How to Save for the Three Different Types of Financial Goals

July 27th, 2022 | 4 min. read

Financial goals are never-ending. No matter your age or level of happiness, there’s always something you would like to use your hard-earned money for.

To improve your chances of achieving them, it helps to know what type of goals you want to pursue. Not all financial goals are alike. The way you save for each one is different, too. Think about it. You don’t save for a vacation in an IRA and you don’t save for retirement in a regular bank account.

It’s often said your financial goals should drive your financial and investment decisions. But, what does that really mean?

Essentially, how much you need for a goal and when you need the money will help determine the best strategy for achieving it. Those two things tell you whether or not you need to invest your money, how much risk you can take and how liquid, or accessible, those funds should be.

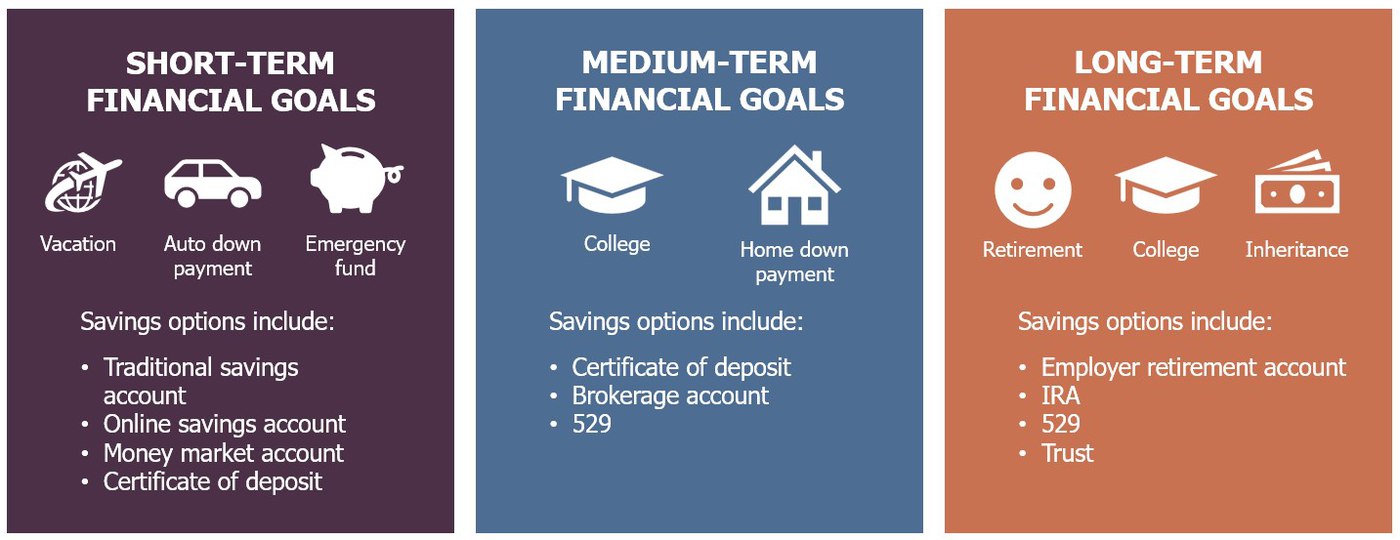

Generally, your financial goals fall under three separate categories: short-, medium- and long-term goals. With a specific savings plan for each of your financial goals, you can avoid having to pick and choose. Instead, you can work toward achieving them all, even as your goals change throughout life.

Type 1: Short-Term Financial Goals

Short-term financial goals examples:

- Vacation

- Auto down payment

- Emergency fund

Short-term financial goal savings options include:

- Traditional savings account

- Online savings account

- Money market account

- Certificate of deposit

Consider short-term financial goals those that you plan to achieve within months or 1-2 years. These are goals for which you need to access your money immediately. And, you don’t need to take on risk.

An emergency fund also falls under this category. You should maintain enough money to help cover expenses for three to six months. As its name suggests, the money should be readily available in case of any unexpected costs.

