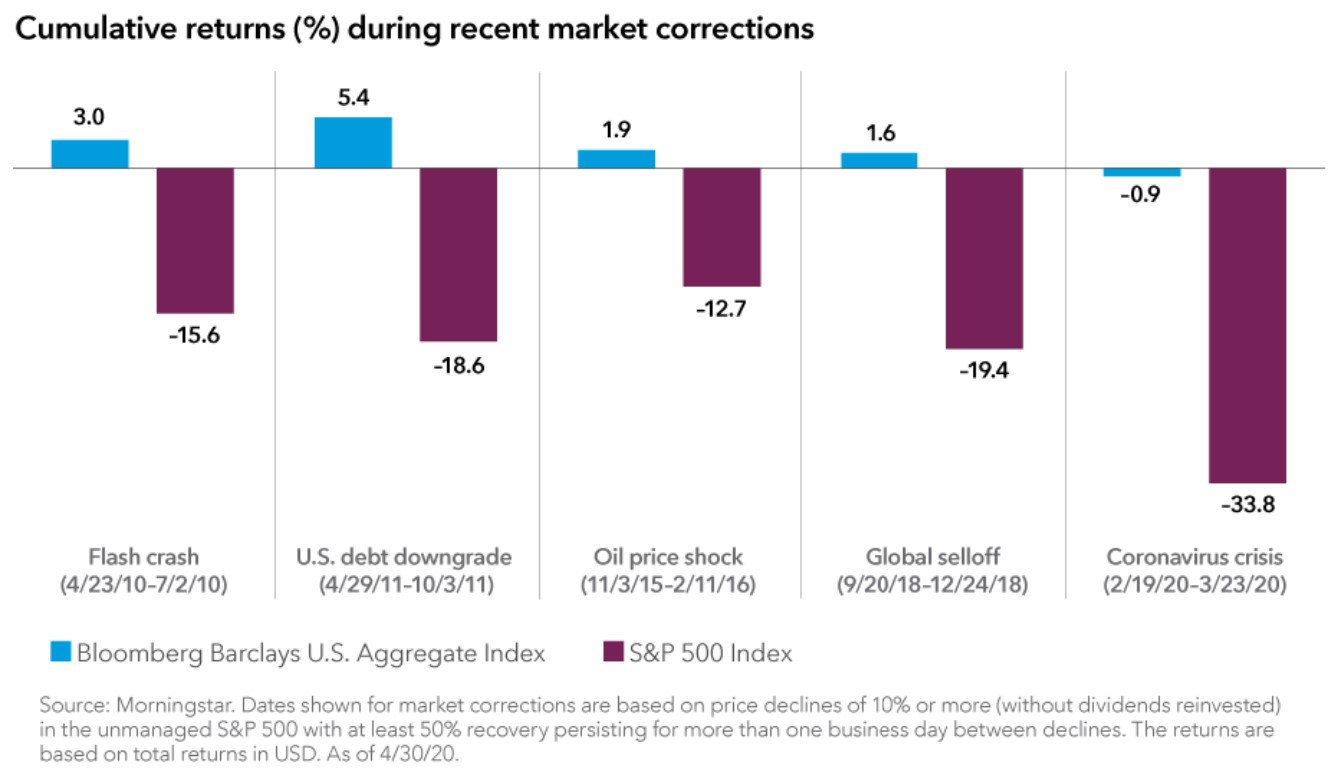

As shown here, bond returns generally move in opposite directions of stocks. This allows bonds to provide stability in your portfolio during times of instability in the stock market.

Stock market history may not always repeat, but it has been shown to rhyme. So, in the depths of a bear market, it is often a good idea to look ahead and prepare for a stock market recovery.

Worried about how a recession could impact your finances? Download this FREE guide to learn how to protect your money against a recession.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.