Wash Your Hands of COVID-19 Scammers

April 8th, 2020 | 2 min. read

Where most of us see this as a time for self-sacrificing unity, others see it as a time for financial opportunity. While people around the world are staying at home to counter the coronavirus (COVID-19) pandemic, fraudsters are staying busy preying on people’s fears.

Criminals are taking a page out of the playbook from past crises. During the 2008 Great Recession, criminals deployed investment fraud and consumer scams using electronic communications to take advantage of the fear of uncertainty in the stock market and economy. After the 9/11 attacks, fraudsters set up fake charity organizations to rip off generous donors.

Since the beginning of the year, the Federal Trade Commission (FTC) has received more than 7,800 coronavirus-related complaints, with consumers reporting losses totaling nearly $5 million. That’s a median loss of almost $600.

The FTC reports:

The top categories of coronavirus-related fraud complaints include travel and vacation related reports about cancellations and refunds, reports about problems with online shopping, mobile texting scams, and government and business imposter scams.

Criminals are using a variety of COVID-19 scams. Various government agencies have published reports of:

- Scam text messages and robocalls offering free home testing kits, promoting fake cures and selling health insurance

- Phishing emails pretending to be from the World Health Organization or the Centers for Disease Control and Prevention

- A text message scam impersonating the U.S. Department of Health and Human Services demanding recipients to take a “mandatory online COVID-19 test”

- Malicious websites and apps that appear to share virus-related information to gain and lock access to your devices until payment is received

- Solicitations for donations to illegitimate or non-existent charitable organizations

- Robocalls offering HVAC duct cleaning claiming to guard your home from the virus

- Robocall scams promoting work-from-home opportunities, mortgage refinancing services, student loan repayment plans, debt consolidation programs and small business loans

- Scam calls and text messages asking for personal or bank account information related to federal government stimulus checks

To help protect yourself from coronavirus scams, the Federal Communications Commission offers the following tips:

- Do not respond to calls or texts from unknown numbers, or any others that appear suspicious.

- Never share your personal or financial information via email, text messages, or over the phone.

- Be cautious if you’re being pressured to share any information or make a payment immediately.

- Scammers often spoof phone numbers to trick you into answering or responding. Remember that government agencies will never call you to ask for personal information or money.

- Do not click any links in a text message. If a friend sends you a text with a suspicious link that seems out of character, call them to make sure they weren't hacked.

- Always check on a charity (for example, by calling or looking at its actual website) before donating.

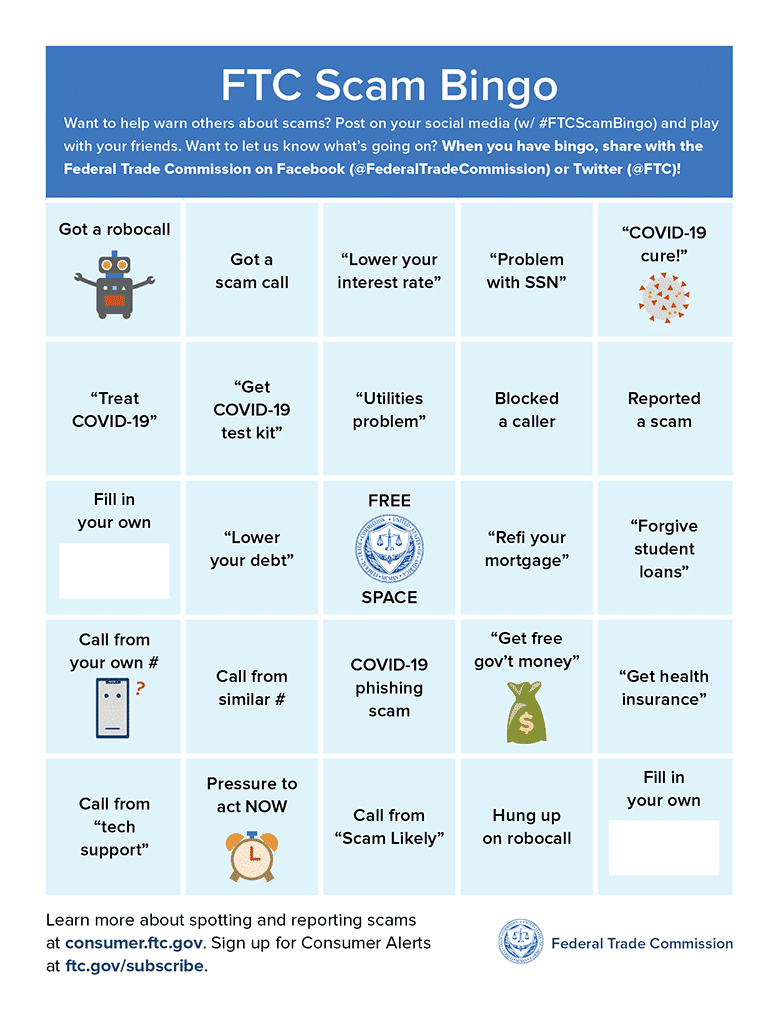

In its efforts to promote awareness and vigilance about coronavirus scams, the FTC even created a scam bingo card to help you stay safe and warn others.

Even if you don’t play bingo, you can still take action. If you think you are a victim of a scam or attempted fraud involving COVID-19, you can report it without leaving your home through a number of platforms.

First and foremost, if you think you've been a victim, contact law enforcement immediately. That includes the FBI, where can file a complaint at https://www.ic3.gov/default.aspx.

The FTC also urges those who have encountered fraud to report it via FTC.gov/complaint. In addition, you can file a complaint about such scams to the FCC at fcc.gov/complaints.

By phone, you can contact the National Center for Disaster Fraud Hotline at 866-720-5721.

If it is fraud involving payment of federal taxes, the U.S. Department of the Treasury encourages you to report it to the Treasury Inspector General for Tax Administration.

And, should you be unsure of anything suspicious, such as a call or email from an unknown contact, before taking action get a second opinion from someone you trust – a loved one, relative, friend or financial adviser.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.