How Often Should You Check Your Investment Portfolio?

July 3rd, 2019 | 2 min. read

Classic 20th-century mystery writer Patricia Wentworth said, “Too much information can be just as disconcerting as too little.” Today, with smartphones and tablets, you have an endless sea of information literally at our fingertips. As it pertains to your investments, instant access to all that information can do more harm than good.

A basic tenet of personal finance is to keep track of your money. How much money you save. How much money you spend. How much your money grows. However, the frequency in which you monitor your investment portfolio can have unintended consequences.

Ask yourself: How often do you look at your investment portfolio? Daily? Weekly? Yearly? Now, how do you feel about your portfolio?

Turns out there is a relationship between how often you look at your portfolio and your feelings toward it. That’s because we tend to experience financial gains and losses differently. According to prospect theory, a behavioral model of risk and uncertainty developed by Nobel Prize-winning psychologist Daniel Kahneman and his colleague Amos Tversky, the pain of a loss is twice as powerful as the pleasure of a gain.

In other words, you feel twice as bad about losing a dollar than you feel good about finding a dollar. To put it mathematically: for every gain, you experience one positive emotional unit; for every comparable loss, you experience two negative emotional units.

So, what does this have to do with looking at an investment portfolio? It suggests two investors with the same exact investments could have vastly different attitudes about their portfolios. The difference being only in how often they look at it.

As we know, markets don’t move in a straight line. Therefore, if these two investors looked at their portfolios at different timescales, they will see a different set of gains and losses. The investor who happens to more often see a loss will have a more negative attitude, even though both investors received the same return.

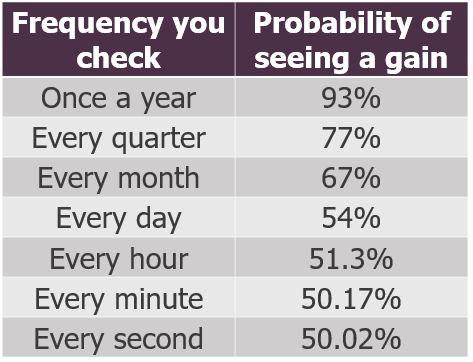

The disparity isn’t just a matter of circumstance. As brilliantly illustrated by Nassim Nicholas Taleb in his bestselling book, Fooled by Randomness, the more frequently you look at your portfolio, the greater the chance you’ll see a loss. Using a hypothetical portfolio with a 15% annual return and 10% standard deviation, Taleb calculated the probabilities you would see a gain at various time periods. If you look once a year, the likelihood of seeing a gain is 93%. Check it every second, minute, hour or day, you have around a 50% chance of seeing a gain, which means you are just as likely to see a loss.

Source: Nassim Nicholas Taleb, Fooled by Randomness.

Therefore, if you checked your portfolio every day, you would have 197 positive emotional experiences and 168 negative emotional experiences per year. Although you would likely see more good days than bad, you would likely feel dissatisfied with your portfolio because, remember, losses are more emotionally impactful than gains.

That means you could own a portfolio delivering outstanding returns, putting you well on your way toward your financial goals, yet feel dissatisfied with it because you’re seeing – and feeling – so many losses.

On the other hand, if you were to check your portfolio every quarter, then you would have three positive emotional experiences compared to one negative emotional experience per year. Better yet, review your portfolio only during your annual financial adviser meeting, you would have nine positive emotional experiences while just one negative emotional experience over 10 years.

Checking your investment portfolio excessively could lead to unnecessary stress, which may coax you into making poor decisions. You could end up abandoning an otherwise appropriate investment strategy and subsequently put yourself further from your financial goals. It is generally in your best interest to check your portfolio periodically rather than frequently.

For long-term investors who plan to use the money for college, retirement or an estate plan, day-to-day performance doesn’t matter that much. Investments fluctuate a lot during the short term. Look too closely and you could draw the wrong conclusions. The next time you get the itch to check your investments, take a minute to think about it first. You could be asking for more information than you want. Or, do it with a financial adviser, who can help put your portfolio in proper context.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.