Q4 2022 Market Update: Has the Fed Gone Too Far?

January 4th, 2023 | 3 min. read

Advance Capital Management’s president and chief investment officer, Christopher Kostiz, provides his key economic and market insights from the most recent quarter.

Perhaps the best thing about 2022 is that it’s over.

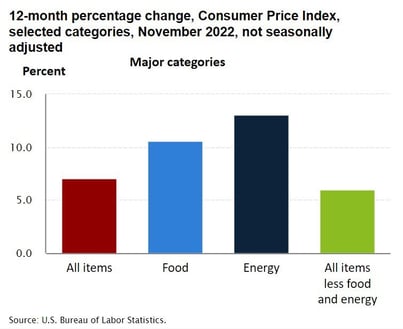

After three tumultuous years of dealing with pandemic-related economic and social issues, the past year brought about a new challenge: dealing with historically high inflation. Rising prices permeated nearly every corner of the economy. Food, gas, labor and vehicles were just a few of the categories that saw a surge in prices, which left businesses and consumers scrambling to find ways to cope while questioning how it happened.

The laws of physics remind us that “for every action there is an equal and opposite reaction.” Actions by the government and Federal Reserve to throw caution to the wind and push trillions of dollars into the economy in reaction to the pandemic has resulted in a level of inflation we have not seen since the early 1980s. Controlling inflation will take time, with some expected pain in both the economy and capital markets. Already, both stocks and bonds have suffered, while economic growth appears to be slowing.

However, consumers and businesses continue to adapt to these headwinds and show remarkable resiliency. While the road back to “normal” may be littered with obstacles, we can take comfort in a strong economic foundation and the determination of our business leaders and citizens to weather the storm.

Despite inflation, consumers keep spending and businesses keep hiring

High inflation has impacted most areas of the economy, with certain sectors suffering more than others. Consumers have generally switched from buying homes, furniture and merchandise to buying experiences like vacations and dining out.

Consequently, the latest monthly report on manufacturing activity showed the first contraction since May 2020. In fact, activity has fallen in five of the last six months due to shrinking orders, lower prices and weaker employment. Yet, as the manufacturing sector contracts, the larger services sector unexpectedly accelerated in the latest month. In the best reading since March 2021, 13 service sectors reported growth in orders and employment. Still, with inflationary pressures high throughout the economy, it is uncertain whether consumers will be willing to continue spending at a robust pace.

Consequently, the latest monthly report on manufacturing activity showed the first contraction since May 2020. In fact, activity has fallen in five of the last six months due to shrinking orders, lower prices and weaker employment. Yet, as the manufacturing sector contracts, the larger services sector unexpectedly accelerated in the latest month. In the best reading since March 2021, 13 service sectors reported growth in orders and employment. Still, with inflationary pressures high throughout the economy, it is uncertain whether consumers will be willing to continue spending at a robust pace.

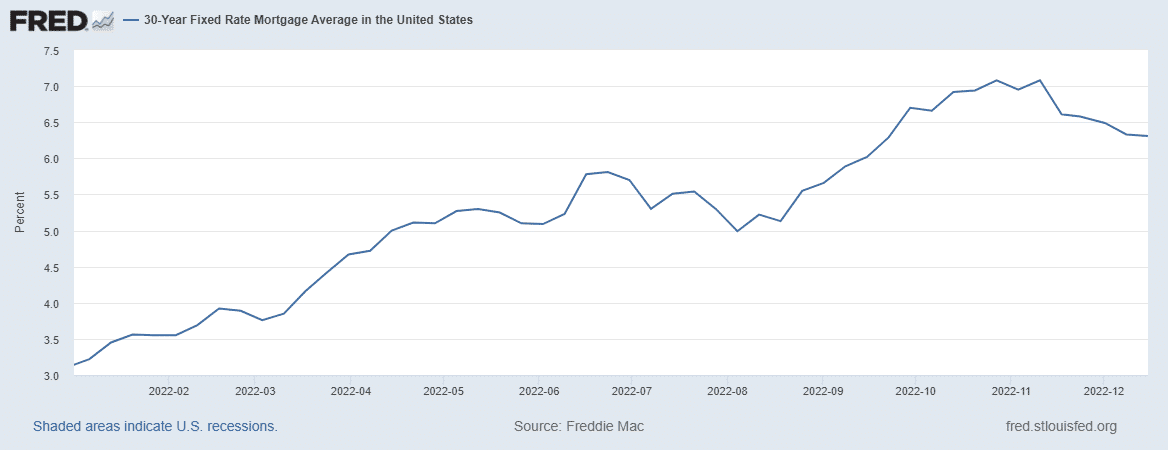

Another sector impacted significantly is residential real estate. Much higher mortgage rates and elevated home prices has led to about a 40 percent increase in average monthly mortgage payments. Not surprising, housing starts have declined significantly along with new permits to build, and builder sentiment is the lowest since the depths of the pandemic in early 2020.

