Buyer Beware: How Low Interest Rates Impact Annuities

June 10th, 2020 | 3 min. read

If you want the guaranteed income an annuity can offer, make sure the payout is worth the various downsides.

One thing we all save and invest money for is certainty. Certainty that I can pay my bills. Certainty that I can do some of the things I’ve always wanted to do. Certainty that I won’t go broke in retirement. Certainty that I’ll be okay during a financial crisis.

If the stock market crashes, you can take comfort in the certainty your portfolio is diversified enough not to lose the same amount in value. In a recession, you can take comfort in the certainty that an emergency fund will help keep you afloat until things turn around.

The benefit of certainty is a major reason people consider buying annuities. These insurance products can offer retirees a guaranteed stream of income. With a single premium immediate annuity, for example, you exchange a lump-sum amount for a monthly paycheck throughout retirement.

These days, however, with interest rates at historic lows, those paychecks aren’t what they used to be. Annuity rates tend to follow interest rates, meaning lower annuity payouts, which may not be worth the downsides that come with it.

The relationship between interest rates and annuity rates

Essentially, annuity rates move with bond interest rates. Insurance companies pool together money and rely on some annuity holders dying early to help fund the guaranteed monthly incomes of others. But they also need to invest that money, too.

Insurance companies tend to invest money conservatively in bonds. According to ImmediateAnnuities.com, “insurance companies typically invest as much as 70% of their capital in fixed income securities, notably, corporate bonds.” The problem is that bond rates have declined significantly since the Great Recession.

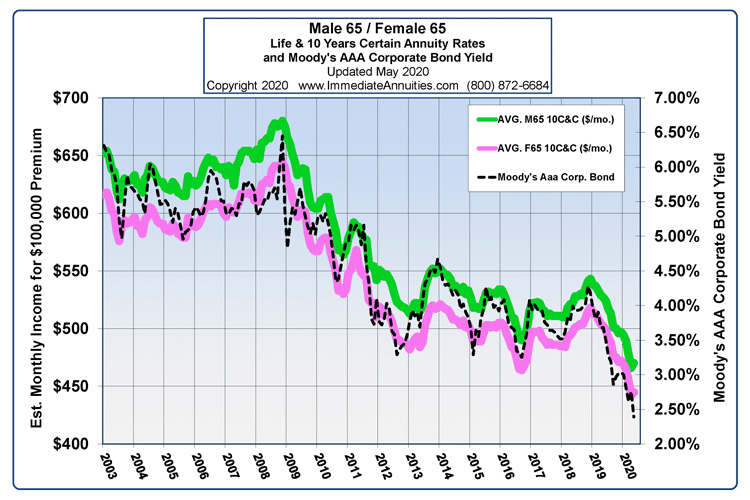

You can see evidence of this correlation when comparing payouts of a $100,000 single premium annuity for a 65-year-old man (green line) and woman (pink line) along with Moody’s AAA Corporate Bond Index (dotted line).

In 2003, a 65-year-old woman buying an annuity could expect to receive more than $600 a month. After 17 years of falling rates, a 65-year-old woman today can expect a monthly annuity payment of less than $450, a difference of about 25%.

Is that lower payment worth the various costs and restrictions found in most annuities?

Drawbacks of annuities

Even in times of higher annuity payouts, the drawbacks demand careful consideration.

For one, most attractive annuity features, such as those lifelong payments and death benefits, come with an added cost. These “riders” increase the total cost of an annuity while reducing your return. Essentially, the annual cost you pay for each rider finances the guarantee of that rider.

On top of the various fees for each rider, you also pay a commission to the insurance broker.

Most important, annuities require you to tie up your money for a certain amount of time. Surrender charges are fees that are incurred when you withdraw money before a specified time period (surrender period) after you buy it, usually seven to nine years. Often, they start around 6-8%, but can be as high as 15%.

You may not anticipate needing the money early. But you can’t discount the importance of access to your money in retirement, especially as health care costs continue to rise. It helps to have flexibility in the event of an emergency or extended stay in a long-term care facility.

Then there are some longer-term considerations. The quality of an annuity depends on the solvency of the insurance company. If your insurance company goes bankrupt, your annuity may go with it. And, when you pass away the insurance company keeps your money, instead of passing it along to a beneficiary.

Altogether, these disadvantages may not be worth buying an annuity that produces a return that’s not much greater than a typical cash investment, like a certificate of deposit (CD) or money market account.

There are annuities that offer higher returns, but they are often much more complex, meaning even more hidden costs and restrictions on your money.

You don’t need an annuity for your retirement income needs

When rates are depressed, those interested in buying an annuity could wait until rates increase. But when you consider the long downward trend of interest rates, you have to wonder just when rates will rise to a level that is suitable for your specific income needs.

Another option is to buy one when you reach an older age – generally, your 70’s – at which insurance companies use your life expectancy as the deciding factor. At that point, your money is pooled together with other annuity buyers. Whomever passes away first, their money funds the payouts of survivors. The risk is that should you pass away early, you may not get to enjoy any of the potential benefits from owning annuity.

Of course, you don’t have to tie up a substantial portion of your retirement savings in an annuity that may not produce the income you need. Instead, you can implement the simple strategy of separating your savings by immediate and long-term needs. For your immediate expenses, whether for the next few months or few years, place those funds in a safe, liquid account. A traditional savings account or CD, for example.

The rest of your savings can stay invested with the chance to grow. Although market returns are volatile in the short term, they are generally predictable and stable over the long term. That means you can build an investment portfolio that has the potential to generate the returns you need to fund your financial goals.

INCOME FOR LIFE? SOUNDS GOOD, BUT READ THE FINE PRINT

Learn more about annuities by downloading our easy-to-understand guide: Is an Annuity Right for You? What to Know Before You Buy. You’ll learn how annuities really work and gain a deeper understanding of three of the most common types: Fixed Annuities, Variable Annuities and Equity-Indexed Annuities.