How to Choose between a Monthly or Lump Sum AT&T Pension Offer

July 20th, 2016 | 3 min. read

(Dear reader: This article pertains to the AT&T pension plan. However, several of the same principles may apply if you are part of a corporate pension plan at another company.)

(Dear reader: This article pertains to the AT&T pension plan. However, several of the same principles may apply if you are part of a corporate pension plan at another company.)

As a union employee in the AT&T pension plan, one of the most important retirement decisions you’ll make comes near the end of your career. Monthly annuity or lump sum pension?

Does it make more sense to take a large sum of cash that you can invest how you want, or stick with a guaranteed check every month for the rest of your life?

This is not an easy decision, as there are pros and cons to each option. In some instances, unfortunately, you are given an offer with a short window of time to make a decision.

Ultimately, this is a very personal decision and it depends on your specific circumstances. So, consider your options carefully and, preferably, with the help of a knowledgeable adviser.

First, learn how your pension is calculated

For union employees, there are three factors that help determine the size of your pension benefit: (1) years of service, (2) pension band and (3) income level. The higher each of these factors, the greater your pension benefit.

You are eligible for a vested pension benefit after five years of service, but your benefit will be negatively affected if you do not reach the age and service breakpoints for your employment position. Additionally, you may receive a reduced pension benefit if you do not work 30 years.

Check the current year’s corporate rate change

One wild card that may affect your decision is a change to the corporate bond rate, which the AT&T pension plan uses to calculate your lump sum offer.

The simple way to think of the corporate bond rate is this: when the rate rises, your lump sum pension shrinks; when the rate drops, your lump sum pension rises. Therefore, depending on which direction the rate goes, a lump sum pension may be more or less attractive, as well as the prospect of retiring or working longer.

We can use last year’s corporate rate change as example. In 2015, rate increased to 3.68%. Here’s how that affected your pension:

|

If your lump sum in 2015 is: |

Your projected lump sum in 2016 is: |

|

$300,000 |

$291,000 |

|

$400,000 |

$388,000 |

|

$500,000 |

$485,000 |

|

$600,000 |

$582,000 |

It is important to remember that union employees are provided a “pension band,” which can help reduce the impact of higher rates.

Your pension is an important income source for retirement. These rate changes may affect your decision whether to retire early, or to take an annuity or a lump sum payout at retirement. However, it is only one part of your overall financial picture. There are many more factors to consider before you decide.

Consider the pros and cons of a lump sum pension

The primary benefit to a lump sum pension is the flexibility that it offers. You can invest it however you like, and you have control over how much you take from it each month.

Additionally, you have control over your beneficiaries. You can pass on what’s left to your children or a charity.

A drawback of a lump sum pension is that when invested, it is at risk of market downturns. You also have the responsibility of making this money last throughout the rest of your life. However, with a sensible investment plan, you can reduce some of the market risk yet still have the opportunity to reap the full rewards of any growth.

Consider the pros and cons of a monthly annuity pension

With a monthly annuity, you don’t have to worry about outliving your money. You can expect a guaranteed check each month for as long as you live. Further, you don’t have to worry about market fluctuations or managing a cash flow from your portfolio.

A monthly annuity may also provide you with the most income overall, if you are in good health and expect to live a long time based on your family history.

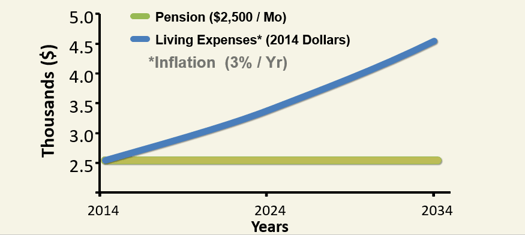

On the other hand, your monthly annuity is not indexed to inflation, meaning you won’t receive a cost-of-living adjustment and may experience a substantial loss of buying power over time. Whereas, a lump sum invested in an IRA gives you the ability to choose investments that may help your money grow above the rate of inflation.

Also, there are survivorship limitations with a monthly annuity. Only a spouse is eligible as a beneficiary.

Your next step should be to speak with a financial adviser who can look at your specific situation and compare options with you. In addition, here are some good questions to ask yourself before making your decision:

- Do I have an emergency fund in case of the unexpected?

- How much income will I need to protect my spouse in case of death?

- Do I even need any more income from my investments?

- Will I need that income now or later?

- Are there concerns about the strength of AT&Ts pension plan?

- Do I care what is left behind for my children or charity?

- How long will I likely live?

LEARN MORE

Download our free interactive e-book that covers all things retirement for AT&T employees -- from the AT&T pension to the AT&T 401(k) plan and more:

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.