Thinking About Timing the Market? Think Again.

November 7th, 2018 | 2 min. read

Whether sitting in a speeding car or investing in a tumbling stock market, you can get the same uneasy feeling in your stomach.

Motion sickness is caused from your brain and body interpreting an experience differently, which disrupts our sense of balance. But, you don’t have to be physically in motion to experience symptoms. Emotional events can also trigger stress hormones in your body that produce physiological reactions similar to motion sickness.

For some investors, one such event is seeing their investment portfolio take a dip during a market downturn. Overcome with emotion, they consider taking their money out of the stock market. Unlike a speeding car, it’s not so easy to just hit the brakes. But, some investors try to by timing the market.

Basically, market timing is the process of selling your investments before the market hits bottom and then buying back into the market to reap the recovery.

Timing the market is a very difficult strategy to pull off. Not only do you have to time the exit right (sell before the market drops) but also the moment to get back in (buy before the market rebounds).

Compounding the difficulty is the fact that much of the stock market’s biggest gains tend to occur on a small number of days. These are days that are almost impossible to reliably predict, and missing out on them can greatly harm your chances of reaching your financial goals.

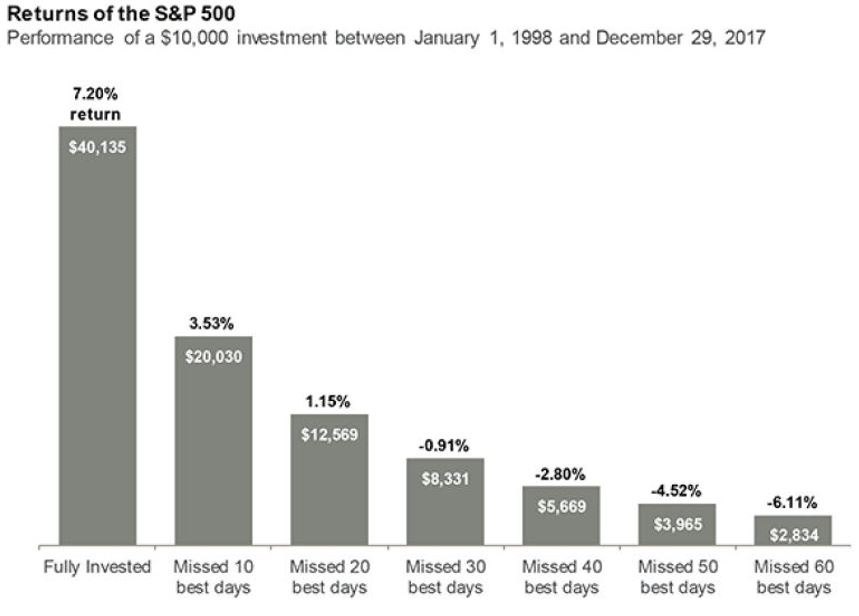

Consider a study of the S&P 500 by JP Morgan over a 20-year period. Hypothetically, if you were to leave a $10,000 investment fully invested during those two decades, you would have earned a 7.20% return and ended up with $40,135. Miss just the 10 best days, your return and growth drops by half to 3.53% and $20,030, respectively.

Think about that, skipping only 10 days out of about 5,200 open trading days over 20 years means earning 50% less.

Source: JP Morgan

Your return would have progressively worsened the more “best days” you missed. By the time you missed out on the 30 best days, you would have started to lose money.

Further, the best and the worst days tend to occur right next to each other. Six of the best 10 days in the stock market occurred within two weeks of the 10 worst days, according to JP Morgan. Talk about a thin margin of error.

Moral of the story: trying to time the market is a fool’s errand.

Still, investors often struggle to keep their emotions in check. A study by Dalbar, a market research firm, found the average investor’s annual return over the past 20 years was 5.3% compared to the broader stock market’s gain of 7.2%.

This on account of investors moving in and out of markets. It’s further proof that investors are typically more successful when they buy and hold on for the long term. Not to mention, it’s another reason to consider working with a financial adviser who can objectively manage your investments and act as a stopgap between your emotions and your money.

Although motion sickness isn’t curable, there is a trick that can alleviate the symptoms. If you open your eyes and focus, either on a single point in the distance, you can actually override the incorrect interpretation of your senses.

Focusing on the horizon can help make for a more comfortable investing experience as well. With an asset allocation that’s aligned with your long-term financial goals and a level of risk you’re comfortable with, you can avoid short-term market distractions.

Looking for an investment strategy that aligns with your long-term goals? Let’s start planning.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.