Inflation Protection for Retirement Planners

March 17th, 2021 | 3 min. read

Something that hasn’t been high on the list of retirement risks for many years is inflation.

That might be changing.

There are fears inflation could rise dramatically due to extensive government spending and Federal Reserve policies in response to the Covid-19 pandemic. Too many dollars fighting over too few resources can lead to higher prices.

Granted, it remains to be seen how prices will change long term as economies recover and things return relatively to normal. But even if inflation were to stay below the Federal Reserve’s target of 2%, it is a risk to the assets of those planning for retirement. Even at a low 1.5% annual inflation rate, what costs you $1,000 today will cost nearly $1,350 in 20 years and more than $1,550 in 30 years.

Inflation works like cold air seeping through cracks in your home. It will cost you over time without proper insulation. And inflation can disproportionately affect older Americans due to differences in spending habits. Healthcare prices, for example, typically rise much higher than those in other categories.

Below are ways to insulate your financial life from inflation throughout retirement.

Risk of inflation in retirement

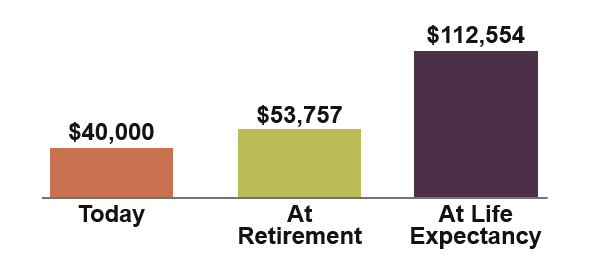

First, to get a better sense of why you need to account for inflation in your retirement plan, imagine you’re age 55 and plan to retire at age 65. Your current annual income is $100,000 and you need to live off 80% of that amount in retirement. Half will be covered by your Social Security benefit, which leaves 40%, or $40,000, to be funded with your retirement savings.

Due to inflation, however, your income needs will grow by the time you retire. At your retirement date of age 65, your income need will be $53,757, assuming 3% inflation. Now, let’s say your life expectancy is 90 years old. By then, your income need will balloon to $112,554.

Effect of inflation on retirement income needs

So, what are some ways to help manage inflation risk?

Keep stocks in your portfolio

With a potential 30-plus year retirement, you likely will want to keep some of your investment portfolio invested in stocks, which historically provide the best inflation-beating gains.

Conventional wisdom says you should invest more conservatively as you near retirement. However, it’s possible to make the mistake of becoming too cautious. Stocks, because of their higher growth potential, provide another important benefit to retirement investors: inflation protection.

Over time, stocks tend to outperform bonds, making them a better bulwark to the corrosive effects of inflation.

Rather than hit the investment brakes and go from, say, a 70/30 stock-to-bond portfolio to a 20/80 portfolio, you may want to just ease off the gas. Consider investing in a 50/50 or 40/60 portfolio, depending on your level of wealth and retirement needs.

Take a lump sum pension payout

If you’re fortunate to receive a pension, you can typically take it as a monthly annuity or in one lump-sum payout. There are pros and cons to both.

While the pension annuity guarantees you a monthly paycheck, it’s important to know that it may not rise with inflation. That means your pension plan may not have a cost-of-living adjustment (COLA) if you choose the monthly payout. So, you could experience a substantial loss of buying power in those paychecks over time.

On the other hand, by taking a lump-sum pension payout, you can invest it in an IRA. This gives you the ability to choose investments that may help your money grow above the rate of inflation. The downside, however, is that it exposes your pension money to market risk. What works for you depends on your personal financial situation and attitude toward risk.

Delay Social Security, if you have a long life expectancy

Social Security provides a COLA each year based on inflation as measured by the Consumer Price Index. But many retirees who rely on their benefit as their prime source of income may find it underwhelming. That’s because it likely won’t keep pace with particular costs that affect older consumers and that rise faster than inflation, such as prescription drugs and utilities.

One way to increase your Social Security benefit is to delay. By waiting to file, you can increase your benefit by up to 8% per year until age 70.

Keep in mind, delaying benefits means increased Social Security income later in life, but your portfolio may need to bridge the gap and provide income until delayed benefits are received. Essentially, the fewer other income sources you have and the longer your life expectancy, the more it makes sense to wait to take your benefit.

Be careful with other financial products

An annuity, for example, is attractive as a potentially guaranteed stream of income. Inflation protection though doesn’t come standard in annuities. Instead, to receive an inflation adjustment with your annuity you must purchase it like an upgrade, which increases the total cost of the annuity and reduces your return.

Inflation, like Mother Nature, is going to take its course. You can’t totally avoid it. What you can do is take the proper retirement planning steps to protect yourself as much as possible.

The inflation-protection strategies above may not be appropriate for everyone. After all, investing involves risk and expenses that can lower your return as well. It is important to carefully consider what works for your personal situation. Therefore, everyone should work with a financial professional during their retirement planning process.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.