What If You Retire in a Bear Market?

June 1st, 2022 | 4 min. read

In retirement, one of your primary sources of income will consist of your retirement savings accounts, such as 401(k)s and IRAs. Withdrawing money from those accounts while they’re down can negatively affect the longevity of your portfolio. So, what can you do if you retire in a bear market?

KEY TAKEAWAYS

- Bear markets occur about once a decade, last an average of 9.5 months

- A flexible withdrawal rate can increase your portfolio's longevity

- By waiting to claim Social Security, you can increase your benefit by up to 8% per year until age 70

While a bear market is not the ideal investment environment for transitioning into retirement, market declines of 20% or more are nothing new. There have been 14 since 1945, lasting an average of 9.5 months. That is significantly shorter than bull markets, which last 2.7 years on average. So, if you have worked with a financial adviser to craft a retirement plan, the possibility of a bear market should already be factored into your plan.

However, there are some steps you can take that may give you some extra peace of mind. Which options are best for you will depend on your personal situation, including your savings, age and estimated retirement needs. Ultimately, planning ahead should keep a bear market from severely impacting your retirement.

Put your emergency savings or extra cash to use

In retirement, it makes sense to have one to two years’ worth of expenses in cash accounts and liquid cash investments, such as savings and checking accounts, money market funds and CDs. Using some of that money, coupled with other income sources, could help cover your basic needs without you having to dramatically adjust your investments or desired retirement lifestyle. Just remember your emergency fund should be replenished once the market recovers.

Adjust your withdrawal rate

How much you plan to withdraw from your retirement accounts is a personal choice, depending on factors such as your level of wealth, annual expenses, sources of guaranteed income (pensions, Social Security, etc.) and age when you retire.

Generally, the higher your rate, the lower the chances your portfolio will last throughout retirement. One way to bypass that danger is to maintain a flexible withdrawal rate, which can improve your portfolio’s longevity. By taking modestly lower withdrawals, if possible, in those beginning weak years, you can help preserve some of your balance and give it time to recover. It also puts you in position to possibly spend more during those future strong years.

Stay invested in the market

The farther along your investment journey, the less you typically should have invested in stocks. After all, by the time you retire, your investment goal shifts from growing to preserving your savings. However, you should never consider cashing out of stocks completely, especially in a bear market.

