Surviving a Recession

December 5th, 2019 | 3 min. read

72 hours.

That is the sufficient quantity of disaster supplies the Department of Homeland Security recommends having on hand in case of an emergency. After an emergency occurs, it could be hours or even days for first responders to reach you.

Fortunately, in most cases, such as hurricanes and blizzards, people are given some forewarning of what’s coming and when. You have time to prepare. But what if you are in the middle of potential trouble and don’t know it yet?

A recession is when GDP declines for two consecutive quarters (six months). So, by the time we know a recession is here, we’ve already been in one for half a year, and its effects may finally reveal themselves with no warning.

A recession can impact you in a variety of ways. The worst of which is arguably the loss of a job. A common feature of recessions is a rise in the unemployment rate, which spells trouble for many people. According to research from the Brookings Institution on recessions and job losses, men on average lost “a staggering 2.8 years of predisplacement earnings if displaced when the unemployment rate exceeds 8%.”

This highlights the need to prepare for a recession, even if you think your job is secure or you’re retired.

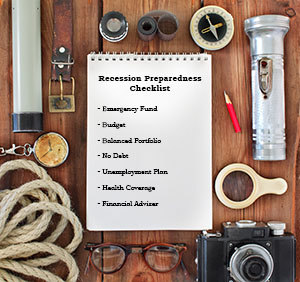

Everyone should have a recession disaster plan. Taking precautions in all areas of your financial life will help alleviate any financial pain when economic trouble hits.

Financial steps to prepare for a recession

- Increase your emergency fund

The rule of thumb is to have three to six months’ worth of expenses saved. But during times of economic trouble and high unemployment, it is better to increase that to nine months or even one year.

- Review and adjust your budget

It’s also a smart idea to take a look at your budget and make adjustments, as needed. Consider refraining from any unnecessary discretionary expenses, such as dining out.

- Make sure your portfolio is built for the long haul

Aggressive market-timing moves, such as shifting your portfolio to cash, can backfire. Some of the biggest gains can happen at the tail end of an economic cycle or immediately after a market bottom. The best way to prepare for a recession is to make sure in advance that your portfolio is aligned with your personal goals and designed to be balanced enough to benefit from periods of growth before it happens, while resilient during those inevitable periods of volatility.

For more about building a recession-proof portfolio, check out: Preparing Your Portfolio for a Recession

- Pay down outstanding high-interest debt

Paying down high-interest debt, such as credit cards, is generally always a good idea. This is especially true before a recession strikes, because you want to have as much liquid cash available as possible during a recession. However, make sure to build a sizeable emergency fund first.

- Prepare for unemployment

Even if you don’t feel your job is at risk, now is the time to think about what you would do if you did lose your job. Instead of waiting for it to happen, take action: update your resume, learn new skills, research companies that are hiring and evaluate your contact network.

- Evaluate your health insurance options

Second to being in the position of having no income is having no health insurance. Medical expenses are the number one reason people file for bankruptcy. Even without a job, you may still have options available to you for health insurance. Look into your ability to join your spouse’s coverage (if married), signing up for COBRA or finding coverage through the Affordable Care Act Exchange.

- Consider adjusting your retirement date, if possible

If you feel uncomfortable with the possibility of retiring in a recession, one option is to delay your retirement date. Waiting a year or so could put you in better position to start drawing down your assets. Unfortunately, it is not always under your control, as older, more compensated workers are often the first employees to be encouraged to leave when a company cuts its workforce.

- Talk with a financial adviser

If you have concerns about your recession preparedness, talk to a financial adviser who can provide a professional assessment. There is a lot of room to make costly mistakes. Instead of attempting to do it alone, an adviser can help you with everything from creating a financial plan to building a long-term investment portfolio and providing honest guidance to help keep your emotions in check.

The Bottom Line

The best time to take steps to survive a recession is before a recession occurs. And the next best time is any time. The ultimate goal is to be prepared for the worst-case scenario – an extended period of unemployment. Review your entire financial life – emergency fund, budget, debt, job, insurance coverage, etc. – and make sure it is as secure as possible.

For a more comprehensive overview of preparing for a recession, be sure to download our guide: Protecting Your Money Against a Recession.

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.