What’s Your Asset Allocation, and Why’s It so Important?

October 28th, 2015 | 3 min. read

When markets become volatile, you may hear lots of talk about the importance of staying put and sticking with your asset allocation. That may sound counterintuitive. If market conditions change, shouldn’t you adjust your portfolio as well?

When markets become volatile, you may hear lots of talk about the importance of staying put and sticking with your asset allocation. That may sound counterintuitive. If market conditions change, shouldn’t you adjust your portfolio as well?

To explain why not, think for a moment about a time you’ve traveled on a great vacation. As you prepared to depart, you likely collected certain must-have items: your passport or ID, a map, an itinerary, and so on. All of these items in some way contributed to your successful trip. They gave you guidance, access and clarity. If you had misplaced any of them, it could have been a terrible experience.

When it comes to investing, your asset allocation is similar to all of those documents rolled into one. Your asset allocation is how your portfolio is divided among different asset classes – stocks, bonds, alternative investments, etc. – based on your unique characteristics such as your objectives, age, savings and income, current assets and attitudes toward risk.

Therefore, it is a map and guide marking the course toward your destination, or long-term financial goals, even when markets change course. And, it is your identity as an investor in the amount of risk you’re comfortable with and able to take.

In fact, it is so important that some research suggests that over 90% of your portfolio’s return is determined by its asset allocation. Let’s explore further why the appropriate asset allocation is a key factor in your financial future.

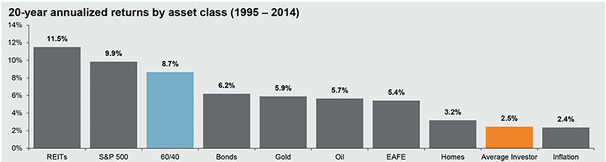

It’s hard to pick winners

In the short term, markets are highly unpredictable. In any given year, any asset class can be the best or the worst performer. This means it’s extremely difficult to consistently choose winners. As shown in the chart below, the annualized return of the average investor (2.5%) barely beat out the rate of inflation (2.4%) over a 20-year period. Meanwhile, a 60% stock and 40% bond asset allocation earned 8.7%.

Source: J.P. Morgan Asset Management, Dalbar Inc.

Indexes used are as follows: REITS: NAREIT Equity REIT Index, EAFE: MSCI EAFE, Oil: WTI Index, Bonds: Barclays Capital U.S. Aggregate Index, Homes: median sale prices of existing single-family homes, Gold: USD/troy oz., Inflation: CPI, 60/40: A balanced portfolio with 60% invested in S&P 500 Index and 40% invested in high quality U.S. fixed income, represented by the Barclays U.S. Aggregate Index. The portfolio is rebalanced annually. Average asset allocation investor return is based on an analysis by Dalbar Inc., which utilizes the net of aggregate mutual fund sales, redemptions and exchanges each month as a measure of investor behavior. Returns are annualized (and total return where applicable) and represent the 20-year period ending 12/31/14 to match Dalbar’s most recent analysis.

These indices do not incur expenses and are not available for investment.

This indicates that the average investor who makes decisions based on recent market trends often ends up buying and selling at the wrong time. Instead of reacting to short-term market movements, you can eliminate the guesswork by maintaining an appropriate asset allocation across several asset classes. A diversified asset allocation helps to reduce risk as well as provide greater exposure to the returns of several investments.

You have long-term financial goals

As an investor, you are planning to build or preserve wealth for long-term financial goals such as retirement. Over the long term, investment returns are relatively stable. That means you can build an asset allocation with reasonable return expectations to reach your goals and match your tolerance for risk, helping to ensure you stick with it. In a sense, your asset allocation is your compass to follow and focus on during market highs and lows.

Discipline is key to investing

Finding an investment strategy is easy. The hard part is exercising the discipline to stick with it at all times. Discipline can really pay off for investors, as markets historically go through cycles. In the chart above, an investor who followed a 60/40 asset allocation strategy would have beaten the average investor by more than 6%. Investors who flee markets in time of stress risk missing out on the positive growth of a recovery.

It’s easy to be tempted to make adjustments when markets fluctuate. No one wants to lose money. But, if your asset allocation appropriately reflects your attitudes toward risk, it can help you stay invested as an investor, and help increase the likelihood that you reach you financial goals.

That’s why it is beneficial to work with a financial adviser to determine an appropriate asset allocation. An adviser can help you choose which asset classes can meet your needs. Then, he or she can keep you on track by helping to minimize stress and the natural desire to make unnecessary adjustments during rough markets.

For most investors, the only reason to adjust your asset allocation is when you’ve reached your goals or your financial needs significantly change. In other words, only when your travel plans change should you recalibrate how you’ll get there and what you’ll need along the way.

Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.