Why Tapping Your Retirement Accounts Early Is a BAD Idea

March 2nd, 2022 | 3 min. read

In the past year, a record number of Americans have put in their resignation letters. They have left to find better jobs, start their own businesses, simply take a break, or retire. All can be good reasons to quit, unless it means tapping your retirement accounts early.

KEY TAKEAWAYS

- One in three workers cash out their retirement accounts when leaving jobs

- Taking money from a retirement account before age 59 ½ could result in a 10% tax penalty

- An early retirement account withdrawal could mean thousands in lost compound interest

When deciding what to do with their retirement accounts, many people take the money and run. Research from the Women’s Institute for Secure Retirement shows that a third of workers cash out their retirement accounts when leaving jobs.

Leaving a job is not the only reason people tap their retirement accounts early. In today’s hot housing market, for instance, many potential homebuyers have turned to their retirement accounts for large sums of cash. Nearly 10% of homeowners polled by Bankrate.com said they withdrew from their retirement savings to cover their down payment and closing costs.

While your retirement account should not be the only deciding factor when making a major life decision, it should get you to think twice. At the very least, it is important to know the rules and consequences. So, here are reasons why tapping your retirement accounts early is often a terrible idea.

You Risk Early Withdrawal Tax Penalties

The funds in a tax-deferred retirement account, such as a 401(k) or traditional IRA, are yours. But you can’t simply withdraw them like in a checking or savings account. At least, not until you reach age 59 ½.

If you take money out of one of those retirement accounts before age 59 ½, the IRS may hit you with a 10% tax penalty. And that is on top of the income taxes due on the amount withdrawn.

As an example, if you were to withdraw $10,000 you may owe 30%, or $3,000, to the government. The early withdrawal penalty would then tack on another $1,000 (10%), leaving you with only $6,000.

One exception is the Rule of 55. Basically, if you retire or are laid off in the calendar year you turn age 55 or later, you can withdraw funds from your current employer’s plan without paying the early withdrawal penalty. However, penalty-free early withdrawals are limited to funds held in your most recent company’s retirement plan.

You Could Lose Thousands in Potential Growth

Before jumping ship and cashing out your retirement account, it is important to also consider the long-term consequences. There is potentially a major opportunity cost that could reach up to thousands of dollars in missed growth.

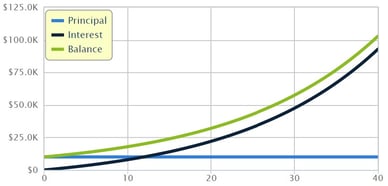

Using the $10,000 example from above, let’s say you instead decide to keep it put. Over 40 years, that $10,000 balance would grow to $102,857, assuming an annual investment return of 6%.

Growth of $10,000 over 40 years (6% annual return)

That is without adding any additional contributions, which shows the power of compounding.

By making an early withdrawal, it is highly unlikely you’ll be able to recover those lost years of compound interest. Ultimately, that is a retirement risk. It’s impossible to know how long you’ll live in retirement, so every bit of savings and growth matters.

Loans Are a Bad Idea, Too

What if, instead of withdrawing money, you take out a loan? This is more common for those using their 401(k)s or other retirement accounts to buy a home. Since you are borrowing from your own money, a 401(k) loan may feel different from a typical bank loan. But it shouldn’t.

Here’s why 401(k) loans are a bad idea:

- You must pay back the amount you withdraw with interest.

- Your investments into your workplace 401(k) account are pre-tax, but you’ll pay back the loan with after-tax dollars. That means it will take longer to build up the same amount.

- You’ll have to pay additional taxes and penalties if you don’t pay back the loan within a certain time frame.

- If you leave your job, for whatever reason, and still have an outstanding 401(k) loan balance, you must pay it back in full by the tax filing deadline the following year. If you fail to do so, it’ll count as a normal distribution, which means the amount is subject to income taxes and possibly that dreaded 10% early withdrawal penalty.

The Bottom Line

In other words, tapping your retirement accounts for reasons other than a well-planned retirement is often a bad mistake. Sure, life happens. New opportunities materialize. But it shouldn’t come at the expense of all the good things that could happen in the future.

What else should you be prepared for in retirement? Download this free ebook to learn what steps can help you transition into retirement with greater confidence: Your Money in Your 50s: A Retirement Planning Guide for Procrastinators and Avid Savers

Advance Capital Management is a fee-only RIA serving clients across the country. The Advance Capital Team includes financial advisers, investment managers, client service professionals and more -- all dedicated to helping people pursue their financial goals.