The Unintentionally Brilliant Money Advice of Mark Twain

June 28th, 2016 | 4 min. read

While our lives are often complex, we don’t believe the financial advice you get should be, too. Often, the best financial advice is actually pretty simple.

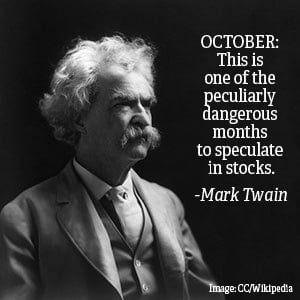

A great illustration can be made with the words of American author Mark Twain, whose real name was Samuel Clemens. The mustachioed humorist is best known for seminal works such as, The Adventures of Tom Sawyer and Adventures of Huckleberry Finn. However, he’s become equally famous for his witticisms on everything from politics to love. He was a vanguard of simple but enlightening language.

So we’ve taken 12 Mark Twain quotes and applied them to finance and investing. When it came to money, he told the truth, mainly.

1. “The secret of getting ahead is getting started.”

This nugget of truth actually reads like it came from a page in a Finance 101 textbook. Although we would all prefer a secret to financial success, it’s just wishful thinking. The safest, most assured way to wealth is to start saving and planning early. The sooner you save, the greater you will be rewarded by the power of compounding.

2. “I’ve had a lot of worries in my life, most of which never happened.”

One obstacle that can lead investors off course is emotion. Feelings of greed and fear are frequently the catalysts for undisciplined financial decisions. The market will keep going up. The market will never recover. Fear, for instance, tends to make investors risk averse or indecisive. But avoiding the market, stocks in particular, can lead to the loss of buying power by way of inflation. Historically, the inflation rate has been around 3%, which will reduce your money by half over 30 years.

3. “A man is never more truthful than when he acknowledges himself a liar.”

“Liar” is a little harsh. However, people like to believe they are always rational and in control while psychological research suggests that we are victims to certain behavioral biases. We feel a financial loss twice as much as we feel a financial gain, for example. These biases can distort our perceptions, which is a major reason why you should be careful in your financial decision-making and seek the objective advice of a financial adviser.

4. “Let us endeavor so to live so that when we come to die even the undertaker will be sorry.”

It’s easy to focus solely on the financial aspects of retirement planning. Don’t forget about all the fun stuff; it’s just as important. If you want to live a fulfilling retirement, you also have to figure out what you want to do, what will make you happy. You may even discover you need less money than you thought.

5. “Whenever you find yourself on the side of the majority, it is time to pause and reflect.”

Herd mentality is the phenomenon of when people become influenced by their peers and adopt certain behaviors. This is a common occurrence in the market, as investors get caught chasing performance – buying what’s hot and selling what’s not. As another great thinker, Warren Buffet, once said: “Be fearful when others are greedy, be greedy when others are fearful.” In your working years, you can avoid following the herd by simply saving money in your retirement account every month, no matter what the market or other investors are doing.

6. “It's not the size of the dog in the fight, it's the size of the fight in the dog.”

Perceptions are often unreliable. When it comes to investing, costs are what matter most and not performance or star ratings. In fact, costs are a better indicator of future returns than past performance. While you can’t control where markets will go or how a particular fund will perform, you can control the fees you pay. A low-cost approach can help you keep more of your portfolio’s return.

7. “If you don’t read the newspaper you are uninformed, if you do read the newspaper you are misinformed.”

The news is filled with a lot of noise. Most topics concern short-term events that are unrelated to your specific financial needs and have no bearing on your long-term goals. It’s better to tune out the headlines and rely on an adviser who knows your personal situation.

8. “A man who carries a cat by the tail learns something he can learn in no other way.”

Mistakes happen to all of us. And some of the best financial knowledge comes from experiencing past mistakes. Use them to help guide your financial decisions, such as how much risk you’re comfortable with in your portfolio.

9. “It ain't what you don't know that gets you into trouble. It's what you know for sure that just ain't so.”

In other words: “past performance is not a guarantee of future results.” Unfortunately, this disclaimer is too frequently overlooked by investors who jump on an investment bandwagon only to find they’re late to the party and have missed out on any gains they could have earned. No one can predict the future. Investors are generally better off maintaining a diversified portfolio and thinking long term.

10. “Climate is what we expect, weather is what we get.”

Every January, financial experts release their market forecasts for the New Year. And, invariably, those projections are proven wrong. Before using them as the basis for your investment decisions, take them for what they are: just guesses.

11. “Don't go around saying the world owes you a living. The world owes you nothing. It was here first.”

You likely won’t reach your financial goals on luck alone. Working hard and saving regularly is still the best route toward financial success.

12. “OCTOBER: This is one of the peculiarly dangerous months to speculate in stocks. The others are July, January, September, April, November, May, March, June, December, August, and February.”

Enough said.

LEARN MORERead these related articles:

Speak with an Advance Capital adviser who can help create an easy-to-understand yet comprehensive financial plan – no cost, no obligation. Fill out the contact form here or call 800-345-4783. |

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.