For short-term financial goals, liquidity is most important. So, a traditional savings account should suffice, but that’s not your only option. Many traditional savings accounts offer little interest. Meanwhile, online savings and money market accounts generally provide higher interest rates.

However, if you’re certain you won’t need the money for a while, you may want to consider a certificate of deposit (CD) for even higher returns. Just keep in mind a CD locks up your money until its maturity date (typically, from a few months to several years) and you may be subject to a penalty if you take your money out early.

Type 2: Medium-Term Financial Goals

Medium-term financial goal examples:

- College

- Home down payment

Medium-term savings options include:

- CDs

- Brokerage account

- 529

With medium-term financial goals, you may not need the money for 5 to 10 years, or even longer.

Like short-term financial goals, CDs may be a good option here, if you want to play it safe. But, you should consider longer-term CDs. Generally, the longer the term, the higher the interest rate.

A higher savings target and longer target date mean you have the ability, and maybe the need, to take some risk. Therefore, you should invest your savings. You can do so in a basic brokerage account.

Unlike a long-term financial goal, such as retirement, you have less time to recover from any potential losses. That means you may want to follow a conservative investment strategy and generally invest more of your savings in conservative investments like bonds rather than stocks.

Ultimately, be sure you understand the account costs, minimums and fees involved. Taxes are also a consideration. In a taxable account, it’s worth considering a municipal bond fund for its tax-exempt status. Whenever investing, it’s a good idea to get some professional help from a financial adviser.

For college savers, consider a 529 plan. A 529 plan is a tax-advantaged investment account designed for college and other higher-education expenses. Things like tuition and books. Your earnings can grow tax-deferred and some states allow you to deduct your contributions. Also, withdrawals for qualified higher-education expenses are tax-free. Work with an adviser to set up a 529 plan that’s most appropriate for you and your student.

Type 3: Long-Term Financial Goals

Long-term financial goal examples:

- Retirement

- College

- Inheritance

Long-term financial goal savings options include:

- Employer retirement accounts (401(k), 403(b), 457, etc.)

- IRA

- 529

- Trust

When we talk about long-term financial goals, we’re talking about those that will likely take more than 10 years to achieve. For example, if you start saving for college as soon as your child is born then you could be saving for 18 years. The most common long-term financial goal is retirement.

For a long-term financial goal like retirement, you’re saving over the course of your career. That’s a potential span of 20 to 30 years or more.

Many workers are provided a place to save for retirement by their employers, such as a 401(k), 403(b) or 457. At the very least, you should save enough to earn the company match, if available, but the sweet spot is 10%-15% of your paycheck each month. Those who don’t have access to an employer-sponsored plan can save in an individual retirement account (IRA).

Whatever type of retirement account you own, the general rule of thumb is to invest aggressively when you are young and many years from retirement. Gradually reduce risk as you near retirement, as your objective changes to preserving your savings.

When saving for the long-term, it’s also important to keep costs in mind. The lower your investment fees, the more of your return you keep. Lowering your investment costs by just 1% could mean having tens of thousands more in your portfolio by the time you retire.

For those who are interested in leaving a financial legacy for their heirs, there are a variety of options to consider. For instance, you can set up a trust or designate heirs as beneficiaries on your financial accounts. Because of the complexity and tax implications involved, it’s best to create an estate plan with the help of a financial adviser and estate attorney.

The Bottom Line

Time plays a pivotal role in our financial decisions. The more time you have, generally, the more risk you can take. Still, it’s a challenge to find the right way to save for all your financial goals when there are so many different places to put your money. Not to mention, so many financial institutions who would love to hold that money for you. Let your individual financial goals help guide you, and as they get more complicated, let a financial adviser do the same.

Learn more about saving and investing for retirement by reading our free ebook, YOUR MONEY IN YOUR 50s: A RETIREMENT PLANNING GUIDE FOR PROCRASTINATORS AND AVID-SAVERS.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.