Q1 2022 Market Update: US Economy Proves Resilient – But for How Long?

April 13th, 2022 | 4 min. read

Advance Capital Management’s president and chief investment officer, Christopher Kostiz, provides his key economic and market insights from the most recent quarter.

KEY TAKEAWAYS

- The Consumer Price Index (CPI) posted a year-over-year increase of 7.9 percent, the highest since the early 1980s.

- The nation’s unemployment rate is now below 4 percent and wages have increased more than 5 percent over the past year on average.

- The S&P 500 Index fell 4.60 percent, while mid- and small-cap indices were off 5.68 and 7.53 percent, respectively.

As the world continues to claw its way back from the grip of the pandemic, we are constantly reminded that the road may be long and treacherous. While nationwide Covid cases have receded, its impact continues to reverberate with 40-year high inflation, massive global supply disruptions, lack of qualified workers and high consumer demand. The war between Russia and Ukraine has put additional pressure on world commodity prices, with growing fears of a potential conflict between world superpowers.

Still, amidst these negatives, our economy has proven resilient and able to withstand many of these pressures to date. The economy is growing modestly, the unemployment rate is low, and wages are rising. The question remains whether at some point these negative trends will trump the positive ones and lead to an economic slowdown and further disruptions in the capital markets.

Inflation remains high

On the economic front, record-high inflation has permeated nearly every aspect of our lives. The Consumer Price Index (CPI) posted a year-over-year increase of 7.9 percent, the highest since the early 1980s. Energy prices have spiked more than 40 percent already this year, while food prices are up more than 5 percent.

12-month percentage change, Consumer Price Index, January 1980 – February 2022

.jpeg?width=452&name=12-month-percentage-chan%20(1).jpeg)

A reduction in domestic oil production along with pandemic-related supply chain disruptions have made it more difficult and expensive to get parts and supplies across the country. The recent invasion of Ukraine by Russia has put additional pressure on supply and sent prices surging for many fuels, fertilizers and commodities around the world. This is likely to further exacerbate the inflationary problem and lead to higher consumer prices in the coming months. Producer prices, a gauge of inflation that measures changes to the cost of production, also hit a fresh 40-year high. Prices are higher for nearly every part of the supply chain and across most sectors of the economy.

Employment is a major bright spot

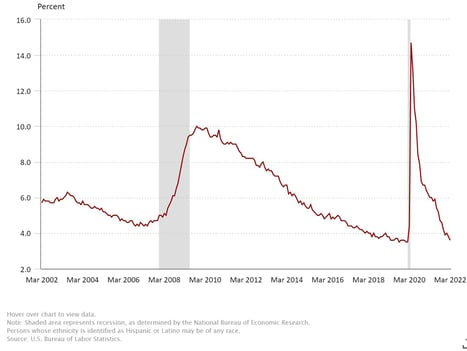

Even as inflation runs hot, most sectors of the economy are holding up reasonably well and serving as a ballast for further growth. The nation’s unemployment rate is now below 4 percent. Employers have added at least 400,000 jobs each month since last May. With demand high for workers, wages have increased more than 5 percent over the past year on average. The gains have been broad-based across most sectors of the economy.

Unemployment rate, seasonally adjusted

An improving employment picture has kept consumers on a spending spree over the past year. In fact, total retail sales were up 14.4 percent annualized in the first quarter. While higher energy prices were the main culprit for the surge in spending, disposable income for consumers has continued to rise.

Another bright spot is the housing sector. New home construction rebounded to the strongest pace since 2006, suggesting builders have had success navigating material and labor constraints. While positive, rising commodity prices, higher mortgage rates and geopolitical conflicts could impact builder confidence. Finally, the services sector, which comprises about 80 percent of the U.S. economy, reported 14 industry sectors in growth mode, led by construction and transportation.

Can the Fed thread the needle?

Since the onset of the pandemic and economic shutdown, the Federal Reserve (Fed) has been extremely accommodative with their interest rate policy and their willingness to protect credit markets through unprecedented measures. With inflation surging, the Fed has now reversed course. In March, the Fed raised interest rates by 25 basis points and strongly signaled more hikes to come given a tight labor market and much higher inflation. They indicated that inflationary risks materially outweigh the downside risks to economic growth. They also guided investors to expect five to six additional interest rate hikes and a reduction in their balance sheet for the remainder of the year. While these actions are mostly positive developments long term, it has produced volatility and uncertainty in the short term.

Capital markets experience higher volatility

During the quarter, the combined impact of elevated Covid cases, rising inflation and war between Russian and Ukraine served as the catalysts for much higher volatility in the capital markets. The S&P 500 Index fell 4.60 percent, while mid- and small-cap indices were off 5.68 and 7.53 percent, respectively. Corporate earnings grew about 30 percent for the fourth quarter of last year and are expected to moderate to around 7-9 percent for all of 2022. Value stocks firmly outpaced growth stocks, as investors now favor quality companies with a history of consistent and strong earnings growth. In bonds, higher interest rates continued to pressure prices as most sectors of the bond market declined materially during the quarter.

Our market outlook

Looking ahead, the pervasive inflationary pressures will be met with aggressive action by the Federal Reserve. This scenario will push up market-based interest rates and likely cool growth in the economy. The key is whether the Fed can thread the needle by tamping down inflation without squashing growth too much.

In this environment, we continue to assess the trends and act when necessary to combat the increased market volatility in both stocks and bonds. Already, we have reduced bond duration, or sensitivity to interest rates, added real assets as an inflationary hedge and added more value stocks. While there is no silver bullet, we continue to work diligently to analyze the environment and make strategic investment moves in client accounts as appropriate.

As always, investing in capital markets comes with some risk and uncertainty. We thank you for your continued support of our investment process as we work hard to deliver positive risk-adjusted portfolio returns to our clients. Should you have any questions, please do not hesitate to reach out to your financial adviser.

Christopher Kostiz, President & CIO

Chris is the President and Chief Investment Officer (CIO) of Advance Capital Management. As CIO, he directs the strategy and structure of the discretionary model portfolios and leads the investment committee.