Investment Fees: Avoid Paying Too Much

June 13th, 2018 | 3 min. read

In just about anything you do, a firm grasp of the rules can lead to success. It allows you take advantage of opportunities and avoid making mistakes.

In just about anything you do, a firm grasp of the rules can lead to success. It allows you take advantage of opportunities and avoid making mistakes.

Take, for example, an NBA game between the Phoenix Suns and Memphis Grizzlies in 2017. The score was tied and the Suns had the ball at midcourt. But, with only 0.6 seconds left in regulation, they would need a miracle to win. They got it.

The Suns coach at the time, Jay Triano, had read the NBA rule book and remembered an obscure rule that would give them the victory. According to the rules, an inbounds pass could not go directly into the basket. But, offensive goaltending also could not be called on such an illegal shot. So, Triano drew up a play to lob the ball into the basket and let another player touch it on the way down. It worked.

One thing that makes an investor successful is a good grasp of investing rules. Among those include the fact that investing for retirement comes at a cost. You are essentially buying products (investments) and paying for services (advisory help). Confusion arises from the fact that there are widely different fees charged by different investments and financial professionals.

The complexity of investment fees helps explain why only 30% of Americans trust their own retirement plan provider, according to the National Association of Retirement Plan Participants. Participants in the survey said they didn’t understand the fees they paid for their retirement accounts.

It’s important to understand how fees work. That’s because the amount you pay is one of the few things you can control as an investor. To better build wealth and avoid paying too much, it then helps to know how fees impact your portfolio and what types of fees are out there.

The Effect of Investment Fees

This is one of the most important investing lessons you can learn: The more you pay in fees, the less of your return you get to keep. That’s less money you have in your portfolio compounding and building wealth.

Fees are typically expressed as percentages, so they may seem small and insignificant. But, they can make a big difference over time.

Think 1% is insignificant? Consider this example from a U.S. Department of Labor report.

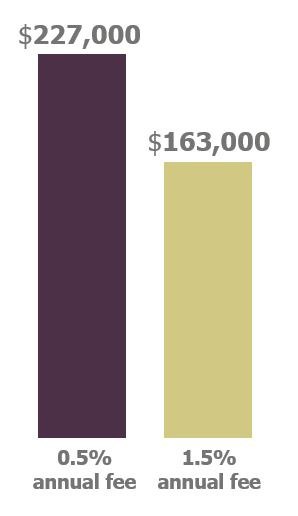

An investor with a $25,000 portfolio balance earning an average 7% return with 0.5% in fees can expect it to grow to $227,000 in 35 years. If that same investor paid 1.5% in fees, the balance would grow to only $163,000. Just a 1% difference in fees reduces the ending portfolio by $64,000.

The difference an additional 1% in fees has on a $25,000 portfolio

Types of Investment Fees

There are a wide variety of investment fees. While you will have to pay some to invest, others you can avoid. Here is a quick overview of some common investment fees.

Expense ratios

Every mutual fund charges an expense ratio. These annual fees are in the form of a percentage of your investment in the fund. High fee funds tend to underperform cheaper funds because they have a larger expense to overcome.

Advisory or management fees

An investor typically pays a percentage of assets under management to a financial adviser. Some financial professionals though are compensated by the products they sell.

Front-end and back-end commissions

That brings us to commissions, which are also commonly called “loads.” These are sales fees that are charged when you buy shares (front-end) or when you sell shares (back-end). It’s important to be aware of the potential conflict of interest for advisers who make a living on commissions. Their incentive is to sell you products more so than to provide services that help grow your wealth.

12b-1 fees

These are fees charged by mutual funds to shareholders for marketing and distribution purposes. Essentially, these fees don’t directly benefit you and instead lower your return. Thus, it’s better to avoid funds and advisers who charge 12b-1 fees.

Retirement plan fees

In addition to fund fees, employer-sponsored retirement accounts charge administrative fees to maintain the plan. Typically, it is you as the participant that pays these fees and not your employer.

Steps to avoid paying too much in fees

As they say, you have to spend money to make money. However, spending too much can adversely affect your financial goals. Here’s what you can do to keep your investment fees in check:

- Make sure you fully understand the costs involved when investing.

- Work with an adviser who can help find the appropriate investments for your goals at the lowest cost. Be sure to find an adviser who will also openly explain the costs to you.

- Preferably, hire an adviser who is a fiduciary, which means the person providing financial services is legally obligated to act in your best interest.

- Consider avoiding investments that charge commissions, 12b-1 fees, and other fees that may not directly benefit you.

- Look for low-cost investments in your 401(k) or other employer-sponsored retirement account. In other words, if you are choosing between two similar funds, choose the cheaper one.

- When leaving your employer, consider transferring your retirement account assets into an IRA. You have a greater number of investments to choose from in an IRA, which means you may be able to reduce your costs.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.