Q1 2023 Market Update: Unintended Consequences for the Economy and Capital Markets

April 5th, 2023 | 3 min. read

Advance Capital Management’s president and chief investment officer, Christopher Kostiz, provides his key economic and market insights from the most recent quarter.

There are constant reminders that governments’ and central bankers' response to the global pandemic can have severe and unintended consequences for both the economy and capital markets. The massive infusion of money into the financial system during the early days of the crisis, combined with global supply-chain disruptions, led to a surge in inflation. In response, the Federal Reserve has aggressively raised short-term interest rates by an unprecedented 4.5 percent in less than a year.

Although the Consumer Price Index (CPI) has fallen from a high of around 9 percent last June to about 6 percent today, its impact is profound. Mortgage interest rates have more than doubled, while rent, food and energy prices have spiked. Consumers and businesses are struggling to adapt to this new inflationary environment. Higher inflation, tightening lending standards and volatility in the credit markets have also impacted the financial system as two large domestic banks were taken over by the FDIC in March due to credit concerns and massive client withdrawals. Although our economy is strong and resilient, these are cautionary signs that actions have consequences, and both growth and corporate earnings could suffer as a result in the months ahead.

Consumers remain resilient

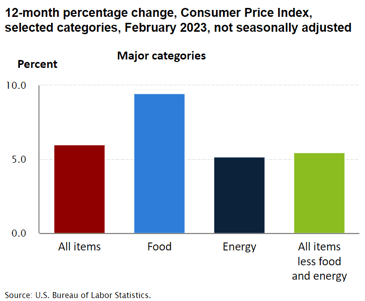

In the first quarter, the economy showed modest signs of growth with declining inflation and a fairly resilient consumer. Inflation, as measured by both the Consumer Price Index and Producer Price Index fell to 6 percent and 4.6 percent, respectively. While still higher than the Federal Reserve’s target of about 2 percent, inflation is slowly receding from its 40-year high. Still, consumers are dealing with much higher prices for many everyday purchases. Food prices are up about 10 percent over the past year, energy is up about 5 percent and shelter costs rose about 8 percent.

On the other hand, commodity prices have fallen and supply-chain problems have eased, leading to a modest decline in producer prices this year. With the nation’s unemployment rate hovering near a 40-year low, consumers generally have the resources and willingness to spend on goods and services. In fact, the service sector expanded more than forecasted in the latest release, as orders and employment climbed to a one-year high. Thirteen sectors reported growth, including agriculture, construction and retail. However, most industries are being pinched by inflation and more expensive labor costs while consumers face rising credit card debt and higher interest rates.

Several other areas of the economy remain volatile with nascent signs of growth. The housing market has been hit hard by rising mortgage rates and nervous buyers, but a pervasive shortage of homes and rising rents should help improve building activity this spring. The business sector remains cautious and unwilling to spend on non-essential items. The most recent monthly release of durable goods orders showed a decline of 1 percent, after falling 5 percent in the prior month. While certain areas showed some growth, the overall decline suggests higher interest rates and economic uncertainty tied to an evolving banking crisis is forcing businesses to trim their investment plans.

The Federal Reserve keeps tightening

In this environment, the Federal Reserve remains determined to fight inflation through higher short-term interest rates. In mid-March, the Fed raised rates another 0.25 percent, marking one of the fastest and most aggressive tightening cycles in history over the past year. While the Fed is concerned about the recent issues in the banking system, they believe it is generally sound and resilient. Further, they anticipate some additional hikes in rates to keep inflation tamed and return it to their target of 2 percent. Yet, these cumulative actions are expected to result in tighter credit conditions for households and businesses and weigh on economic activity, hiring and inflation.

These cumulative effects kept investors on edge and the capital markets quite volatile during the quarter. The S&P 500 Index returned 7.5 percent for the quarter, while mid- and small-cap stocks returned 3.8 percent and 2.5 percent, respectively. Growth stocks tended to outperform value while international markets generally outperformed domestic markets. In bonds, a drop in market-based interest rates produced healthy returns for most areas of the bond market during the quarter.

Our outlook

The past few years brought a unique set of events to our lives that felt unprecedented and historic at the time. Yet, history reminds us that periods of financial crisis, wars, natural disasters and other catastrophic events are an unfortunate part of life. In nearly every instance, we solved the problem, won the war, defeated inflation, saved lives and rebuilt communities. This time isn’t different. While we are still fighting the remnants of the pandemic, inflation is high, the economy is weak and uncertainty abounds, our collective “will” to solve our problems and improve our lives will shine through once again.

Along the way, the capital markets will likely remain volatile and unnerving for investors. But, as in the past, our capitalistic system will prevail and the markets will recover. It just takes time. With that, we expect stocks to produce positive but lackluster results for the year, while bonds should post healthy returns as interest rates moderate. International markets might post slightly better results than domestic due to their lower relative valuations and modest growth expectations. We will continue to analyze the data and make sound investment decisions on your behalf based on thoughtful research and an eye toward balancing risk and return.

We thank you for your continued support of our firm, our investment process, and the trust you have bestowed upon us to manage your assets. We will continue to work hard on your behalf to deliver solid risk-adjusted returns. Should you have any questions, please do not hesitate to reach out to your financial adviser.

Christopher Kostiz is President and Chief Investment Officer of Advance Capital Management. As CIO, he directs the strategy and structure of the discretionary model portfolios and leads the investment committee.

Christopher Kostiz is President and Chief Investment Officer of Advance Capital Management. As CIO, he directs the strategy and structure of the discretionary model portfolios and leads the investment committee.

Christopher Kostiz, President & CIO

Chris is the President and Chief Investment Officer (CIO) of Advance Capital Management. As CIO, he directs the strategy and structure of the discretionary model portfolios and leads the investment committee.