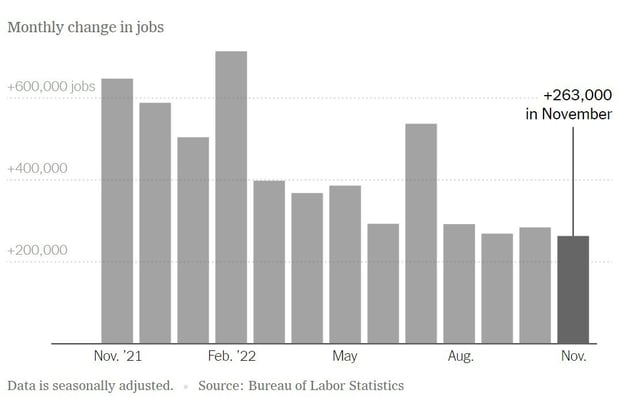

Although growth in parts of the economy is slowing, both employment and consumer spending remains solid. The latest report showed a robust job market with a significant gain in new jobs, higher hourly earnings and very low unemployment.

Source: New York Times

Healthy employment and strong household balance sheets continue to support above-average consumer spending. Both goods and services spending were strong in the latest report.

The Federal Reserve commits to raising rates

The Federal Reserve remains steadfast in their commitment to raise short-term interest rates amidst a tight labor market and historically high consumer price inflation. Already, the Fed has hiked rates by over 4 percent since last March and started to reduce their bloated balance sheet.

.png?width=1168&height=450&name=fredgraph%20(1).png)

While their efforts have had a modest impact on inflation to date, the cumulative effects are expected to slow both the economy and overall inflation through 2023. In their recent announcement on monetary policy, the Fed indicated a slowdown in their rate increases over the next few quarters.

DESPITE THE YEAR'S LOSSES, markets were up in the 4th quarter

The combination of relatively good economic data and investor expectations that interest rate hikes by the Fed would soon end led to a strong rebound in the capital markets during the fourth quarter. The S&P 500 surged 7.5% percent, while small- and mid-cap stocks were up 9.2% and 10.8%, respectively. International and emerging market stock returns were even better.

After significant declines in bonds through most of the year, returns were strong during the final quarter as market-based interest rates declined.

Our Outlook

The future direction of the economy and capital markets hinge on the severity and persistency of inflation and the continued response of the Federal Reserve to tame it. Already, the cumulative rate hikes have led to marginally lower inflation, a modest slowdown in growth and lower asset prices.

The unknown is whether the Fed has gone too far and will tip the economy into a recession. While the capital markets have mostly factored in different scenarios, we expect more volatility in stocks until there is a clearer picture on inflation in the quarters ahead. Bonds, which are usually a ballast during tumultuous periods in stocks, have posted historically bad returns during this inflationary period. However, we expect bonds to provide much better returns in the year ahead if inflation moderates.

We realize the past year has been unnerving for investors with combined returns in both stocks and bond indices as some of the worst on record. Rest assured: we will continue to make investment decisions in your account based on trends and thoughtful research, while balancing risk with potential investment return.

We thank you for your continued support of our firm, our investment process, and the trust you have bestowed upon us to manage your assets. We will continue to work hard on your behalf to deliver solid risk-adjusted returns. Should you have any questions, please do not hesitate to reach out to your financial adviser.

Christopher Kostiz is President and Chief Investment Officer of Advance Capital Management. As CIO, he directs the strategy and structure of the discretionary model portfolios and leads the investment committee.

Christopher Kostiz is President and Chief Investment Officer of Advance Capital Management. As CIO, he directs the strategy and structure of the discretionary model portfolios and leads the investment committee.

Christopher Kostiz, President & CIO

Chris is the President and Chief Investment Officer (CIO) of Advance Capital Management. As CIO, he directs the strategy and structure of the discretionary model portfolios and leads the investment committee.