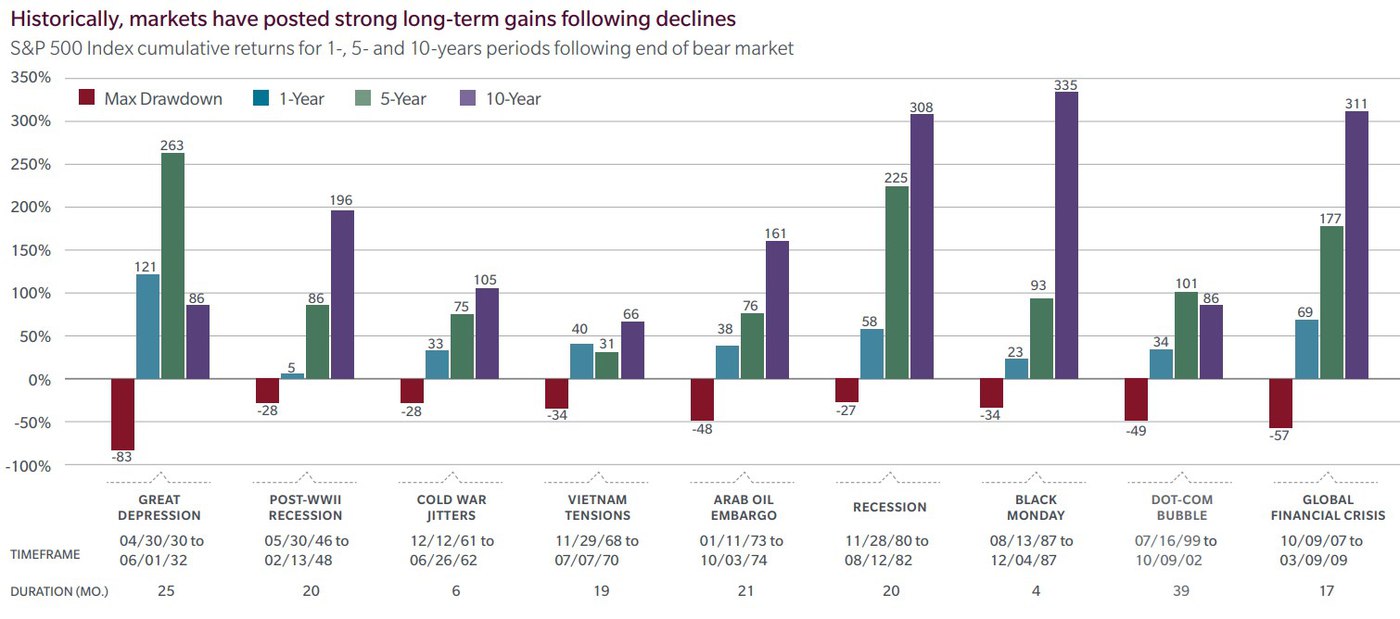

For one, the stock market has historically always recovered. Investors who have stayed invested for the long term are likely to benefit from the recovery. This is shown by the positive returns over 1-, 5- and 10-year periods following the end of some past bear markets.

Source: MFS

Additionally, your retirement could last 20 to 30 years, which means your savings need to keep pace with inflation. Using the historical average rate of inflation, 3%, your purchasing power could be cut in half over that time period. The higher expected returns of stocks compared to other investments make them better suited as a means for inflation protection.

Reevaluate your Social Security strategy

Those who plan to delay Social Security in order to maximize their benefit may want to at least take a second look. By waiting to file, you can increase your benefit by up to 8% per year until age 70.

But, while you wait, you may be relying on your portfolio for your income needs. In a down market, that might be putting too much stress on your portfolio. Therefore, it might make sense to consider claiming Social Security earlier than planned to have an additional income stream as your portfolio recovers.

Ultimately, it is important to consider your Social Security claiming strategy carefully. The right time for you to file for Social Security will depend on your financial situation and health.

Take advantage of potential tax savings

When a bear market gives you lemons, you can make tax lemonade.

One option is to lower your taxable income by selling losing investments from your taxable account. This is known as tax-loss harvesting. When properly done, you may be able to sell investments that have lost value to offset up to $3,000 in ordinary income.

Further, with lower stock prices, it may be a good time for a Roth conversion. That is, transfer some or all your funds from a traditional IRA to a Roth IRA. Withdrawals from Roth IRAs are tax-free, and Roth accounts are not subject to RMDs. A Roth conversion is a taxable event, in which you pay taxes on the money you rollover that you haven’t paid taxes on before. Since you would be converting a lower balance because of the market downturn, your conversion taxes would be lower as well.

There are a variety of tax rules to navigate here, so these moves are best done with the guidance of a tax or financial professional to avoid triggering any unnecessary taxes.

Wait out the bear market

We know, it’s probably the least attractive option. But, if it’s possible to stay in the workforce, it may be the surest option. Remember, it takes on average a little over a year for the market to recoup its losses, so working just one year longer could significantly help your investment accounts recover and keep you from having to consider spending less in retirement.

Retiring during a bear market will likely impact your retirement plan. The good news is that you have options to manage its impact. Which ones work best for you depend on your personal situation, so talk it over with a financial adviser.

On average there is one bear market every decade. But you don’t need to let it ruin your one retirement.

If you're worried about the market, learn why sticking with a diversified investment strategy over the long term is often the best approach. Download our free guide on "How to Survive a Market Downturn."

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.